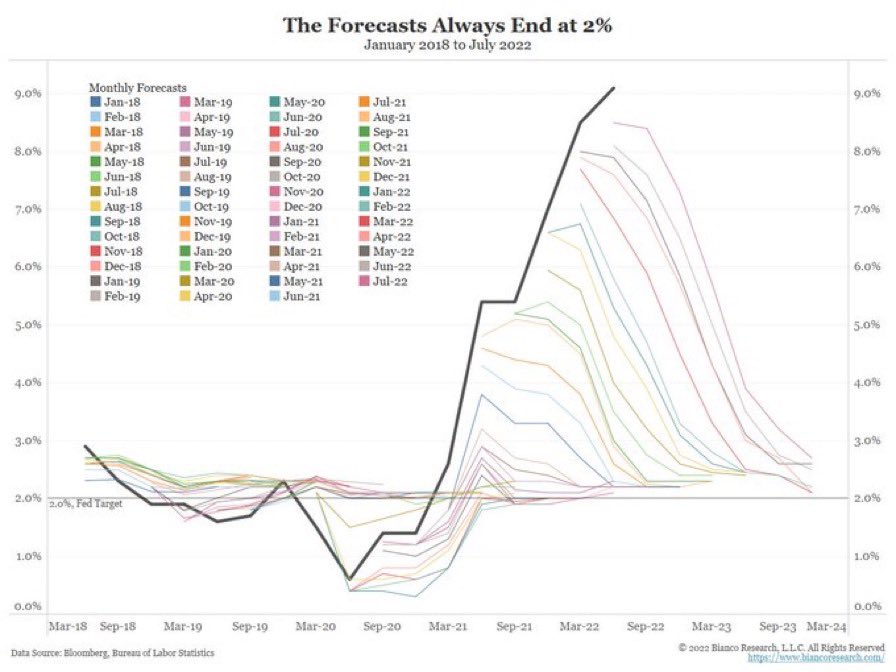

The big, big risk is that (almost) every investor expects #equities AND #bonds to decline further due to ongoing tight monetary policy and a weakening global economy.

This significantly increases the odds that 2023 will play out differently.

This significantly increases the odds that 2023 will play out differently.

This does not automatically mean you must be contrarian (even though I like bonds better than most.) So far, this bear market is without capitulation and significant outflows, but with ‘all’ investors in the same boat, little is needed for markets to move in the other direction.

The beauty, of course, is that 2023 predictions are entirely arbitrary and that every sound investment framework should allow you to adjust based on new information. Sticking to your convictions without incorporating (enough) new information is an inferior investment strategy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh