🧵U.S.-China Economic and Security Review Comm. 2021 Annual Report to Congress

5 sections: competition (92 pages), economic relations(168), security(100), Taiwan(52), HK(52). 500+ pages, 1.5 hr video, 32 recommendations, w. 10 top recommendations.

/1

5 sections: competition (92 pages), economic relations(168), security(100), Taiwan(52), HK(52). 500+ pages, 1.5 hr video, 32 recommendations, w. 10 top recommendations.

https://twitter.com/USCC_GOV/status/1461056031858081802

/1

Directly relevant, top recommendation related to Chinese VIE structured companies.

The commission not clear whether prohibition of VIE companies are limited to US listed or not. In the next 3 years most Chinese companies will be moving US listings to HK/mainland. /2

The commission not clear whether prohibition of VIE companies are limited to US listed or not. In the next 3 years most Chinese companies will be moving US listings to HK/mainland. /2

I myself have written extensively on VIE. It is not straightforward to say VIE is illegal in China, as VIE structured companies are now listed on China's own exchanges, folded into merge and acquisition regulations. /3

https://twitter.com/liqian_ren/status/1458940753170870273

The most interesting section of the whole report is the subsection on China economic and technological ambitions: synthetic Bio, new mobility(auto driving), cloud computing and digital currency. Specifically, a list of hard tech target areas /4

https://twitter.com/S_Rabinovitch/status/1370214528571514884

The US-China competition in the sphere of biology is under reported in English news.

Most of the report is still very focused on Chinese government’s role in this sphere while the hottest money on the ground has been the PE frenzy in China biotech.

/5

uscc.gov/files/001935

Most of the report is still very focused on Chinese government’s role in this sphere while the hottest money on the ground has been the PE frenzy in China biotech.

/5

uscc.gov/files/001935

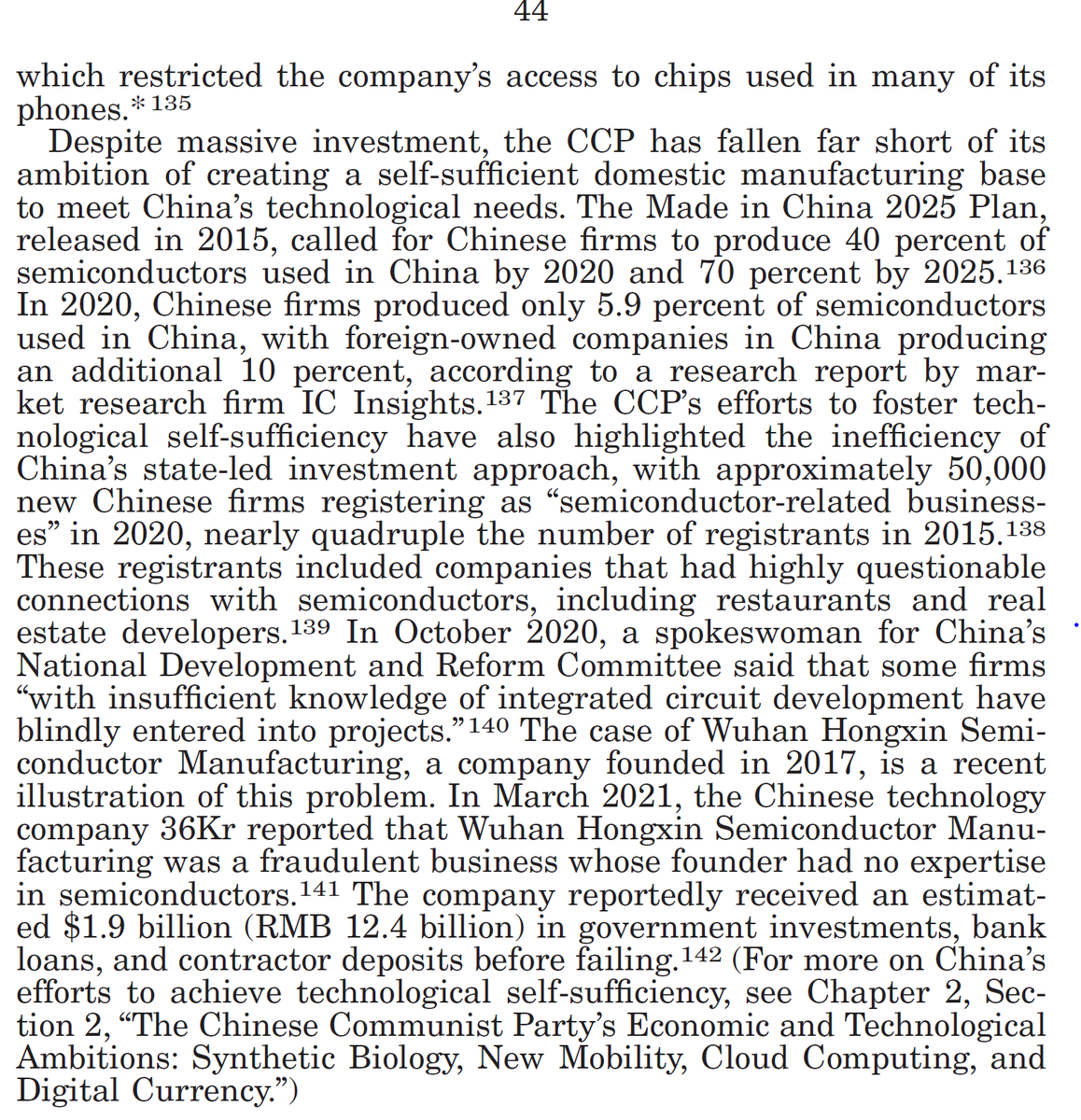

Extensive discussion on semiconductor, in light of Huawei sanction, mentioning the $50bil China PE style National Semiconductor Fund.

Again, the report's characterization is a bit dated. The current influx of PRIVATE money is driving this sector on the ground, like Biotech. /6

Again, the report's characterization is a bit dated. The current influx of PRIVATE money is driving this sector on the ground, like Biotech. /6

Taiwan occupies a big section. I personally believe Taiwan is a media trumped crisis to sell news.

Politicians in mainland, Taiwan and US are all happy to go along so they don't have to talk to their citizens about the hard problems at home. /7

Politicians in mainland, Taiwan and US are all happy to go along so they don't have to talk to their citizens about the hard problems at home. /7

https://twitter.com/liqian_ren/status/1445345128797900807/7

In summary, all encompassing US-China report, more complete if focus not just on Chinese govt.

Any measure, China's private businesses is >50% of the economy and patents filed. Read @USCC_GOV report without having this in mind, you will likely mis-read what's on the ground.

Any measure, China's private businesses is >50% of the economy and patents filed. Read @USCC_GOV report without having this in mind, you will likely mis-read what's on the ground.

@threadreaderapp unroll #USCC #China #US #Economic #Competition #Congress #VIE #Seimiconductor #Biotech #AI #AutonomousVehicles #CloudComputing #CBDC

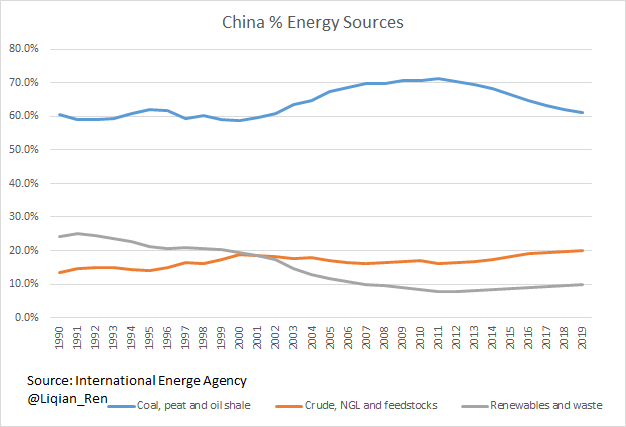

@USCC_GOV Top down govt guidance funds promoting innovation, as many top down policies, not much successful.

Challenge for US comes from private side.

Target 1,741 funds, 11T RMB (1.55T USD). Raised 4.76T trillion RMB (672B USD) from private and public sources.

cset.georgetown.edu/publication/un…

Challenge for US comes from private side.

Target 1,741 funds, 11T RMB (1.55T USD). Raised 4.76T trillion RMB (672B USD) from private and public sources.

cset.georgetown.edu/publication/un…

• • •

Missing some Tweet in this thread? You can try to

force a refresh