My contribution to the #electricity market debate, today at @voxeu

Thread 🧵

cepr.org/voxeu/columns/…

Thread 🧵

cepr.org/voxeu/columns/…

1/Von der Leyen “Current electricity market design is not doing justice to consumers They should reap the benefits of lowcost renewables We will do a deep and comprehensive reform of electricity markets”

politico.eu/article/ursula…

Which should be the building blocks of the reform?

politico.eu/article/ursula…

Which should be the building blocks of the reform?

2/ On the objectives:

➡️*Productive efficiency*: demand must be met by the plants with the lowest marginal costs 📉📈

➡️*Investment efficiency*: investments must take place at the right scale, mix, and locations 🌞🍃

➡️*Equity*: prices should be cost-reflective 🪙

➡️*Productive efficiency*: demand must be met by the plants with the lowest marginal costs 📉📈

➡️*Investment efficiency*: investments must take place at the right scale, mix, and locations 🌞🍃

➡️*Equity*: prices should be cost-reflective 🪙

3/On the tools:

Combine #short-term energy markets (1⃣) with regulator-backed #long-term contracts (2⃣)

1⃣ provide short-run signals for efficient generation + consumption

2⃣facilitate efficient investments while adjusting profitability through #competitive forces

Combine #short-term energy markets (1⃣) with regulator-backed #long-term contracts (2⃣)

1⃣ provide short-run signals for efficient generation + consumption

2⃣facilitate efficient investments while adjusting profitability through #competitive forces

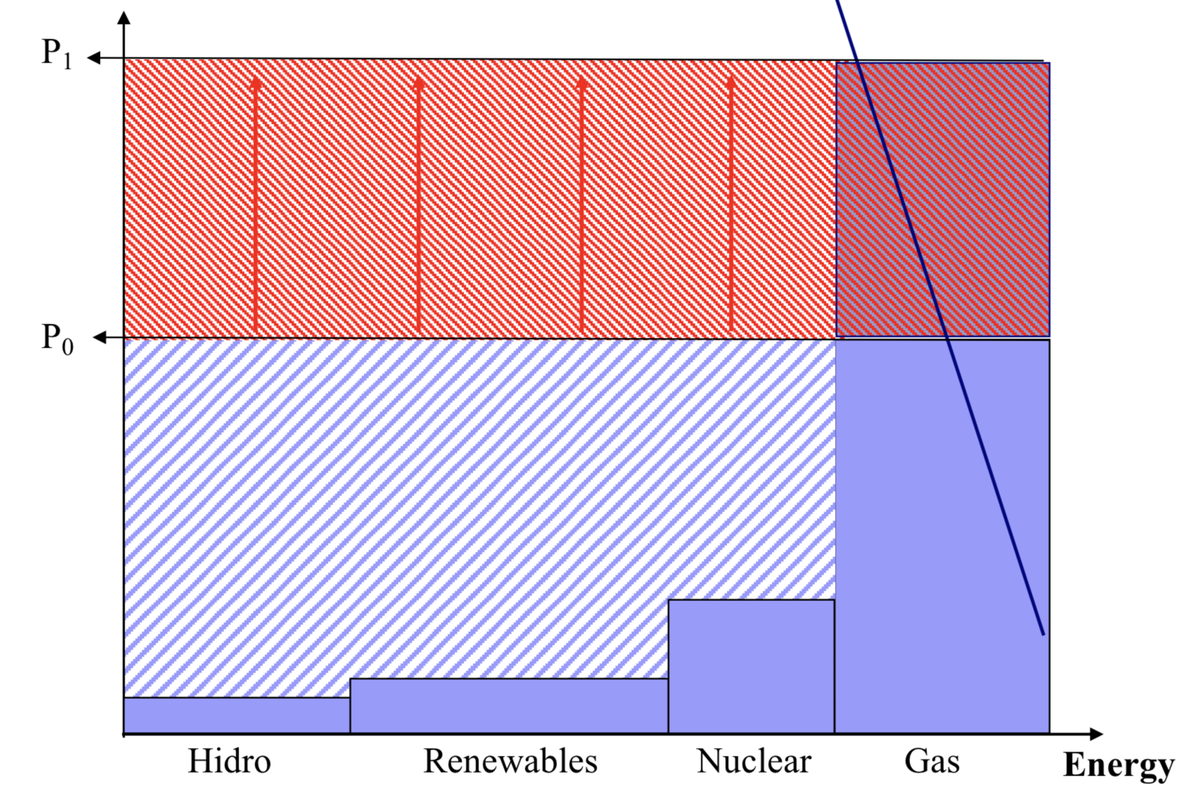

4/ *A well-functioning #short-term market*

📢 We should preserve short-run electricity markets but improve their performance through increased #transparency + #liquidity

➡️ Compulsory participation (as original UK design), participants allowed to enter into financial contracts

📢 We should preserve short-run electricity markets but improve their performance through increased #transparency + #liquidity

➡️ Compulsory participation (as original UK design), participants allowed to enter into financial contracts

5/ *Efficient and equitable long-term contracts for all consumers*

Highly capital-intensive and long-lived assets + various externalities imply that:

➡️Long-term efficiency requires some form of #long-run contracting

➡️#Regulators must play an active role in promoting investments

Highly capital-intensive and long-lived assets + various externalities imply that:

➡️Long-term efficiency requires some form of #long-run contracting

➡️#Regulators must play an active role in promoting investments

6/ Benefits of long-term contracts:

➡️ #Derisking the investments -> cheaper #capital 🪙+ more competitors🧑🏭

➡️ #Competition for these contracts through #auctions would pass on this efficiency gain to #consumers in the form of lower prices 👨👨👧👦

➡️ #Derisking the investments -> cheaper #capital 🪙+ more competitors🧑🏭

➡️ #Competition for these contracts through #auctions would pass on this efficiency gain to #consumers in the form of lower prices 👨👨👧👦

7/ An important economic #principle should be kept in mind throughout:

*Exposing producers to short-run price signals (whenever desirable) is compatible with decoupling their average payments from those prices*

➡️This can be achieved through *Contracts-for-Differences* (CfD)

*Exposing producers to short-run price signals (whenever desirable) is compatible with decoupling their average payments from those prices*

➡️This can be achieved through *Contracts-for-Differences* (CfD)

8/ Under a CfD, producers sell at the short-term price (p) and pay/receive the difference between a ‘reference price’ (p’) and the contract’s strike price (f)

➡️They keep the difference (p-p’) -> exposed to short-run prices

➡️Choosing f adequately allows adjusting profitability

➡️They keep the difference (p-p’) -> exposed to short-run prices

➡️Choosing f adequately allows adjusting profitability

9/ Contract design should differ across technologies depending on their flexibility to respond to short-run price signals:

➡️Full-price exposure important for storable resources 🌊

➡️Exposing wind or solar plants to short-run prices brings limited benefits 🌞🍃

➡️Full-price exposure important for storable resources 🌊

➡️Exposing wind or solar plants to short-run prices brings limited benefits 🌞🍃

10/ For #hydro and #nuclear power plants, setting the ‘reference price’ at the annual average market price effectively provides a #bonus for producing at peak times or a #penalty for producing at off-peak times, contributing to an efficient operation

11/ For existing plants competition to enter the market is not possible:

➡️ Instead, set technology-specific caps or strike prices in a cost-reflective manner

📢Political will required

Not addressing the economic + social consequences of windfall profits is no less challenging!

➡️ Instead, set technology-specific caps or strike prices in a cost-reflective manner

📢Political will required

Not addressing the economic + social consequences of windfall profits is no less challenging!

12/ Regulators should be the counterparty of the long-run contracts:

➡️Bilateral contracts (PPAs) are #scarce and too #short and only benefit those with strong bargaining power 🫵

➡️Counterparty risk is lower under regulator-back contracts, to the benefit of #all consumers 👨👨👧👦

➡️Bilateral contracts (PPAs) are #scarce and too #short and only benefit those with strong bargaining power 🫵

➡️Counterparty risk is lower under regulator-back contracts, to the benefit of #all consumers 👨👨👧👦

13/ Changing the electricity market design without significantly affecting the outcomes would be a lost opportunity

Watch out 📢: The risk of "Plus ça change, plus c’est la même chose"…is not negligible

Watch out 📢: The risk of "Plus ça change, plus c’est la même chose"…is not negligible

14/ We cannot miss this #opportunity to redesign our #electricity markets to make them more #robust to the current and future energy crises while simultaneously achieving carbon #abatement goals 🌞🍃🌊 at least cost for consumers and #society 👨👨👧👦

• • •

Missing some Tweet in this thread? You can try to

force a refresh