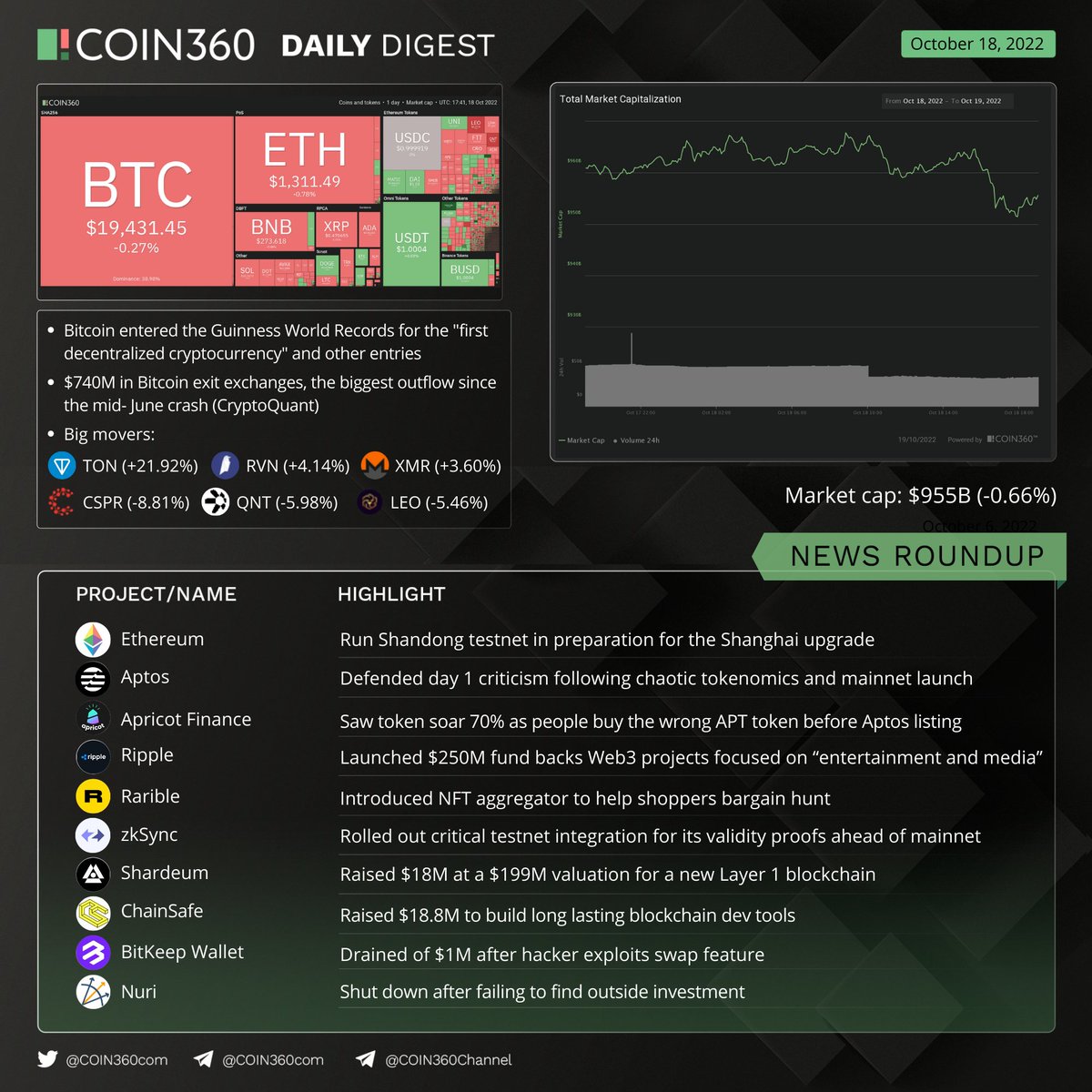

A pretty quiet day for $BTC as it showed lagging performance while so much noise was created in the #crypto space today.

In @coin360com Daily Digest:

In @coin360com Daily Digest:

1/ In the pic:

@Ethereum @AptosLabs @ApricotFinance @ripple @rarible @zksync @shardeum @ChainSafeth @BitKeepOS @NuriBanking @ton_blockchain @ravencoin @monero @Casper_Network @quant_network @bitfinex

@Ethereum @AptosLabs @ApricotFinance @ripple @rarible @zksync @shardeum @ChainSafeth @BitKeepOS @NuriBanking @ton_blockchain @ravencoin @monero @Casper_Network @quant_network @bitfinex

2/ Both S&P 500 and Nasdaq saw the green today due to strong earning reports from @GoldmanSachs and the market was waiting for more, but $BTC marked a 0.3% drop.

$740M in #BTC outflow from exchanges on Oct 18 (@cryptoquant_com) didn't seem to push a clear move for the price.

$740M in #BTC outflow from exchanges on Oct 18 (@cryptoquant_com) didn't seem to push a clear move for the price.

3/ $ETH saw a 0.8% decline in the past 24h with the likeliness to make a long squeeze by going down to $1,290 as stated in our TA post: coin360.com/news/bitcoin-f…

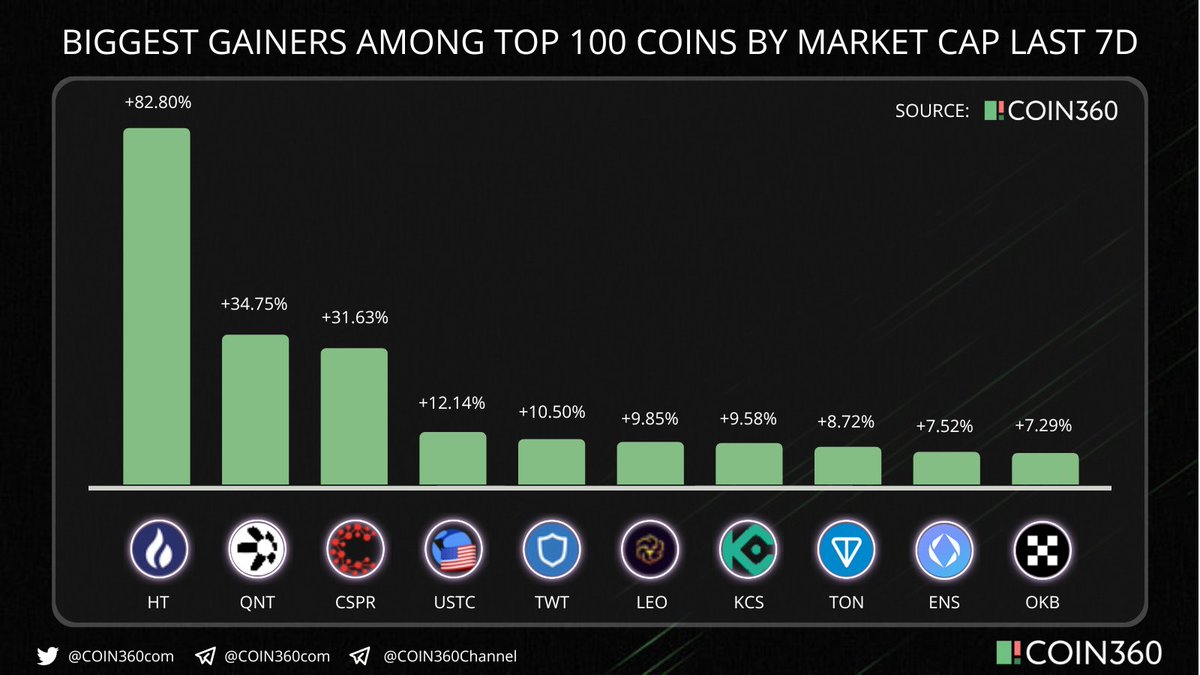

Top gainers: $TON $RVN $XMR

Top losers: $CSPR $QNT $LEO

Details in our heatmap: coin360.com

Top gainers: $TON $RVN $XMR

Top losers: $CSPR $QNT $LEO

Details in our heatmap: coin360.com

4/ @Ethereum devs can start testing out their next upgrades to the protocol on the new Shandong testnet in preparation for the Shanghai upgrade in 2023.

coindesk.com/tech/2022/10/1…

coindesk.com/tech/2022/10/1…

5/ @AptosLabs had a dramatic mainnet launch today with both its tps and #tokenomics sparking a debate on CT despite $APT being listed on major CEXes like @binance @okx: coindesk.com/business/2022/…

The #Aptos team defended the chain in its "day 1 update": cointelegraph.com/news/performin…

The #Aptos team defended the chain in its "day 1 update": cointelegraph.com/news/performin…

6/ The $APT hype also caused some serious mistakes as traders carelessly jumped into @ApricotFinance's $APT instead of @AptosLabs', causing the token to rise 70% at one point.

cryptopotato.com/people-buy-the…

cryptopotato.com/people-buy-the…

7/ @Ripple launched the #Ripple Creator Fund, a $250M initiative committed to providing creators with the financial, creative and technical support to build on the $XRP Ledger.

decrypt.co/112200/ripple-…

decrypt.co/112200/ripple-…

8/ @Rarible has introduced an #NFT aggregator that displays options across several marketplaces to compare prices.

coinjournal.net/news/rarible-l…

coinjournal.net/news/rarible-l…

9/ @zkSync rolled out a critical integration for its zkEVM technology called validity proofs ahead of its mainnet launch on Oct. 28, allowing increased scalability capabilities without compromising on security.

theblock.co/post/177819/zk…

theblock.co/post/177819/zk…

10/ @shardeum, the #blockchain startup founded by @WazirXIndia co-founder Nischal Shetty, raised $18.2M in a seed funding round from more than 50 investors.

Shardeum is a PoS smart contract platform for improved scaling capabilities.

coindesk.com/business/2022/…

Shardeum is a PoS smart contract platform for improved scaling capabilities.

coindesk.com/business/2022/…

11/ Blockchain research and development studio @ChainSafeth raised $18.8M in a Series A round to build long-lasting developer tools across multiple chains.

The investment was led by @r13vc with participation from @NGC_Ventures @HashKey_Capital & others.

cointelegraph.com/news/web3-infr…

The investment was led by @r13vc with participation from @NGC_Ventures @HashKey_Capital & others.

cointelegraph.com/news/web3-infr…

12/ A hacker stole $1M of @BNBChain and @0xPolygon-based tokens from @BitKeepOS token swap service users, then transferred them to Tornado Cash.

The team will refund all victims that lost funds in the exploit.

decrypt.co/112305/bitkeep…

The team will refund all victims that lost funds in the exploit.

decrypt.co/112305/bitkeep…

13/ #Sony-backed crypto neobank @NuriBanking has to shut down after failing to find an acquirer or outside investment.

blockworks.co/german-crypto-…

blockworks.co/german-crypto-…

14/ Other news:

3AC founders’ locations unknown as court ‘manhunt’ begins: bitcoinist.com/three-arrows-f…

@Terra_money co-founder @stablekwon tells Laura Shin fraud charges against him are illegitimate: cryptoslate.com/terra-co-found…

3AC founders’ locations unknown as court ‘manhunt’ begins: bitcoinist.com/three-arrows-f…

@Terra_money co-founder @stablekwon tells Laura Shin fraud charges against him are illegitimate: cryptoslate.com/terra-co-found…

15/ EU Commission warns crypto mining may be halted in energy emergency: theblock.co/post/177966/eu…

Users upset that @Binance's wrong crypto network retrieval fees have soared to 500 $BUSD: cointelegraph.com/news/users-ups…

Users upset that @Binance's wrong crypto network retrieval fees have soared to 500 $BUSD: cointelegraph.com/news/users-ups…

16/ Liking our daily digests? Join us on Twitter & Telegram!

We also provide you with a collection of insights from thought leaders in the Telegram channel every day 😉

Telegram chat: t.me/COIN360com

Telegram announcement: t.me/COIN360Channel

We also provide you with a collection of insights from thought leaders in the Telegram channel every day 😉

Telegram chat: t.me/COIN360com

Telegram announcement: t.me/COIN360Channel

17/ That's a wrap!

If you enjoyed this thread:

1. Follow us @COIN360com for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow us @COIN360com for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/976434652322979840/status/1582427608494804992

• • •

Missing some Tweet in this thread? You can try to

force a refresh