How to snag cheap $LUNA and $ETH below market value using @TeamKujira's Orca protocol 🐋

Here's an explanation of how it works, and a guide on how to use it 🧶 👇

#DeFi #Crypto #Cryptocurrency #Whales #Terra #TerraLuna #Cryptocurrencies

Here's an explanation of how it works, and a guide on how to use it 🧶 👇

#DeFi #Crypto #Cryptocurrency #Whales #Terra #TerraLuna #Cryptocurrencies

1/ You already know about setting limit buy orders to scoop up crypto when its market price dips. This is not what this guide is about.

This guide is about a new way to scoop up crypto for a (possibly hefty) discount to its current market price.

Read on..

This guide is about a new way to scoop up crypto for a (possibly hefty) discount to its current market price.

Read on..

2/ @TeamKujira's #Orca Protocol allows users to snipe crypto for cheaper prices when borrowers get liquidated. 🐳

This means you could buy $ETH or $LUNA for 10% less than its trading price.

Maybe even 20% cheaper. Or 30%. 👀

Here's how it works..

This means you could buy $ETH or $LUNA for 10% less than its trading price.

Maybe even 20% cheaper. Or 30%. 👀

Here's how it works..

3/ I've posted before about how you can earn up to 20% interest on your stablecoins using @anchor_protocol:

The interest you're earning on Anchor Protocol comes from borrowers.

https://twitter.com/shivsakhuja/status/1467550237036187650?s=20

The interest you're earning on Anchor Protocol comes from borrowers.

4/ @anchor_protocol requires users to deposit an asset like $bETH or $bLUNA as collateral in order to borrow against it.

In order to borrow $60 of $UST, you need to deposit $100 or more of collateral.

Your Loan-To-Value or LTV ratio here is $60/$100 = 60%

In order to borrow $60 of $UST, you need to deposit $100 or more of collateral.

Your Loan-To-Value or LTV ratio here is $60/$100 = 60%

@anchor_protocol requires borrowers to have an LTV ratio <= 60%.

This means that borrowing the maximum amount allowed ($60 $UST with $100 bETH collateral) is very risky because the value of $ETH could fall, and put your collateral at risk.

This means that borrowing the maximum amount allowed ($60 $UST with $100 bETH collateral) is very risky because the value of $ETH could fall, and put your collateral at risk.

6/ Let’s say you borrow $60 $UST using $100 $bETH as collateral.

$ETH falls 20%. You now have $80 of $bETH collateral but $60 of borrowed $UST. So your LTV now rises to $60/$80 = 75%.

Anchor is not comfortable with this level of collateral, so the loan is deemed at risk

$ETH falls 20%. You now have $80 of $bETH collateral but $60 of borrowed $UST. So your LTV now rises to $60/$80 = 75%.

Anchor is not comfortable with this level of collateral, so the loan is deemed at risk

7/ Anchor is now looking to liquidate the collateral and repay the loan. So they need to find buyers for the $bETH collateral. 🐳

The buyer of the collateral needs an incentive as well (otherwise he / she could simply buy $ETH from the spot market).

The buyer of the collateral needs an incentive as well (otherwise he / she could simply buy $ETH from the spot market).

8/ So Anchor is willing to sell it at a discount to the market value. The size of the discount depends on what people are willing to pay.

This is where Kujira #Orca comes in.

On Kujira, you can place "bids" to buy the collateral ($bETH or $bLUNA) for a discount of 0-30%.

This is where Kujira #Orca comes in.

On Kujira, you can place "bids" to buy the collateral ($bETH or $bLUNA) for a discount of 0-30%.

9/ Collateral will be sold at the lowest discount (0%) first, then going all the way up to 30% till all the necessary collateral has been liquidated.

When you buy this collateral, you can then use @terraswap_io to immediately exchange it for $UST or $LUNA for a higher price.

When you buy this collateral, you can then use @terraswap_io to immediately exchange it for $UST or $LUNA for a higher price.

