Where is Fed Put?

In late 2018:

- S&P touched bear mkt in mid-Dec'18 (20% correction)

- Dropped 9% in Dec'18

- Dropped 2.5% on 3rd Jan'19

Then Powell did dovish pivot on 4th Jan'19: Fed "will be patient"

In 2022:

- S&P has dropped 7.73% in Jan'22

- Corrected 8.73% off peak

1/8

In late 2018:

- S&P touched bear mkt in mid-Dec'18 (20% correction)

- Dropped 9% in Dec'18

- Dropped 2.5% on 3rd Jan'19

Then Powell did dovish pivot on 4th Jan'19: Fed "will be patient"

In 2022:

- S&P has dropped 7.73% in Jan'22

- Corrected 8.73% off peak

1/8

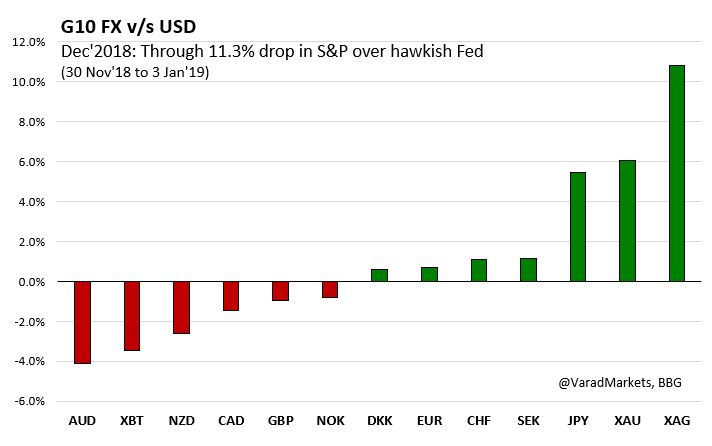

But in 2018, Powell was extremely hawkish even as Inflation did not even touch 3%

Now CPI is 7% => implies Fed's hawkishness is justified on inflation + mkt understands it => Fed's Put is further away (v/s 2018)?

What!!! So let S&P correct another ~12% before Fed wakes up?

3/8

Now CPI is 7% => implies Fed's hawkishness is justified on inflation + mkt understands it => Fed's Put is further away (v/s 2018)?

What!!! So let S&P correct another ~12% before Fed wakes up?

3/8

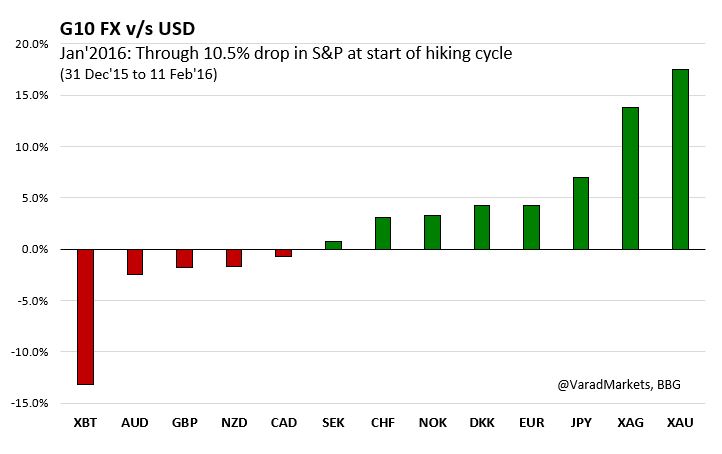

In early 2016 also, at the beginning of hiking cycle, S&P dropped 11.3% YTD by 20 Jan'16

Fed eventually ended up hiking only once in 2016 despite starting the year with DOTS showing 4 hikes for 2016 ('on tightening financial conditions on geopolitical concerns')

4/8

Fed eventually ended up hiking only once in 2016 despite starting the year with DOTS showing 4 hikes for 2016 ('on tightening financial conditions on geopolitical concerns')

4/8

Overall

1⃣ Given high inflation, Fed may be more tolerant to equity correction + they're often blamed for frothy valuations (time to take back!)

2⃣ Fine balance from political angle into US mid-term elections. Bigger evil = 25% erosion of investor/retail wealth OR Inflation?

5/8

1⃣ Given high inflation, Fed may be more tolerant to equity correction + they're often blamed for frothy valuations (time to take back!)

2⃣ Fine balance from political angle into US mid-term elections. Bigger evil = 25% erosion of investor/retail wealth OR Inflation?

5/8

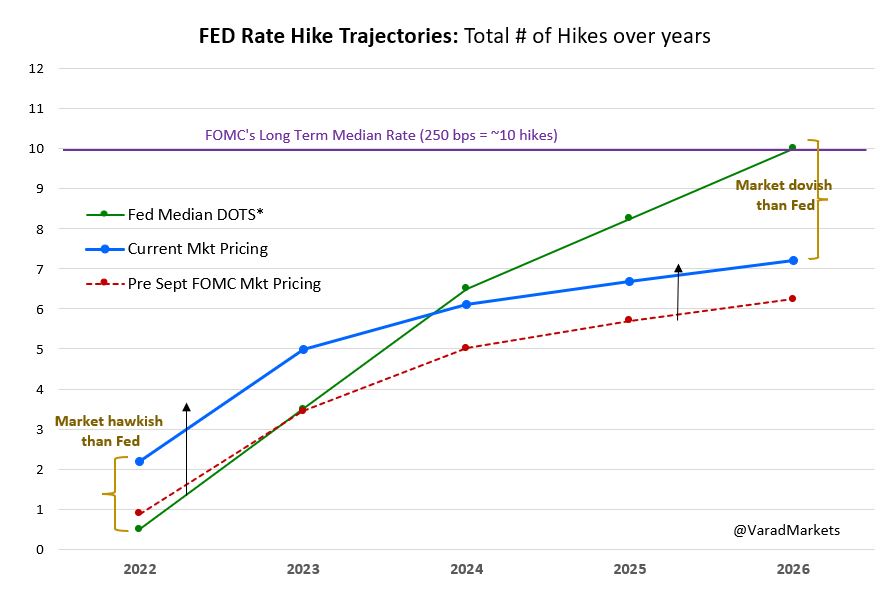

3⃣ Given [2] & from 2016/18 experience, Fed Put may not be that far => another 5% on S&P & mkt should forget +50bp in March

4⃣ But early taper end at Jan FOMC real possibility, otherwise Fed will end up purchasing assets in Mar + hiking rates (Powell has detested that idea)

6/8

4⃣ But early taper end at Jan FOMC real possibility, otherwise Fed will end up purchasing assets in Mar + hiking rates (Powell has detested that idea)

6/8

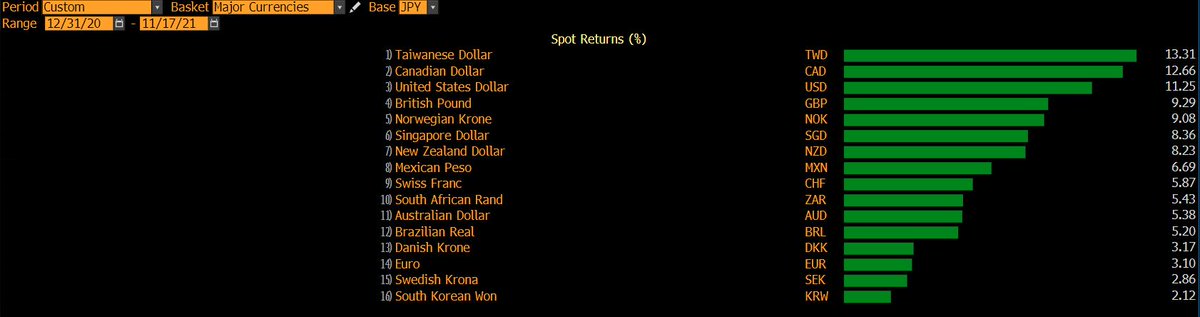

5⃣ Often asked: can Fed be even more hawkish (6 hikes in 2022?). Recent equity correction should put s/t ceiling on pricing of Fed's hawkishness (limited upside in f/e yields?)

6⃣ Best time to invest/add to long equities is when Fed does a dovish pivot

7/8

6⃣ Best time to invest/add to long equities is when Fed does a dovish pivot

7/8

https://twitter.com/VaradMarkets/status/1479471150514139137?s=20

Refresher on Fed Put & Financial Conditions Index

https://twitter.com/VaradMarkets/status/1368804516112437250?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh