🛑.@NewYorkFed / @BIS_org Collaboration Huge

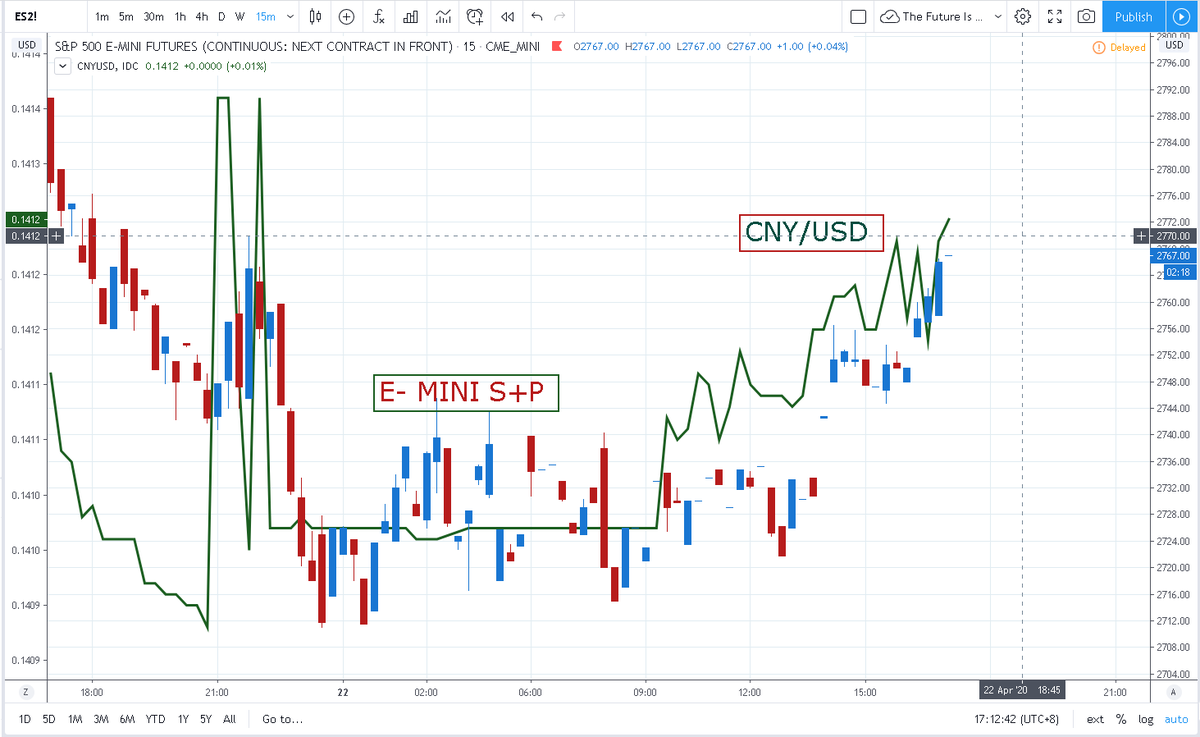

China is already out in front with its CBDC. Socialising its FinTech and layering onto DCEP is what I call an App Store Moment positively Intertwining The Fortunes Of China's Tech Sector and its new Digital Currency in one. @SecYellen

China is already out in front with its CBDC. Socialising its FinTech and layering onto DCEP is what I call an App Store Moment positively Intertwining The Fortunes Of China's Tech Sector and its new Digital Currency in one. @SecYellen

https://twitter.com/CurrencyWar1/status/1465472276040667136

and @federalreserve Powell and many others didn't really care about a digital dollar 12 months ago, but policy stance has changed as has approach to #crypto broadly. @GaryGensler appeared hostile initially and then did a volte face. In recent days China has switched attention

from targetting #BTC as a vehicle for money laundering, switching its focus to DEfI etc. China wants its DCEP to offer the best of both worlds, A Sovereign Reserve Currency, underpinned by 1.3 Bio Digial consumers promoting Yuan adoption via its digital wallets with its tech

sitting on top of a digital currency in a world where Global Institutions are massively O/weight Dollars and U/Weight Yuan. This dual threat presented to traditional reserve currencies is also a threat to the crypto ecosystem. The Fed and BIS aligning, is not a vote in favour

of ignoring the threat presented by china's centralised system, in dee dits the opposite. This threat is bigger than any one regulatory/financial regime, it required the weight of 135 members of the BIS and the markets arm of the FED to work together. Its a call to arms.

China's DCEP will offer Money properties, wehre Bitcoin is seen as a digital competitor but more importantly a threat to the DCEP project, with PBOC mindful of their 2014/17 experince when #BTC popularity threatened Yuan Sovereignty. Alternately where real value is seen in the

crypto universe, namely #DEFI China has taken huge steps to invert the reward structure in its tech sector in favour of the stakeholder over the previous winner takes all shareholder approach. Layering this technology stack ontop of the new Digital Currency, presents an invesment

opportunity on one side and a challenge to the nasient Crypto Ecosystem encompassed in Defi on the other. Its a race to the bottom, This is an all out fight to the death between the Dollar, Fiat, RMb and Crypto. #BTC and #ETH very vulnerable.G7 will forsake privacy for taxation

• • •

Missing some Tweet in this thread? You can try to

force a refresh