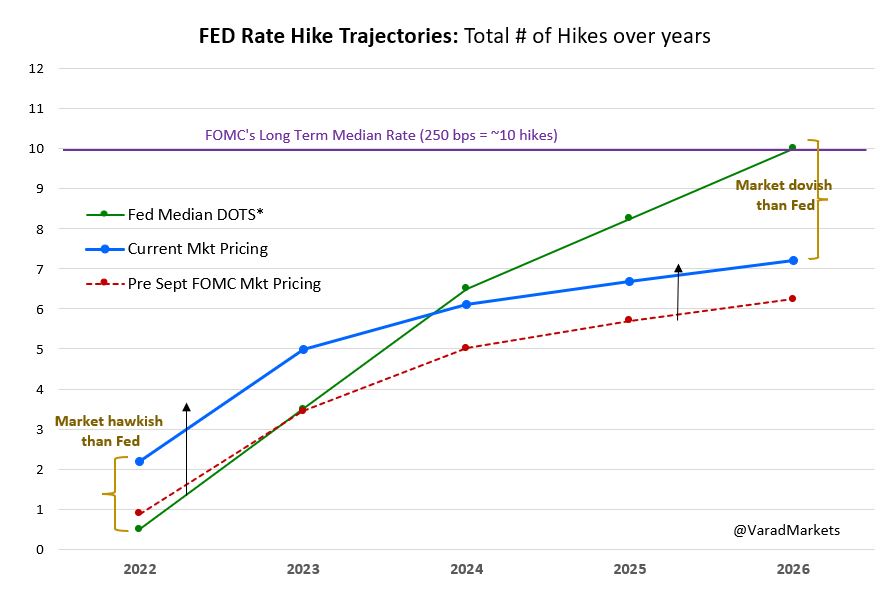

#Nasdaq v/s #FedFundRate:

Few comparisons of Fed's recent hawkishness with Powell's extreme hawkishness in late 2018

Nasdaq dropped 22% in Q4'18; currently 5.0% off its peak

1. Fed not really as hawkish as 2018

2. Fed has learnt when to back off. Or has it?

@saxena_puru

Few comparisons of Fed's recent hawkishness with Powell's extreme hawkishness in late 2018

Nasdaq dropped 22% in Q4'18; currently 5.0% off its peak

1. Fed not really as hawkish as 2018

2. Fed has learnt when to back off. Or has it?

@saxena_puru

Few news reports from that time:

"Federal Reserve raises rates despite signs of economic softening"

edition.cnn.com/2018/12/19/bus…

politico.com/story/2018/11/…

"Federal Reserve raises rates despite signs of economic softening"

edition.cnn.com/2018/12/19/bus…

politico.com/story/2018/11/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh