Wondering about latest news 📰 in the #realestate #housingmarket 🏡💵 with pricing, #interestrates, etc.? Here's an updated thread for January 23' that includes all the latest macro/market data... 🧵/👇🏼

📊h/t @RealEstateCafe

📊h/t @RealEstateCafe

1/🧵 "44% year/year drop in @MBAMortgage

Purchase Index is largest decline on record." 🇺🇸📉

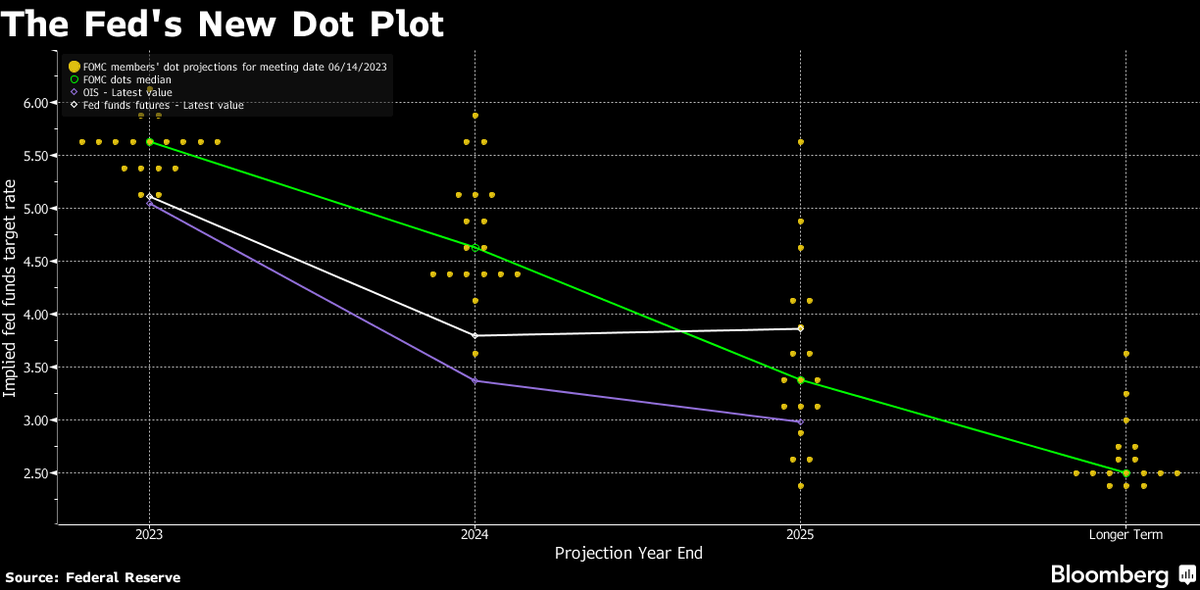

📊h/t @LizAnnSonders @bloomberg

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

Purchase Index is largest decline on record." 🇺🇸📉

📊h/t @LizAnnSonders @bloomberg

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

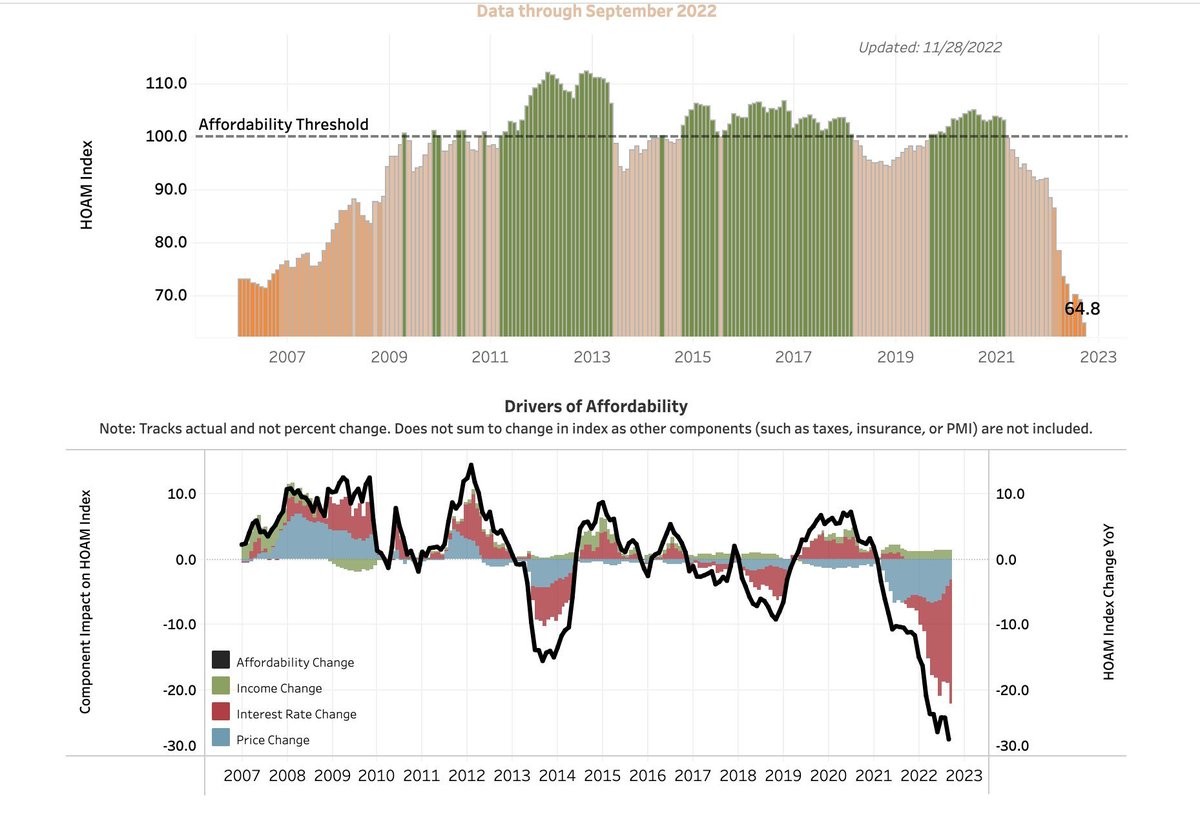

2/🧵 Affordability "threshold" for housing, via the @AtlantaFed 🏡

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

3/🧵 Will this acceleration continue? ⚠️🏡📉

"November 2022: 14 markets were down YoY."

"December 2022: 29 markets were down YoY"

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

"November 2022: 14 markets were down YoY."

"December 2022: 29 markets were down YoY"

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

4/🧵 Latest bank lending standards data from @GoldmanSachs... 🏦🏡

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates #banks $GS $JPM $BOA $C $WFC $MS

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates #banks $GS $JPM $BOA $C $WFC $MS

5/🧵 Overall, credit "quality" remains "strong"...

📊h/t @LoganMohtashami

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates #banks $GS $JPM $BOA $C $WFC $MS

📊h/t @LoganMohtashami

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates #banks $GS $JPM $BOA $C $WFC $MS

6/🧵 Homebuilder #stocks showing "resiliency"... $XHB

D.R. Horton (+78% since January 1, 2020) $DHI

Lennar (+73%) $LEN

Toll Brothers (+34.5%) $TOL

NVR (+29.3%) $NVR

PulteGroup (+25.2%) $PHM

KB Home (+1%) $KBH

📊h/t @NewsLambert

#realestate #stockmarket #earnings

D.R. Horton (+78% since January 1, 2020) $DHI

