#FOMC Hawkish Minutes: #Fed Balance Sheet BS

Five topics discussed:

1⃣ Preferred tool for policy normalization: Rate hike v/s BS reduction

2⃣ Comparison with 2014 normalization

3⃣ Timing & sequencing of tools

4⃣ Size & composition of Long Run BS

5⃣ Yield Curve shape

1/12

Five topics discussed:

1⃣ Preferred tool for policy normalization: Rate hike v/s BS reduction

2⃣ Comparison with 2014 normalization

3⃣ Timing & sequencing of tools

4⃣ Size & composition of Long Run BS

5⃣ Yield Curve shape

1/12

Note: Quantitative Tightening = BS reduction whereas 'Tapering' is reducing pace of BS expansion (currently underway)

1⃣ Rate Hike v/s QT:

“Participants..emphasized..federal funds [FF] rate should be Committee's primary means for adjusting stance of monetary policy”

Why?

2/12

1⃣ Rate Hike v/s QT:

“Participants..emphasized..federal funds [FF] rate should be Committee's primary means for adjusting stance of monetary policy”

Why?

2/12

[A] FF rate more familiar tool to general public => [better] for communication

[B] FF gives policy buffer - easier to adjust FF rate in emergency - “few participants..noted..Committee could more nimbly change interest rate than BS in response to economic conditions”

3/12

[B] FF gives policy buffer - easier to adjust FF rate in emergency - “few participants..noted..Committee could more nimbly change interest rate than BS in response to economic conditions”

3/12

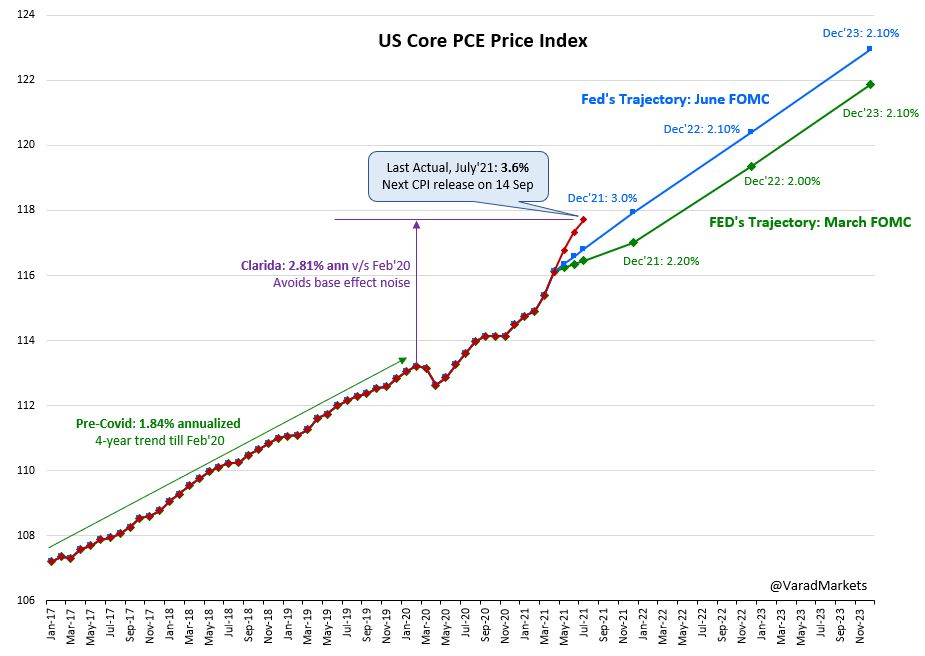

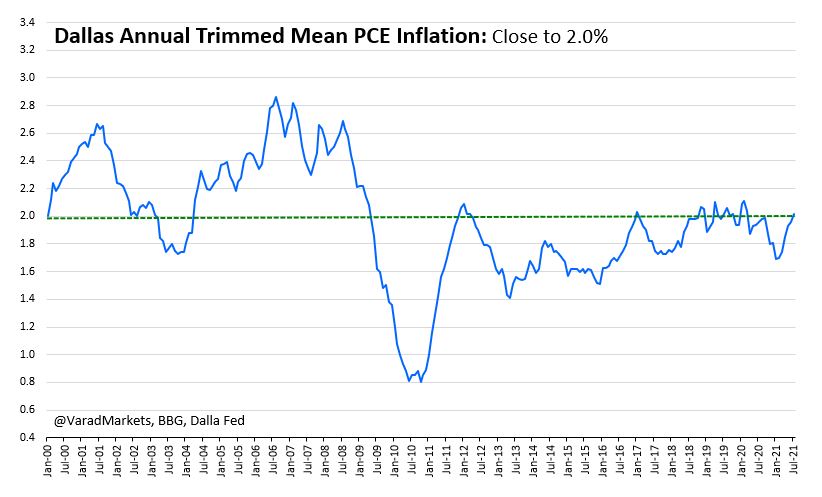

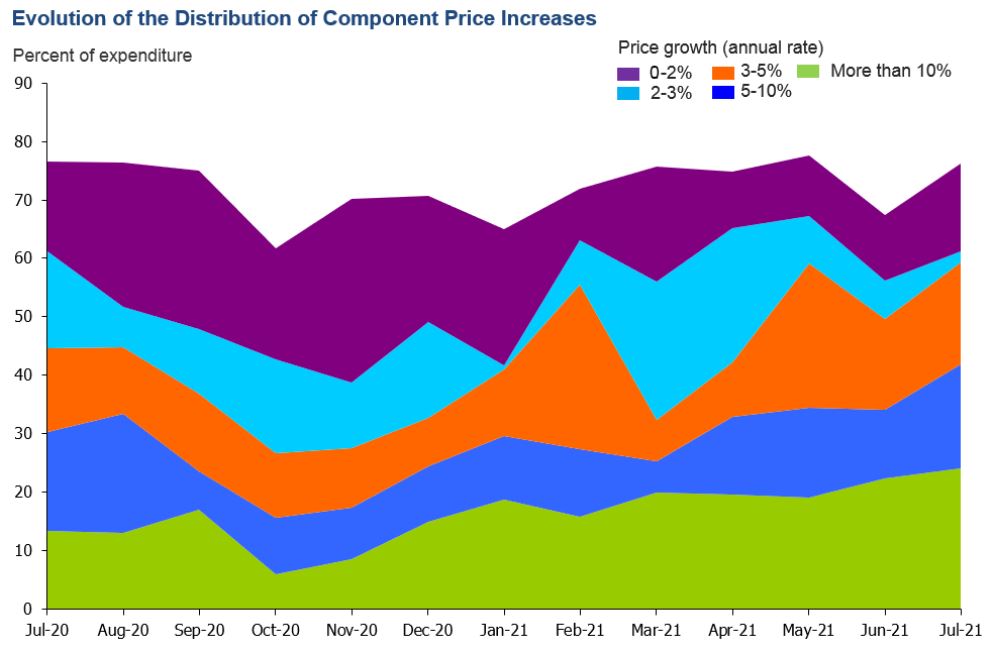

2⃣ FOMC’s judgment of current situation (v/s 2014, previous normalization):

▪️ Economic outlook much stronger

▪️ Inflation higher

▪️ Labour market tighter

▪️ BS much larger, dollar terms & as % of GDP

▪️ BS weighted average maturity shorter

4/12

▪️ Economic outlook much stronger

▪️ Inflation higher

▪️ Labour market tighter

▪️ BS much larger, dollar terms & as % of GDP

▪️ BS weighted average maturity shorter

4/12

▪️ Now better positioned for BS normalization - why?

- Ample reserves

- rate control => interest on reserve balances

- ON Reverse Repo RRP facility

- Standing Repo Facility SRF

“Some observed…BS could potentially shrink faster than last time”

5/12

- Ample reserves

- rate control => interest on reserve balances

- ON Reverse Repo RRP facility

- Standing Repo Facility SRF

“Some observed…BS could potentially shrink faster than last time”

5/12

“Several…raised concerns about vulnerabilities in Tsy mkt => could affect..pace of BS normalization”

“Some..judged..significant BS shrinkage could be appropriate over normalization process…[given] abundant liquidity in money mkts & elevated usage of ON RRP facility”

6/12

“Some..judged..significant BS shrinkage could be appropriate over normalization process…[given] abundant liquidity in money mkts & elevated usage of ON RRP facility”

6/12

3⃣ Timing of BS run-off:

Previous experience - BS runoff started ~2 yrs after policy rate liftoff

"appropriate timing of BS runoff..likely be closer to that of policy rate liftoff than in previous experience"

