1/17 📡Here is the monthly catch-up of Global #DeFi market analysis for AUGUST '22. Last one is here below with some conclusions about Smart Money moves. August was pretty quiet and #realyield submerges CT. So Where are we in #DeFi?

https://twitter.com/Subli_Defi/status/1556566133519548416?t=X_DRd5tjeOWOI_fQ3oNwUg&s=19

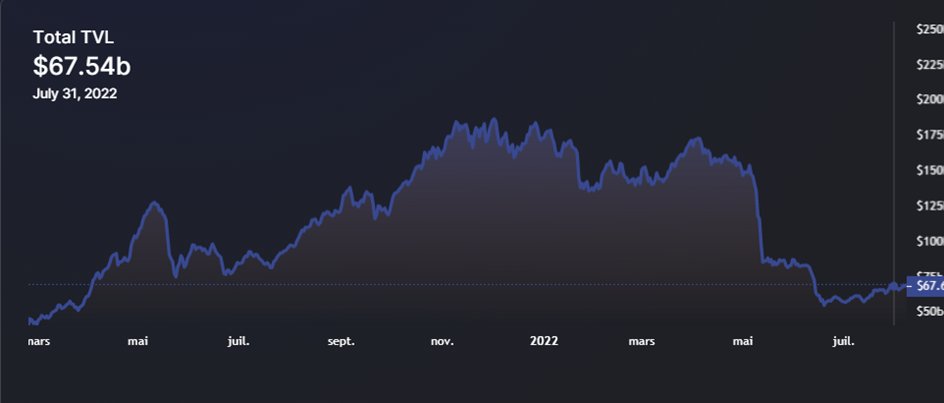

2/17 TVL on #DeFiLlama is at 60b$ at 31/Aug, Decreasing by -12% since end of July.

3/17 On the other hand, #crypto total market cap did not manage to hold the 1b$ threshold and sitting now at 0,96b compared to 1,075b end of July, so -10,4% decrease.

4/17 I also check one Defi Index made by @FTX_Official being the Defi-Perp chart. The index is made up of the following tokens. Here market cap has shrinked by -21% in one month.

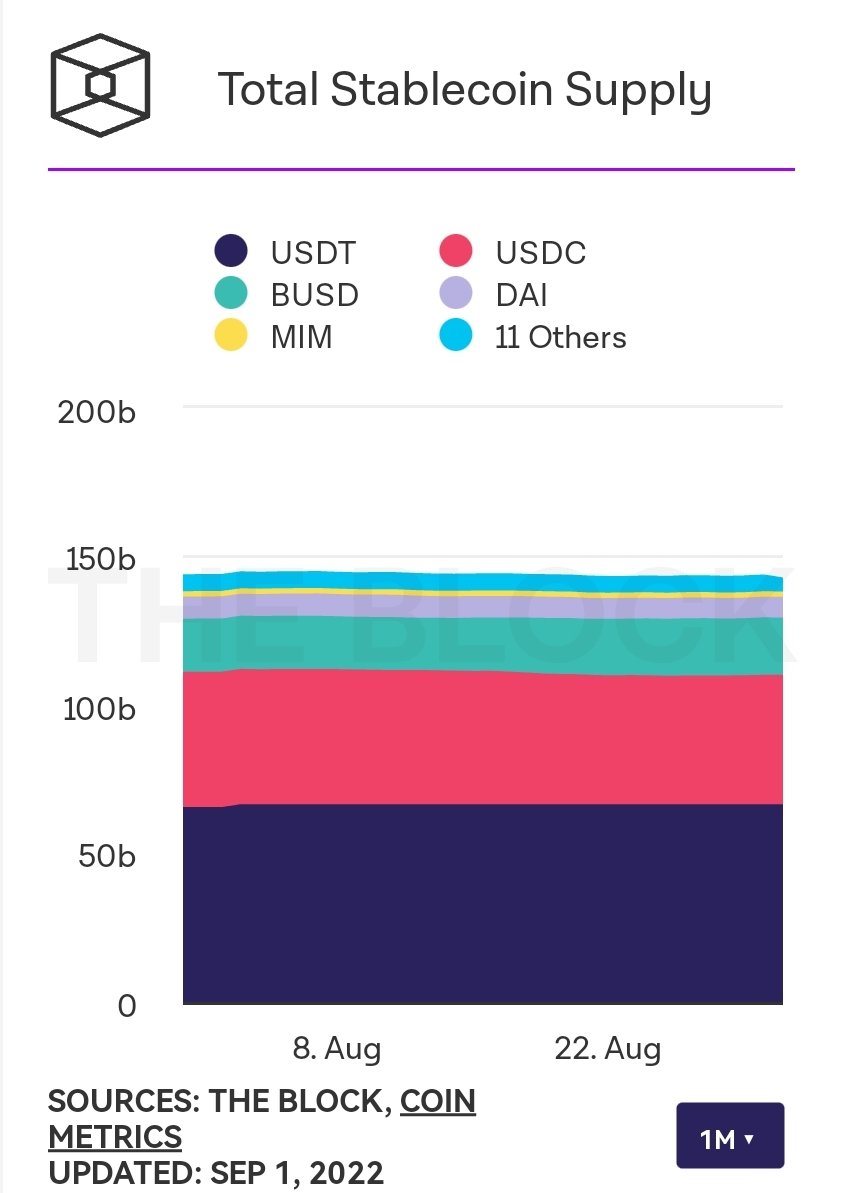

5/17 Now according to @TheBlock__ stablecoin MC is at 143b$, stable since end of July. No real move on the overall, but some internal movements from $USDC to $USDT and $BUSD whith the latest going crosschain recently.

6/17 $EURO stablecoin is however becoming more and more important. This can be seen with $EUROC sitting at a MC of 76m$ x76 in 1 month !

7/17 this is also increased by the fact that #CME opens #Bitcoin & #Ethereum futures paired in €Euro.

https://twitter.com/BitcoinMagazine/status/1564238130857000961?t=jOqfbLDlkQiU7OeKmFteQA&s=19

8/17 This is i guess driven by the fact that EUR-USD reaches an all time low since 20 years trading below 1$.

9/17 Stablecoin is becoming the new narrative in 2022. Now it's the turn of @CurveFinance to leak their newstablecoin will likely be released in September, and that is driving some accumulations from whales & institutions

https://twitter.com/0xroborosCap/status/1565000954566815745?t=NLIDW1qw5MKtsWXkLhwovQ&s=19

10/17 Conclusion of this month, smart money did not really move on August, which is as usual a pretty quiet moment on the financial market.

11/17 In addition over this August month was the one of Layer 2 narratives with @optimismFND , @Arbitrum and @metisdao leading the ranking (blockchain with TVL > 50m$). Let's dig into those 3 #blockchains

12/17 @optimismFND has been attracting liquidity thanks to their $OP grant. As projects are starting receiving and then releasing this incentive, TVL keeps going up. @beefyfinance gains 2 places, while @CurveFinance 3 mainly driven by @synthetix_io incentives on curve LP

13/17 @arbitrum : with no incentives or $Arbi token, the blockchain manages to keep and even increase liquidity thanks the #RealYield narratives of certain protocols such as @GMX_IO.

14/17 with #Nitro upgrade and as rumors of airdrop continue to leak on CT, September may come with some nice surprise. For a complete list of tasks that may help us to be eligible, please check that wonderful thread made by @OlimpioCrypto

https://twitter.com/OlimpioCrypto/status/1563561465344192512?t=VAbwfRYZEVKQHRAHyeLIGg&s=19

15/17 Finally Metis ecosystem is also seeing an increase of TVL thanks tk their recent 100m$ incentives. @hummusexchange is the first project receiving this grant (2m$ in total) and is the first project in TVL of @metisdao.

finance.yahoo.com/tech/hummus-ex…

finance.yahoo.com/tech/hummus-ex…

16/17 It's most likeky that Layers 2 will continue to make the news as users will farm @arbitrum airdrop, new cycle for @optimismFND grants will begin, and more projects will receive @MetisDAO incentives.

#L222 season ! Let's get ready !

#L222 season ! Let's get ready !

17/17 if you liked this monthly catch-up, please feel free to retweet the 1st post, and follow me for more insights !

https://twitter.com/Subli_Defi/status/1565624050491219968?t=a9dQe6tkBjPANIZRvZn99g&s=19

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh