#FX/#Rates thru 2016/18 episodes of 'Equity Tantrum' on hawkish Fed: Takeaways

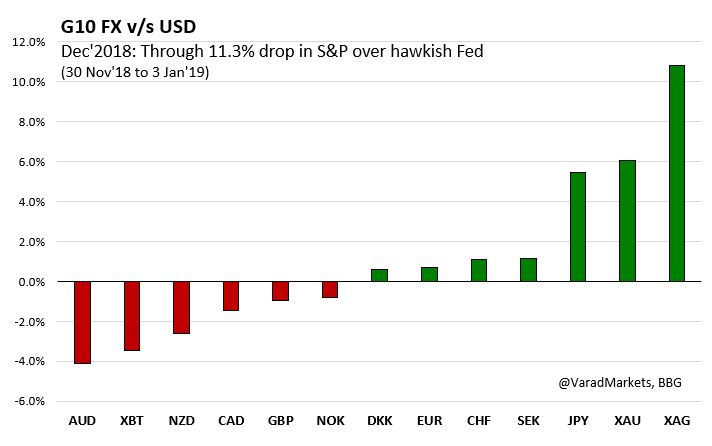

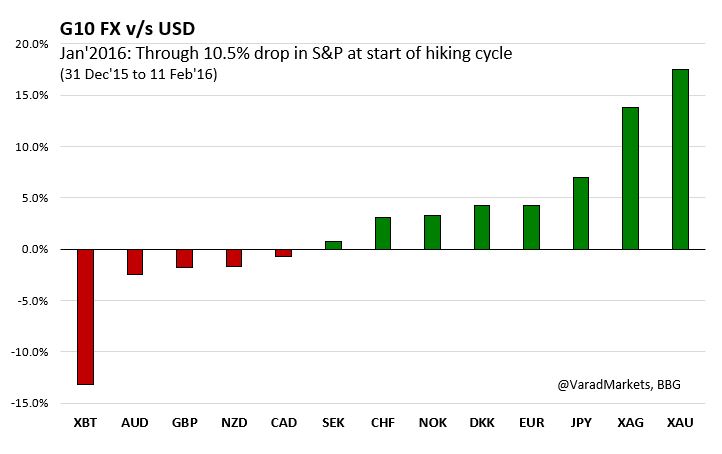

▪️ Short USDJPY best FX trade in both periods

▪️ Short AUDJPY even better

▪️ Short EUR/Long DXY bad idea for risk-off

▪️ Gold/Silver good value here

▪️ Long USDEM not rewarding enuf

▪️ Bonds rally 40bp

▪️ Short USDJPY best FX trade in both periods

▪️ Short AUDJPY even better

▪️ Short EUR/Long DXY bad idea for risk-off

▪️ Gold/Silver good value here

▪️ Long USDEM not rewarding enuf

▪️ Bonds rally 40bp

Dec 2018 Recap:

S&P -11.3% (30 Nov'18 to 3 Jan'19)

2y UST -41bp, 2.78=>2.37

10y UST -43bp, 2.98=>2.55

DXY -1.0%

Oil/WTI +0.30%

BCOM -6.2%

VIX 18=>25 (36 high)

HY OAS +119bp

But Dec'18 episode was late in hiking cycle=>had enough room for a 40bp bond rally. Lets look at 2016

2/7

S&P -11.3% (30 Nov'18 to 3 Jan'19)

2y UST -41bp, 2.78=>2.37

10y UST -43bp, 2.98=>2.55

DXY -1.0%

Oil/WTI +0.30%

BCOM -6.2%

VIX 18=>25 (36 high)

HY OAS +119bp

But Dec'18 episode was late in hiking cycle=>had enough room for a 40bp bond rally. Lets look at 2016

2/7

Jan 2016 Recap:

S&P -10.5% (31 Dec'15 to 11 Feb'16)

2y UST -40bp, 1.05=>0.65

10y UST -61bp, 2.26=>1.65

DXY -3.1%

Oil/WTI -13.5%

BCOM -5.85%

VIX 18=>28 (32 high)

HY OAS +179bp

DXY ⬇️ on higher EUR JPY & CHF

Strong bond rally at start of hiking cycle

2/10 flatter but 5/30 steeper

S&P -10.5% (31 Dec'15 to 11 Feb'16)

2y UST -40bp, 1.05=>0.65

10y UST -61bp, 2.26=>1.65

DXY -3.1%

Oil/WTI -13.5%

BCOM -5.85%

VIX 18=>28 (32 high)

HY OAS +179bp

DXY ⬇️ on higher EUR JPY & CHF

Strong bond rally at start of hiking cycle

2/10 flatter but 5/30 steeper

FX Specifics:

▪️ Short AUD best long $ - complicated this time by hawkish calls on RBA

▪️ (Leveraged) Mkt still reasonably short JPY - pain trade?

▪️ THB, MYR & SGD did well in both episodes

▪️ RUB & ZAR underperformed in both

▪️ INR worst performing Asian in both (then KRW)

4/7

▪️ Short AUD best long $ - complicated this time by hawkish calls on RBA

▪️ (Leveraged) Mkt still reasonably short JPY - pain trade?

▪️ THB, MYR & SGD did well in both episodes

▪️ RUB & ZAR underperformed in both

▪️ INR worst performing Asian in both (then KRW)

4/7

From 2016/18 experience, USDJPY Vols & RR seem to be underpriced

Dec 2018 episode:

3m ATM 6.85 to 9.30

3m RR -1.10 to -2.10

Jan 2016 episode:

3m ATM 8.00 to 14.10

3m RR -0.75 to -2.50

Friday 21 Jan close

3m ATM 6.45

3m RR -1.0

5/7

Dec 2018 episode:

3m ATM 6.85 to 9.30

3m RR -1.10 to -2.10

Jan 2016 episode:

3m ATM 8.00 to 14.10

3m RR -0.75 to -2.50

Friday 21 Jan close

3m ATM 6.45

3m RR -1.0

5/7

#USDJPY Positioning (NonComm CFTC):

2016: mkt had started cutting short JPY posn despite first Dec'15 hike + went long JPY=>USDJPY dropped 7% in Jan'16

2018: mkt less prepared; short JPY posn at extreme but Powell's quick dovish pivot generated less volatility (v/s 2016)

6/7

2016: mkt had started cutting short JPY posn despite first Dec'15 hike + went long JPY=>USDJPY dropped 7% in Jan'16

2018: mkt less prepared; short JPY posn at extreme but Powell's quick dovish pivot generated less volatility (v/s 2016)

6/7

Caveat:

1. Not an investment advice

2. History may not repeat itself (but can help broaden our vision about realm of possibilities)

1. Not an investment advice

2. History may not repeat itself (but can help broaden our vision about realm of possibilities)

https://twitter.com/VaradMarkets/status/1484809963805769729?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh