Is India's Consumption is Booming or Bombing ? keep updating the thread with Nuggets ...

Kantar's FMCG Pulse report .. April-Aug 2022.

Average MONTHLY sales of FMCG packs were 19.2 bn, or 62 packs/household, from Apr-Aug 2022

vs PRE-COVID: Average MONTHLY sales of FMCG packs 15 billion or 51 packs/household => 20% Increase in VOLUME

BUT #DEVIL lies in the #detail

Average MONTHLY sales of FMCG packs were 19.2 bn, or 62 packs/household, from Apr-Aug 2022

vs PRE-COVID: Average MONTHLY sales of FMCG packs 15 billion or 51 packs/household => 20% Increase in VOLUME

BUT #DEVIL lies in the #detail

packs bought pre-pandemic weighed 438 grams on average, the size has shrunk to just 309 grams now amid soaring inflation .... thats a 30% reduction in Volume/Pack...

In Other Words, CONSUMPTION per household in FMCG is Down 15% .... Cant recall such a BAD SCENARIO in 35 yrs..

In Other Words, CONSUMPTION per household in FMCG is Down 15% .... Cant recall such a BAD SCENARIO in 35 yrs..

The ENTIRE INCREASE IN PACKETS (51 => 62) came from FOOD.. PRE-COVID, about 23 packs of food products were purchased by a household every month on average; however, between May and August 2022, this jumped to 31 pack

Essentially, Non-Food FMCG, the SCENARIO is a DISASTER

Essentially, Non-Food FMCG, the SCENARIO is a DISASTER

#Shoes RELAXO FOOTWEAR which caters to the Aam Admi (BATA which caters to the Upper End & has not reported as yet)

Q2FY23: Revenue -6.3% | EBITDA -49.1%

With Footwear inflation @ 13-15% YoY, Relaxo must have witnessed downtrading & volume de-growth (despite schools opening)

Q2FY23: Revenue -6.3% | EBITDA -49.1%

With Footwear inflation @ 13-15% YoY, Relaxo must have witnessed downtrading & volume de-growth (despite schools opening)

#BIZCOM #DIWALI According to data by Bizom, a platform that automates retail execution at 7.5 #million kirana stores, overall #FMCG sales clocked a MoM growth of 5% during #DiwaliSeason

Overall YoY was just 10.6% YoY

(Adjust for 15-20% Inflation, you end up with YoY #DECLINE)

Overall YoY was just 10.6% YoY

(Adjust for 15-20% Inflation, you end up with YoY #DECLINE)

this was driven largely by branded commodities (+26% MoM), chocolates & confectionery (+13% MoM) vs Packaged foods (-4% MoM) and home care (-4% MoM), Personal Care (-18% MoM) and Beverages (-23% MoM).

Source: timesofindia.indiatimes.com/business/india…

Source: timesofindia.indiatimes.com/business/india…

An Analysis of #SaffireFoods ... QSR is witnessing 10-15% VOLUME decline per store... the company will NOT ADMIT IT... the numbers tell you the truth

https://twitter.com/TheFactFindr/status/1588118918924709888?s=20&t=V2BUmrJ-N4ykJBlyrNronQ

#Cookware #Hawkins ... here too Volumes declined

https://twitter.com/TheFactFindr/status/1588141476688855040?s=20&t=V2BUmrJ-N4ykJBlyrNronQ

#IndigoPaints - Just a mean reversion of margins

https://twitter.com/TheFactFindr/status/1588136424687403008?s=20&t=V2BUmrJ-N4ykJBlyrNronQ

#FMCG #ZEROGROWTH #Rural #Urban #Nielsen #hindustanunilever #YouCannotMakeThisUp

During the Sept Quarter #2QFy23 results, @HUL_News shared a presentation showing that in HUL relevant categories, 3 YEAR VOLUMES in URBAN & RURAL India have DECLINED 1% CAGR for the FMCG INDUSTRY

During the Sept Quarter #2QFy23 results, @HUL_News shared a presentation showing that in HUL relevant categories, 3 YEAR VOLUMES in URBAN & RURAL India have DECLINED 1% CAGR for the FMCG INDUSTRY

#FMCG #ZEROGROWTH #Rural #Urban if one drills down into further detail, they show that, In RURAL India during the last 3 Months, Volumes for the FELL 10% YoY for the FMCG INDUSTRY while it fell 3% YoY in URBAN India

Recall Kantar Mentioned FMCG volumes declined 15% vs Pre-covid

Recall Kantar Mentioned FMCG volumes declined 15% vs Pre-covid

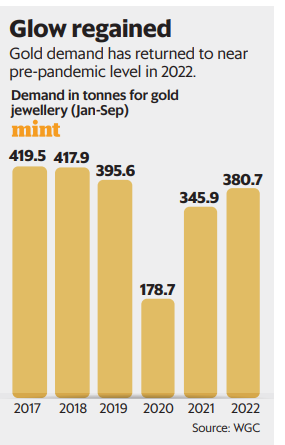

#India #GOLD #Consumption NOT STELLAR as media indicated especially given that GOLD PRICES in INR have remained STEADY and the recent weakness should have helped.

As per World Gold Council, In the Jan-Sept 22 period, gold jewelry demand was at 381 tonnes but below PRE-COVID

As per World Gold Council, In the Jan-Sept 22 period, gold jewelry demand was at 381 tonnes but below PRE-COVID

What did the Listed Companies Report in Sept Qtr

- TITAN’S jewelry division grew 18%

- KALYAN Jeweler's rev grew 14%

Given Retail outlet Expansion & INFLATION, this is DISAPPOINTING !

Indias FALL #GrossHouseHoldSavings rates is putting a Challenge on #Consumption

- TITAN’S jewelry division grew 18%

- KALYAN Jeweler's rev grew 14%

Given Retail outlet Expansion & INFLATION, this is DISAPPOINTING !

Indias FALL #GrossHouseHoldSavings rates is putting a Challenge on #Consumption

• • •

Missing some Tweet in this thread? You can try to

force a refresh