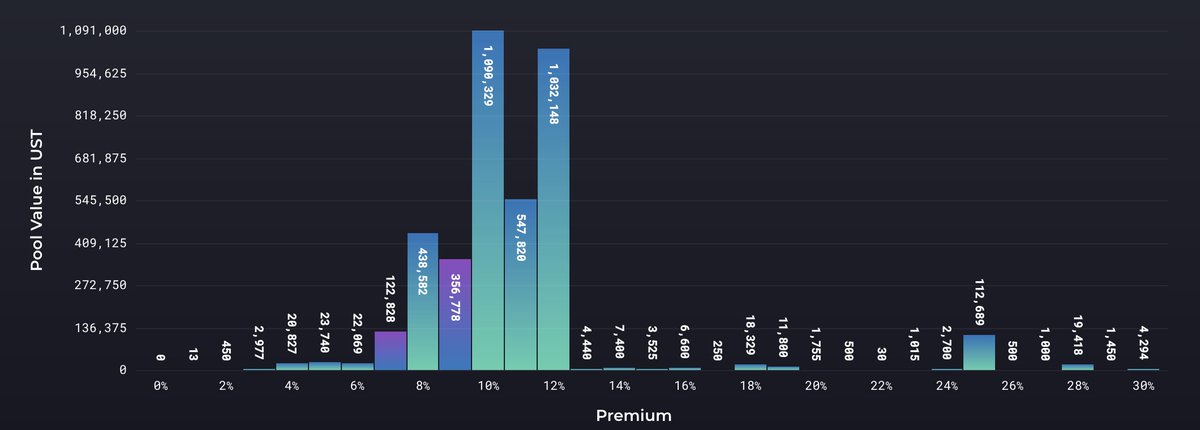

10/ This graph on Kujira shows how many people have placed bids at different discount levels.

As you can see, most people have placed bids around the 10-12% level for $bETH.

Those bids will only be filled AFTER the ones on the left (0-10%) are filled.

As you can see, most people have placed bids around the 10-12% level for $bETH.

Those bids will only be filled AFTER the ones on the left (0-10%) are filled.

11/ The more people that use Kujira Orca, the smaller the opportunity to get discounted assets is likely to be.

Currently the pool size (total amount of people looking to buy discounted assets) is only ~1% of the total collateral Anchor has.

Currently the pool size (total amount of people looking to buy discounted assets) is only ~1% of the total collateral Anchor has.

12/ Liquidations are likely when the asset prices fall, or when borrowers have high LTV.

This is why you should be very conservative when borrowing using crypto as collateral.

With high-volatility assets, chances of liquidation are quite high if your LTV is high.

This is why you should be very conservative when borrowing using crypto as collateral.

With high-volatility assets, chances of liquidation are quite high if your LTV is high.

13/ If you want to snipe some cheap crypto on Kujira, here are the steps:

1. Get $UST onto Terra Station wallet

2. Go to orca.kujira.app/market/bETH

3. Select your desired discount (they call it "premium")

4. Choose amount and place bid

5. After 10 mins, you can activate the bid

1. Get $UST onto Terra Station wallet

2. Go to orca.kujira.app/market/bETH

3. Select your desired discount (they call it "premium")

4. Choose amount and place bid

5. After 10 mins, you can activate the bid

14/ To activate the bids, scroll down to the section that says "My Bids", and click activate.

I'm not sure why this step is necessary.

You can also cancel the bids from this section.

I'm not sure why this step is necessary.

You can also cancel the bids from this section.

15/ Here are some resources for further reading if you're interested.

Kujira's official guide on how to bid on liquidations in Orca: teamkujira.medium.com/orca-how-to-bi…

Kujira's official guide on how to bid on liquidations in Orca: teamkujira.medium.com/orca-how-to-bi…

16/ Kujira's explanation on how liquidations work: 🌊

teamkujira.medium.com/an-intro-to-li…

Interestingly, this protocol is also supposed to prevent cascading liquidations by having this gradient of buyers at lower discounts (though we're not quite sure how that works yet).

teamkujira.medium.com/an-intro-to-li…

Interestingly, this protocol is also supposed to prevent cascading liquidations by having this gradient of buyers at lower discounts (though we're not quite sure how that works yet).

17/ Hopefully this thread was helpful, and the explanation made sense! Let us know what kind of #DeFi / #Crypto guides you'd like to see in the future.

#WAGMI 🙏

#WAGMI 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh