#EUR Crosses & dovish #ECB:

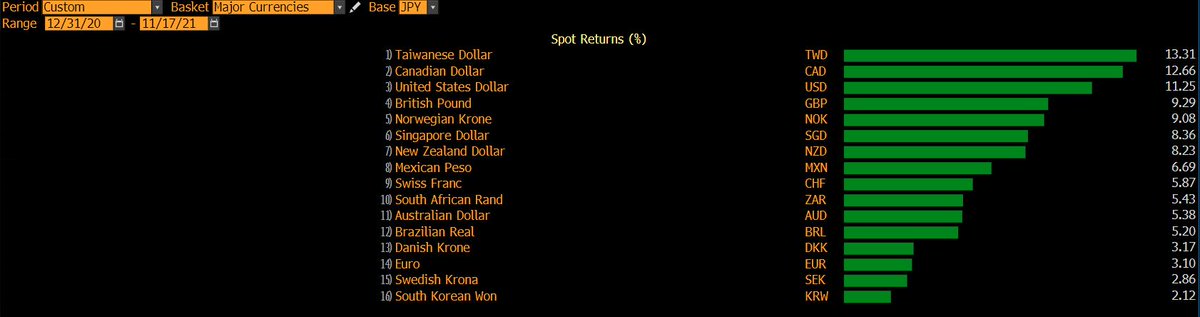

▪️ EURUSD claims next big fig; on 1.13-handle; most FX stronger vs EUR (chart vs Nov FOMC)

▪️ ECB to increase upper limit for cash as collateral for Securities Lending (75 to 150bn)

▪️ LAGARDE: Conditions for rate hike very unlikely to be met 2022

1/8

▪️ EURUSD claims next big fig; on 1.13-handle; most FX stronger vs EUR (chart vs Nov FOMC)

▪️ ECB to increase upper limit for cash as collateral for Securities Lending (75 to 150bn)

▪️ LAGARDE: Conditions for rate hike very unlikely to be met 2022

1/8

f/e Euro bond futures lower on doubling of limit to 150bn for cash as collateral=>possible easing of collateral shortage in repo mkt

But last utilization only 15.5bn (Sep monthly avg) & peak daily util 40.8bn (Jun21)

FYG

DU Euro Schatz ~2y

OE - Euro Bobl ~5y

RX - Euro Bund ~10y

But last utilization only 15.5bn (Sep monthly avg) & peak daily util 40.8bn (Jun21)

FYG

DU Euro Schatz ~2y

OE - Euro Bobl ~5y

RX - Euro Bund ~10y

Lagarde:

▪️ pandemic challenge isn't over yet

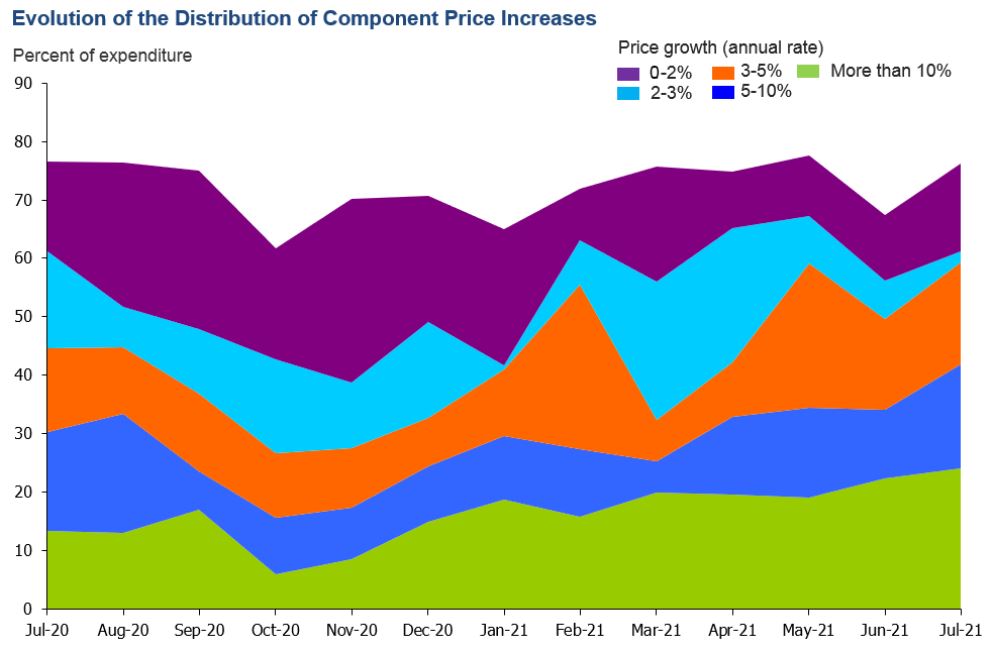

▪️ energy >50% of headline inflation

▪️ inflation boost from reversal of German VAT cut to fall out of calculations from Jan22

▪️ wage growth next yr potentially rising somewhat more...but risk of second-round effects remains limited

▪️ pandemic challenge isn't over yet

▪️ energy >50% of headline inflation

▪️ inflation boost from reversal of German VAT cut to fall out of calculations from Jan22

▪️ wage growth next yr potentially rising somewhat more...but risk of second-round effects remains limited

Lagarde:

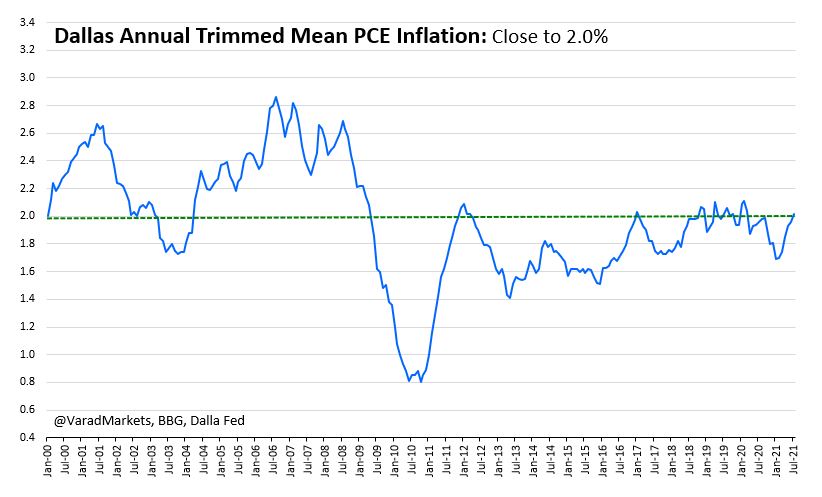

"Despite current inflation surge, outlook for inflation over m/t remains subdued & thus these three conditions very unlikely to be satisfied next yr"

"Overall, continue to foresee inflation in m/t remaining below our new symmetric 2% target"

What three conditions?

4/8

"Despite current inflation surge, outlook for inflation over m/t remains subdued & thus these three conditions very unlikely to be satisfied next yr"

"Overall, continue to foresee inflation in m/t remaining below our new symmetric 2% target"

What three conditions?

4/8

ECB Conditions for rate hike:

1⃣ “until inflation reaches 2% well ahead of end of projection horizon”

2⃣ "inflation to reach 2%..durably for rest of projection horizon”

3⃣ “progress in inflation sufficiently advanced to be consistent with inflation stabilising at 2% over m/t”

1⃣ “until inflation reaches 2% well ahead of end of projection horizon”

2⃣ "inflation to reach 2%..durably for rest of projection horizon”

3⃣ “progress in inflation sufficiently advanced to be consistent with inflation stabilising at 2% over m/t”

▪️ Owner Occupied Housing OOH to be included eventually (2026?) into HICP Inflation

▪️ HICP to remain as main reference inflation index during transition period

▪️ Prelim estimates - HICP including OOH about 0.20% higher than current HICP inflation rate

6/8

▪️ HICP to remain as main reference inflation index during transition period

▪️ Prelim estimates - HICP including OOH about 0.20% higher than current HICP inflation rate

6/8

*ECB STIMULUS USES OPERATIONAL CEILING OF 50% OF NATIONAL BONDS

More from Frederik @fwred

7/8

More from Frederik @fwred

7/8

https://twitter.com/fwred/status/1460232003568107520?s=20

▪️ 1m EURUSD ATM Vol jumped from 4.60 to 6.40 vol over last wk - partly as 1m expiry date now captures Dec FOMC

▪️ Significant spike in EURUSD Option volumes - daily notional touches 30bn v/s daily average 10bn (highest in last 3m)

▪️ Significant spike in EURUSD Option volumes - daily notional touches 30bn v/s daily average 10bn (highest in last 3m)

https://twitter.com/VaradMarkets/status/1459500372200853511?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh