Why has @defichain's dUSD been DEPEGGED for more than 5 months?

1/19 🧵 on the Top10 TVL chain that CT doesn't talk about

1/19 🧵 on the Top10 TVL chain that CT doesn't talk about

2/19

Defichain was created by Julian Hosp and partnered with his company, CakeDeFi.

With Hosp's history in TenX and Lyoness, many have wondered if this is the next Cefi rugpull.

Interestingly, CakeDefi is compared to other defunct lenders on their own website. Up to 23.9% APY!

Defichain was created by Julian Hosp and partnered with his company, CakeDeFi.

With Hosp's history in TenX and Lyoness, many have wondered if this is the next Cefi rugpull.

Interestingly, CakeDefi is compared to other defunct lenders on their own website. Up to 23.9% APY!

3/19

For a chain that's called "Defi"chain, its TVL seems overly reliant on just two Dapps. Even His Excellency's Tron has 10.

For a chain that's called "Defi"chain, its TVL seems overly reliant on just two Dapps. Even His Excellency's Tron has 10.

4/19

dUSD's depeg coincided with UST's depeg, and persisted till date.

dUSD can be minted by pledging crypto-collateral. dUSD along other mintable synthetics are termed "Decentralized Assets".

It was also marketed as "Passive Income", similar to Anchor Protocol previously

dUSD's depeg coincided with UST's depeg, and persisted till date.

dUSD can be minted by pledging crypto-collateral. dUSD along other mintable synthetics are termed "Decentralized Assets".

It was also marketed as "Passive Income", similar to Anchor Protocol previously

5/19

To mint a dToken like dUSD, the collateral must consist of 50% $DFI. Interestingly, DFI has 100% collateralization, similar to BTC and USDC.

Combined, it feels like a possible $FTT illiquid lending house-of--cards scenario.

blog.defichain.com/decentralized_…

To mint a dToken like dUSD, the collateral must consist of 50% $DFI. Interestingly, DFI has 100% collateralization, similar to BTC and USDC.

Combined, it feels like a possible $FTT illiquid lending house-of--cards scenario.

blog.defichain.com/decentralized_…

6/19

To get back your collateral, you obtain minted dTokens to pay back the outstanding balance + accrued interest.

And to close the vault, you pay a fee in $DFI. This comes from your initial collateral balance.

To get back your collateral, you obtain minted dTokens to pay back the outstanding balance + accrued interest.

And to close the vault, you pay a fee in $DFI. This comes from your initial collateral balance.

8/19

Back in the 2021 bull market, dUSD was constantly trading at a premium.

To forcefully bring down the premium, emergency proposal DFIP2112 was passed, which allowed dUSD loans/mints to be repayable by DFI.

github.com/DeFiCh/dfips/i…

Back in the 2021 bull market, dUSD was constantly trading at a premium.

To forcefully bring down the premium, emergency proposal DFIP2112 was passed, which allowed dUSD loans/mints to be repayable by DFI.

github.com/DeFiCh/dfips/i…

9/19

This worked in increasing the utility of $DFI and created a way for the premium to be arb-ed.

But it also helped create essentially "unbacked" dUSD.

This worked in increasing the utility of $DFI and created a way for the premium to be arb-ed.

But it also helped create essentially "unbacked" dUSD.

10/19

According to defiscan.live/tokens, over 500M dTokens that have been minted, dUSD accounted for 264.8M.

According to defiscan.live/tokens, over 500M dTokens that have been minted, dUSD accounted for 264.8M.

11/19

After Luna collapsed along with the trust in algo-stables, yield farmers dumped DFI and got out. This indirectly took out the "value" that was backing dUSD.

DFI whales and farmers win.

dUSD holders and dUSD-LPs lose.

After Luna collapsed along with the trust in algo-stables, yield farmers dumped DFI and got out. This indirectly took out the "value" that was backing dUSD.

DFI whales and farmers win.

dUSD holders and dUSD-LPs lose.

12/19

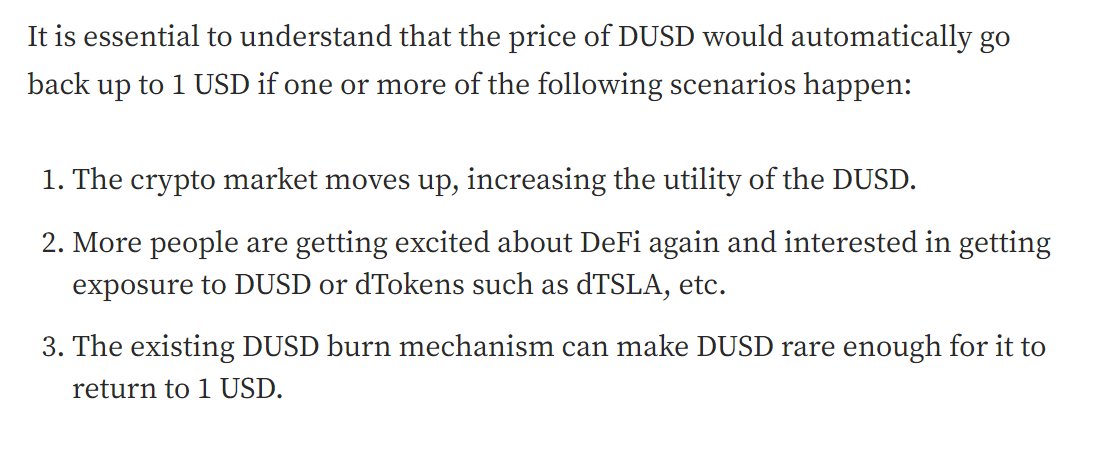

Hosp explains it in his own words in julianhosp.medium.com/resolving-dusd…

While he is optimistic in his post, I feel the greater question is whether the damage done is irreversible.

Hosp explains it in his own words in julianhosp.medium.com/resolving-dusd…

While he is optimistic in his post, I feel the greater question is whether the damage done is irreversible.

14/19

Other concerns - dUSD on DEX

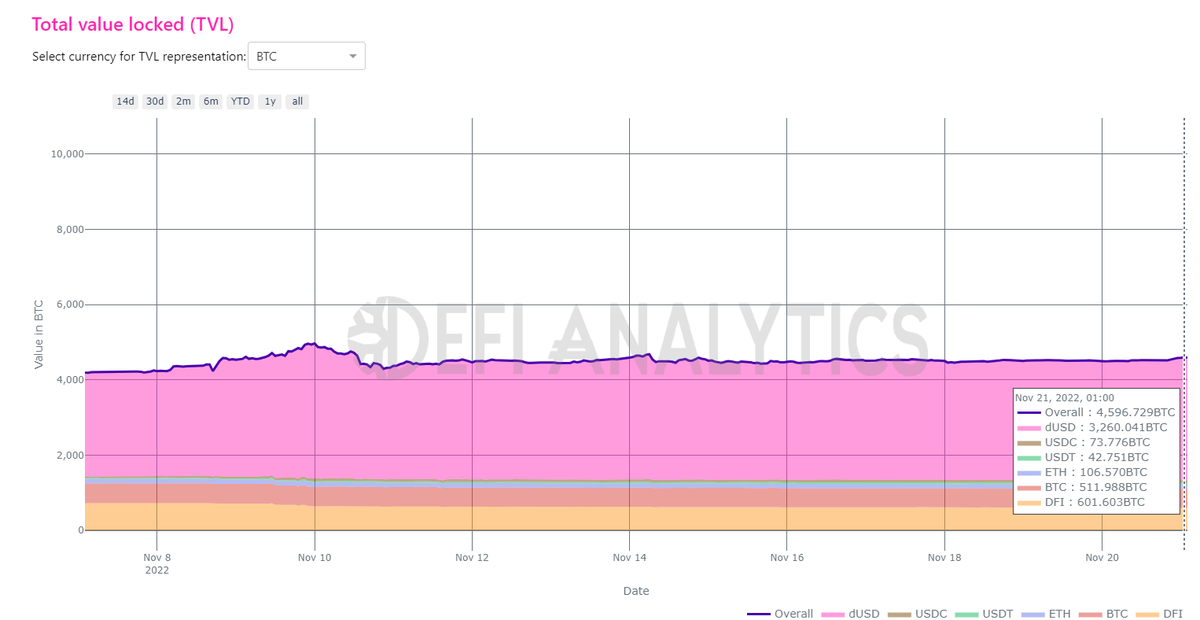

Apart from their vaults that generate the synthetics, their DEX which has a TVL of $274.47M - defillama.com/protocol/defic….

The majority of the pools have dUSD as the opposite pair. Given the oversupply, this dynamic compounds the depeg

Other concerns - dUSD on DEX

Apart from their vaults that generate the synthetics, their DEX which has a TVL of $274.47M - defillama.com/protocol/defic….

The majority of the pools have dUSD as the opposite pair. Given the oversupply, this dynamic compounds the depeg

15/19

Other concerns - BTC Atomic swap exploit 2021-2022.

Atomic swaps enabled users to swap BTC to dBTC. Makers earn 50% of the swap fees.

However, an exploit allowed an exploiter to reconfigure fees to be denominated in $BTC terms instead of $DFI

blog.defichain.com/atomic-swap-po…

Other concerns - BTC Atomic swap exploit 2021-2022.

Atomic swaps enabled users to swap BTC to dBTC. Makers earn 50% of the swap fees.

However, an exploit allowed an exploiter to reconfigure fees to be denominated in $BTC terms instead of $DFI

blog.defichain.com/atomic-swap-po…

16/19

As a result, there are now unbacked dBTCs in circulation. The community fund is insufficient to cover the shortfall.

BTC in CakeDeFi address = 2,345

dBTC held in vaults = 511

dBTC in pool = 2,679

Total dBTC = 3,190

unbacked dBTC in circulation= 845

As a result, there are now unbacked dBTCs in circulation. The community fund is insufficient to cover the shortfall.

BTC in CakeDeFi address = 2,345

dBTC held in vaults = 511

dBTC in pool = 2,679

Total dBTC = 3,190

unbacked dBTC in circulation= 845

17/19 - Links

Known Cake address holding BTC - 38pZuWUti3vSQuvuFYs8Lwbyje8cmaGhrT

(blockchain.com/btc/address/38…)

dBTC locked in vaults - defichain-analytics.com/vaultsLoans?en…

dBTC in pool - defiscan.live/dex

Reddit post - reddit.com/r/defiblockcha…

Known Cake address holding BTC - 38pZuWUti3vSQuvuFYs8Lwbyje8cmaGhrT

(blockchain.com/btc/address/38…)

dBTC locked in vaults - defichain-analytics.com/vaultsLoans?en…

dBTC in pool - defiscan.live/dex

Reddit post - reddit.com/r/defiblockcha…

18/19

Amidst this Cefi meltdown, transparency and information sharing are needed more than ever. (I view Defichain as Cedefi). Not FUDing.

With Defichain having higher TVL than Solana, I'm hoping CT researchooorrrs can look into this and explore as well.

Amidst this Cefi meltdown, transparency and information sharing are needed more than ever. (I view Defichain as Cedefi). Not FUDing.

With Defichain having higher TVL than Solana, I'm hoping CT researchooorrrs can look into this and explore as well.

19/19

Tagging for awareness 👉👈

@DegenSpartan @crypto_condom @Arthur_0x @edison0xyz @DefiIgnas @otteroooo @FatManTerra @Fiskantes @AkadoSang @warobusiness @Route2FI @gammichan @EffortCapital @CryptoMaestro @mrjasonchoi @concodanomics @0xWangarian @0xShual @rektdiomedes

Tagging for awareness 👉👈

@DegenSpartan @crypto_condom @Arthur_0x @edison0xyz @DefiIgnas @otteroooo @FatManTerra @Fiskantes @AkadoSang @warobusiness @Route2FI @gammichan @EffortCapital @CryptoMaestro @mrjasonchoi @concodanomics @0xWangarian @0xShual @rektdiomedes

Tags

#defichain #stablecoin #depeg #defi #cefi #dusd #yieldfarming #crypto #bitcoin #ethereum #genesis #nfts #kucoin #lending #blockfi #celsius #ftx #binance #gemini #kraken #coinbase #bybit #bitmex

#defichain #stablecoin #depeg #defi #cefi #dusd #yieldfarming #crypto #bitcoin #ethereum #genesis #nfts #kucoin #lending #blockfi #celsius #ftx #binance #gemini #kraken #coinbase #bybit #bitmex

• • •

Missing some Tweet in this thread? You can try to

force a refresh