"decision to initiate runoff would be data dependent"

7/12

Previous experience - BS runoff started ~2 yrs after policy rate liftoff

"appropriate timing of BS runoff..likely be closer to that of policy rate liftoff than in previous experience"

"decision to initiate runoff would be data dependent"

7/12

Size of Long-Run BS:

"noted..current [BS] size elevated & would likely remain so for some time after BS normalizing was under way"

"important to carefully monitor developments in money markets to [assess] appropriate level for Long run BS as the level of reserves fell"

8/12

"noted..current [BS] size elevated & would likely remain so for some time after BS normalizing was under way"

"important to carefully monitor developments in money markets to [assess] appropriate level for Long run BS as the level of reserves fell"

8/12

"several..[noted]..establishment of SRF could reduce demand for reserves in longer run => longer-run BS could be smaller than otherwise"

4⃣ Composition of BS

"some..preference for Fed's asset holdings to consist primarily of Tsy securities [v/s Agency MBS] in longer run"

9/12

4⃣ Composition of BS

"some..preference for Fed's asset holdings to consist primarily of Tsy securities [v/s Agency MBS] in longer run"

9/12

5⃣ Yield Curve Shape

“Some...[BS run off better than rate hike to]..help limit yield curve flattening during policy normalization”

“few..raised concerns..relatively flat yield curve could adversely affect interest margins for some fin intermediaries=> fin stability risks”

10/12

“Some...[BS run off better than rate hike to]..help limit yield curve flattening during policy normalization”

“few..raised concerns..relatively flat yield curve could adversely affect interest margins for some fin intermediaries=> fin stability risks”

10/12

Yield curves currently significantly flatter v/s last year with collapse in Term Premium

UST 2x10 at +87 bp v/s +158 bp recent peak in Mar'21

UST 5x30 at +66bp v/s +163 bp Mar'21 peak

11/12

UST 2x10 at +87 bp v/s +158 bp recent peak in Mar'21

UST 5x30 at +66bp v/s +163 bp Mar'21 peak

11/12

https://twitter.com/VaradMarkets/status/1422832084507250691?s=20

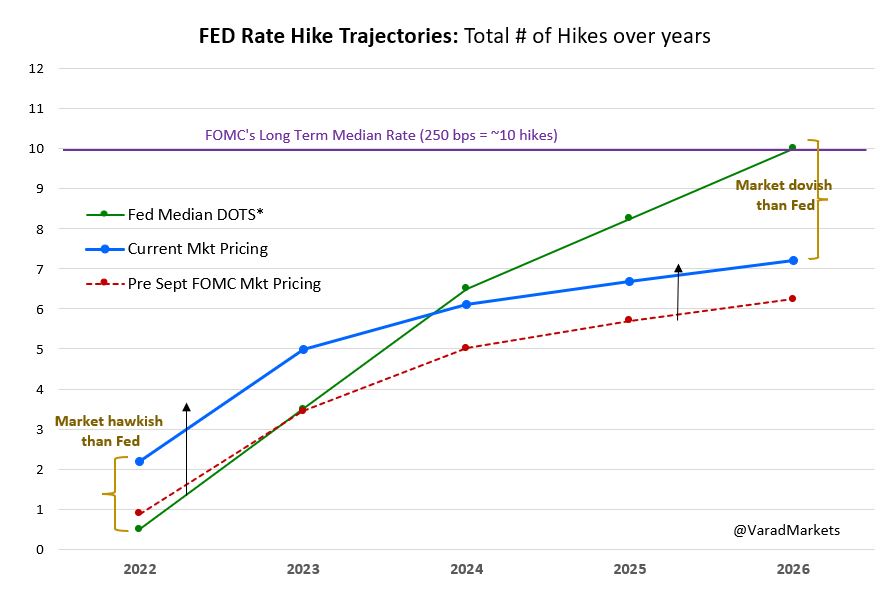

Overall, Fed wants to get on with Tapering, Rate Hike & QT asap. Only constraint: do not tighten financial conditions too much (read as Equity & Equity Vol)

If equities recover, look forward to hawkish Jan FOMC, though mkts may have already priced enough hawkishness by then

If equities recover, look forward to hawkish Jan FOMC, though mkts may have already priced enough hawkishness by then

• • •

Missing some Tweet in this thread? You can try to

force a refresh