🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮

Global Macro Review 02/013/22

1/11

Lots of speculation about where to from here?

Sometimes, it’s as simple as looking at clear Trends

Equities 🐻

Bonds 🐻

Commodities ♉️

Volatility ♉️

USD 😑

Gold 😑

Let’s dig into the 🧮!

Global Macro Review 02/013/22

1/11

Lots of speculation about where to from here?

Sometimes, it’s as simple as looking at clear Trends

Equities 🐻

Bonds 🐻

Commodities ♉️

Volatility ♉️

USD 😑

Gold 😑

Let’s dig into the 🧮!

2/11

With markets closed before 🪆😱, internat’l equities ↗️ last week

$SSEC +3.0% (w) -2.15% (T)

$DAX +2.15% (w) -4.15% (T)

$HSI +1.35% (w) -1.65% (T)

$NIKK +0.95% (w) -6.55% (T)

$CAC +0.9% (w) -1.15% (T)

$KOSPI -0.9% (w) -7.45% (T)

Chart: $DAX remains 🐻 (T) = Trend = 3 mos

With markets closed before 🪆😱, internat’l equities ↗️ last week

$SSEC +3.0% (w) -2.15% (T)

$DAX +2.15% (w) -4.15% (T)

$HSI +1.35% (w) -1.65% (T)

$NIKK +0.95% (w) -6.55% (T)

$CAC +0.9% (w) -1.15% (T)

$KOSPI -0.9% (w) -7.45% (T)

Chart: $DAX remains 🐻 (T) = Trend = 3 mos

3/11

Top internat’t ETFs hale from resource rich countries

$EWW +4.25% (w) +3.15% (T) 🆕 ♉️

$EWZ +2.65% (w) +5.38% (T)

$EWA +2.4% (w) -9.25^ (T)

$THD +1.7% (w) +0.55% (T)

Chart: $EWZ has been signaling ♉️ for weeks, and I ignored it along with $CRB. Why?!

Top internat’t ETFs hale from resource rich countries

$EWW +4.25% (w) +3.15% (T) 🆕 ♉️

$EWZ +2.65% (w) +5.38% (T)

$EWA +2.4% (w) -9.25^ (T)

$THD +1.7% (w) +0.55% (T)

Chart: $EWZ has been signaling ♉️ for weeks, and I ignored it along with $CRB. Why?!

3a/11

Weakest internat'l ETFs in crash mode

$RSX -3.5% (w) -25.8% (T)

$EWD -3.3% (w) -16.0% (T)

$INDA -2.65% (w) -13.0% (T)

$EWN -2.5% (w) -15.1% (T)

Chart: $RSX🪆reeling from 🪖 aggression and 1% rate hike

Weakest internat'l ETFs in crash mode

$RSX -3.5% (w) -25.8% (T)

$EWD -3.3% (w) -16.0% (T)

$INDA -2.65% (w) -13.0% (T)

$EWN -2.5% (w) -15.1% (T)

Chart: $RSX🪆reeling from 🪖 aggression and 1% rate hike

4/11

Great Thursday morning call by @KeithMcCullough to short Qs

$COMPQ -2.18% (w) -13.05% (T)

$SPX -1.8% (w) -5.65% (T)

$IWM +1.5% (w) -15.9% (T)

Chart: $COMPQ -11.85% YTD

Great Thursday morning call by @KeithMcCullough to short Qs

$COMPQ -2.18% (w) -13.05% (T)

$SPX -1.8% (w) -5.65% (T)

$IWM +1.5% (w) -15.9% (T)

Chart: $COMPQ -11.85% YTD

5/11

Top US equity sectors

$XLE +2.2% (w) +22.35% (T)

$XLB +1.06% (w) -6.75% (T)

$XLF +0.02% (w) -0.1% (T)

Chart: $XME +9.35% metals & mining subsector 🆕 ♉️ ripped to ATH

(Top holdings include $BTU, $AA, $ATI, $ARCH, $FCX, $NEM, $NUE)

Top US equity sectors

$XLE +2.2% (w) +22.35% (T)

$XLB +1.06% (w) -6.75% (T)

$XLF +0.02% (w) -0.1% (T)

Chart: $XME +9.35% metals & mining subsector 🆕 ♉️ ripped to ATH

(Top holdings include $BTU, $AA, $ATI, $ARCH, $FCX, $NEM, $NUE)

5a/11

Weakest US sectors

$XLK -2.95 (w) -7.4% (T)

$XLRE 2.7% (w) -5.75% (T)

$XLC -2.6% (w) -14.7% (T)

$XLY -2.15% (w) -11.45% (T)

Chart: $XLK -11% YTD

Weakest US sectors

$XLK -2.95 (w) -7.4% (T)

$XLRE 2.7% (w) -5.75% (T)

$XLC -2.6% (w) -14.7% (T)

$XLY -2.15% (w) -11.45% (T)

Chart: $XLK -11% YTD

6/11

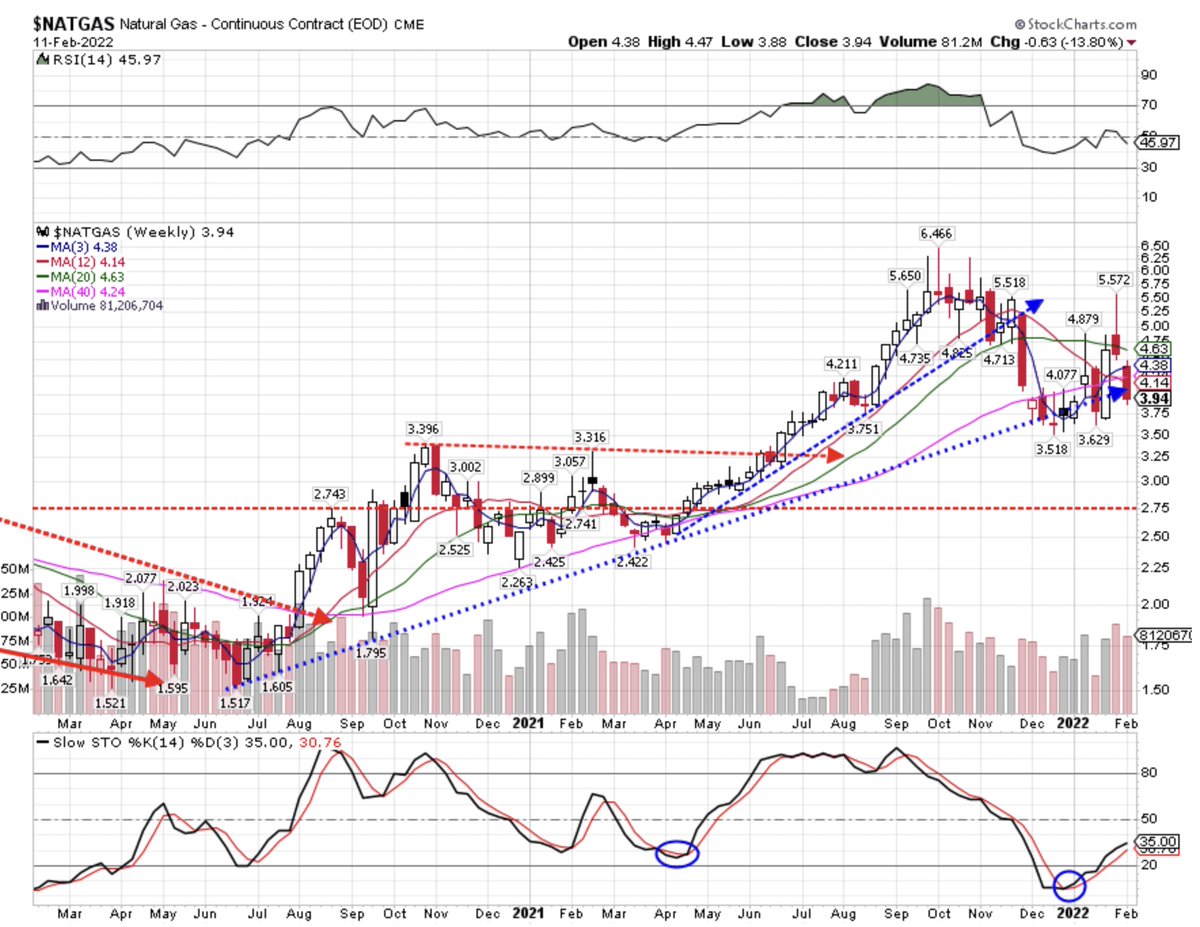

Hydrocarbons - ex Natty - continued their ♉️ 🏃🏿♀️

$BRENT +2.65% (w) +15.9% (T)

$GASO + 2.25% (w) +18.6% (T)

$WTIC +0.85% (w) +15.25% (T)

$NATGAS -13.8% (w) -17.75% (T)

Chart: $BRENT ripping ↗️ to cycle highs

Hydrocarbons - ex Natty - continued their ♉️ 🏃🏿♀️

$BRENT +2.65% (w) +15.9% (T)

$GASO + 2.25% (w) +18.6% (T)

$WTIC +0.85% (w) +15.25% (T)

$NATGAS -13.8% (w) -17.75% (T)

Chart: $BRENT ripping ↗️ to cycle highs

7/11

Precious metals led the complex ↗️

$SILVER +3.95% (w) -7.81% (T)

$GOLD +1.9% (w) -1.4% (T)

$COPPER +0.45% (w) +1.35% (T)

$PLAT -0.54% (w) -6.45% (T)

Chart: $GOLD a close > 1880 confirms ♉️ trend

Precious metals led the complex ↗️

$SILVER +3.95% (w) -7.81% (T)

$GOLD +1.9% (w) -1.4% (T)

$COPPER +0.45% (w) +1.35% (T)

$PLAT -0.54% (w) -6.45% (T)

Chart: $GOLD a close > 1880 confirms ♉️ trend

8/11

Grains keep ripping ↗️ with $DBA at a new cycle high

$CORN +4.9% (w) +12.8% (T)

$WHEAT +4.5% (w) -2.35% (T)

$SOYB +1.9% (w) +27.25% (T)

$SUGAR +0.15% (w) -8.75% (T)

Chart: $WHEAT +7.6% (t) ready for another leg ↗️

Grains keep ripping ↗️ with $DBA at a new cycle high

$CORN +4.9% (w) +12.8% (T)

$WHEAT +4.5% (w) -2.35% (T)

$SOYB +1.9% (w) +27.25% (T)

$SUGAR +0.15% (w) -8.75% (T)

Chart: $WHEAT +7.6% (t) ready for another leg ↗️

9/11

More chop in #FX space

$USD +0.62% (w) +1.0% (T)

$AUD +0.7% (w) -2.75% (T)

$EUR -0.87% (w) -0.79% (T)

$GBP +0.62% (w) +1.12% (T)

Chart: $USD hanging onto ♉️ Trend

More chop in #FX space

$USD +0.62% (w) +1.0% (T)

$AUD +0.7% (w) -2.75% (T)

$EUR -0.87% (w) -0.79% (T)

$GBP +0.62% (w) +1.12% (T)

Chart: $USD hanging onto ♉️ Trend

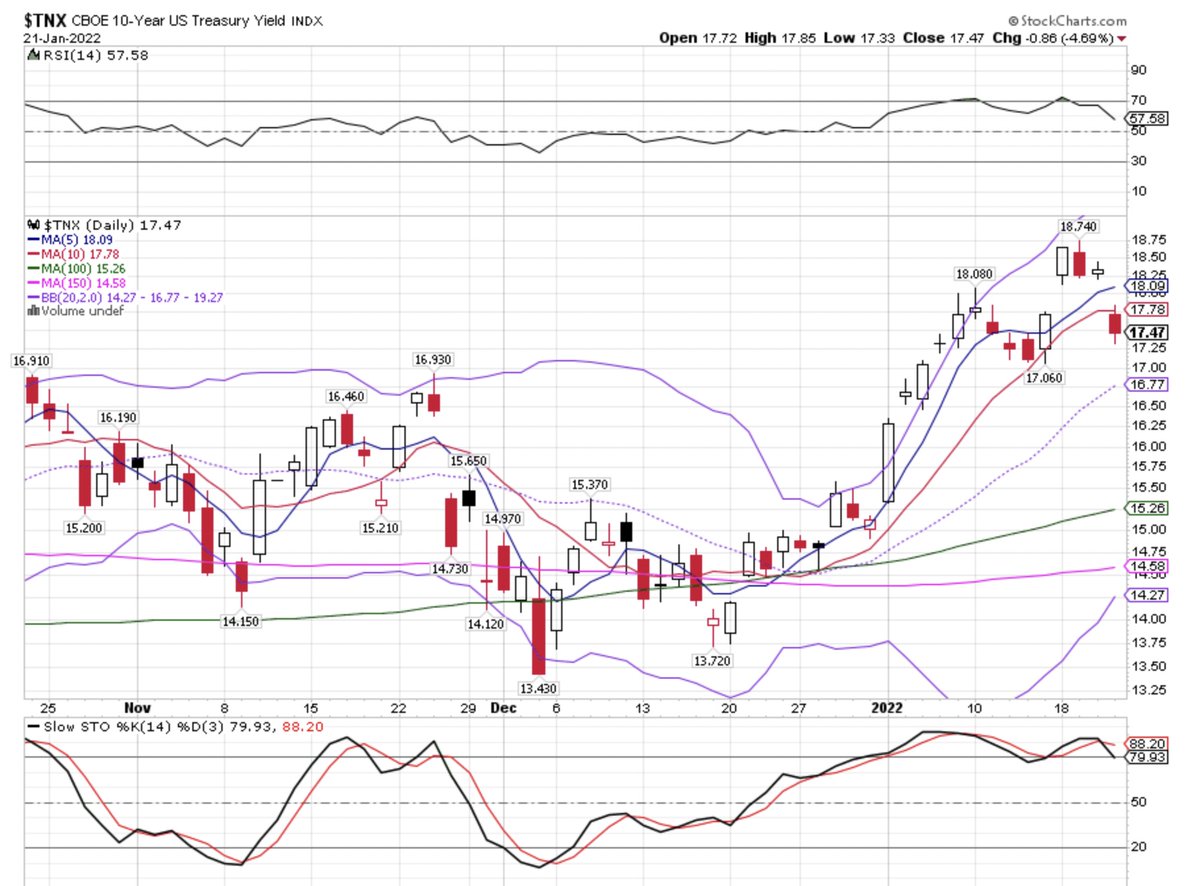

10/11

Absolute carnage 🥩 at the front end of the UST curve

102s to 43 BPS -16.9 BPS 🥞

30/5 to 40 BPS -3.9 BPS 🥞

2Y 1.487 +17.1 BPS

5Y 1.833 +6 BPS

10Y 1.918 unch

30Y 2.234 unch

Chart: UST 2Y yield has DOUBLED since the start of the year

Absolute carnage 🥩 at the front end of the UST curve

102s to 43 BPS -16.9 BPS 🥞

30/5 to 40 BPS -3.9 BPS 🥞

2Y 1.487 +17.1 BPS

5Y 1.833 +6 BPS

10Y 1.918 unch

30Y 2.234 unch

Chart: UST 2Y yield has DOUBLED since the start of the year

11/11

Markets are Trending; ignore or fight 🤺 at your own peril

Better to #STFR in 🐻 Trends and #BTFD in ♉️ Trends

Regime = #Quad3 #Stagflation

No heroics and have a super profitable 💰 week!

Markets are Trending; ignore or fight 🤺 at your own peril

Better to #STFR in 🐻 Trends and #BTFD in ♉️ Trends

Regime = #Quad3 #Stagflation

No heroics and have a super profitable 💰 week!

• • •

Missing some Tweet in this thread? You can try to

force a refresh