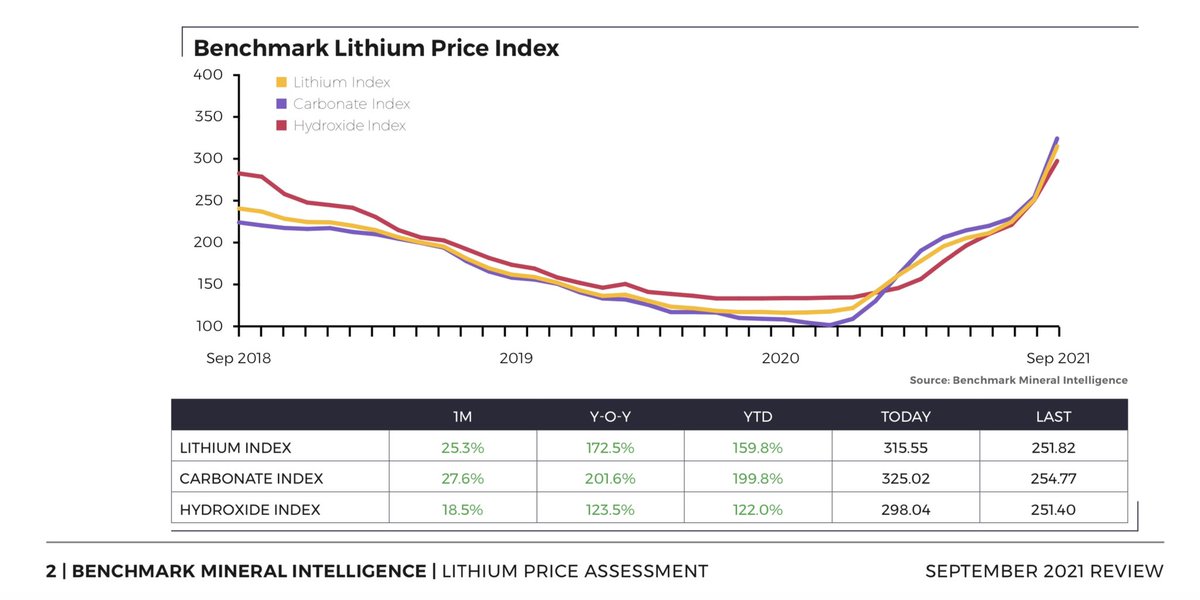

Benchmark Lithium prices - Battery Grade, EXW China @benchmarkmin

Nov 2018 $11,875

Nov 2019 $7,950

Nov 2020 $6,100

Today $30,025

Structural shortage is set to hit in 2022.

Lithium carbonate prices are at all time highs but easy to see them soar above $40k in 2022

Nov 2018 $11,875

Nov 2019 $7,950

Nov 2020 $6,100

Today $30,025

Structural shortage is set to hit in 2022.

Lithium carbonate prices are at all time highs but easy to see them soar above $40k in 2022

Lithium is the key element that this entire low carbon economy is being built on. With low cost energy storage en masse, speed, scale and economics will fall apart

The passed £1 Trillion US #InfrastructureBill is set to send lithium into a super bull market next year.

The passed £1 Trillion US #InfrastructureBill is set to send lithium into a super bull market next year.

The White House has identified lithium ion batteries as a core technology.

“We will get America off the sidelines on manufacturing solar panels, wind farms, batteries, and electric vehicles to grow these supply chains”

“We will get America off the sidelines on manufacturing solar panels, wind farms, batteries, and electric vehicles to grow these supply chains”

Also why The White House and President Biden stepped in to settle LG Chem / SK Innovation dispute in April

whitehouse.gov/briefing-room/…

We were happy to play our part here at @benchmarkmin ( benchmarkminerals.com/membership/us-… )

whitehouse.gov/briefing-room/…

We were happy to play our part here at @benchmarkmin ( benchmarkminerals.com/membership/us-… )

Lithium demand was already set in overdrive before the #InfrastructureBill

Earlier in the year I explained that the lithium demand trajectory was double the rate of the supply response, creating an almighty supply demand gap.

Earlier in the year I explained that the lithium demand trajectory was double the rate of the supply response, creating an almighty supply demand gap.

This lithium gap will increase as a result of the US #InfrastructureBill … it’s natural for investors and industry to focus on the end market - the electric vehicle #EV - first

But any savvy investor will be looking at the entire supply chain and investing in the slowest or weakest link in the #EV supply chain first.

It takes 7 yrs to build a lithium mine, yet only 2 yrs to build a battery plant.

Mining lives on different timelines to manufacturing

It takes 7 yrs to build a lithium mine, yet only 2 yrs to build a battery plant.

Mining lives on different timelines to manufacturing

But the supply chain, from mine to battery cell needs it’s fair share or investment to make it happen otherwise US #InfrastructureBill ambitions or climate ambitions will fall apart

I explained this lithium ion and #EV supply chain criticality to the @EnergyGOP @EnergyDems in:

2017: energy.senate.gov/services/files…

2019:

And 2020: benchmarkminerals.com/membership/a-n…

2017: energy.senate.gov/services/files…

2019:

And 2020: benchmarkminerals.com/membership/a-n…

The one trillion dollar #InfrastructureBill and #COP26 in the same week is great news for the lithium ion battery and #EV thematic and a super bull lithium market

But lithium is an industry that is not yet set for this demand scenario

But lithium is an industry that is not yet set for this demand scenario

To learn more about lithium and the lithium ion battery to #EV supply chain, we welcome all questions and comments at #TeamBenchmark @benchmarkmin >> benchmarkminerals.com/contact/

• • •

Missing some Tweet in this thread? You can try to

force a refresh