Lennar (+73%) $LEN

Toll Brothers (+34.5%) $TOL

NVR (+29.3%) $NVR

PulteGroup (+25.2%) $PHM

KB Home (+1%) $KBH

📊h/t @NewsLambert

#realestate #stockmarket #earnings

7/🧵 Latest housing data including "Home Purchase Sentiment", "Housing Activity Tracker", "Pending Home Sales"... 🏡📉

📊h/t @GoldmanSachs @TheTranscript_ @nardotrealtor

#realestate #stockmarket #mortgagerates #interestrates $XHB

📊h/t @GoldmanSachs @TheTranscript_ @nardotrealtor

#realestate #stockmarket #mortgagerates #interestrates $XHB

8/🧵 $KBH @kbhome CEO Jan. 23' #earnings call:

"...current conditions remain challenging. High #mortgagerates & persistent #inflation, together with an uncertain economy, have made homebuyers more cautious since the middle of last year." ⚠️🏡

$XHB $DHI $LEN $TOL $NVR

"...current conditions remain challenging. High #mortgagerates & persistent #inflation, together with an uncertain economy, have made homebuyers more cautious since the middle of last year." ⚠️🏡

$XHB $DHI $LEN $TOL $NVR

9/🧵 $KBH @kbhome "Q/Q to Nov-22 saw -80% fall in Net Orders Lower Backlogs will soon reveal very weak underlying demand." h/t @EquitOrr

$XHB $DHI $LEN $TOL $NVR #earnings #stocks #realestate #macro

$XHB $DHI $LEN $TOL $NVR #earnings #stocks #realestate #macro

10/🧵 Housing Starts (orange line) vs. Home Builder Sentiment (blue dots) vs. Buyer Traffic (light blue line) ⚠️📉

📊h/t @EquitOrr

$XHB $DHI $LEN $TOL $NVR #earnings #stocks #realestate #macro #stockstowatch

📊h/t @EquitOrr

$XHB $DHI $LEN $TOL $NVR #earnings #stocks #realestate #macro #stockstowatch

11/🧵 Recent data from @nardotrealtor highlights the incredible ROC (Rate of Change) in #mortgage payments via higher @federalreserve #interestrates... 💵🏡

📊h/t @insidefinance @nardotrealtor @JeffWeniger @NAR_Research

#mortgagerates #realestate #realestateagent

📊h/t @insidefinance @nardotrealtor @JeffWeniger @NAR_Research

#mortgagerates #realestate #realestateagent

12/🧵 Median Home Price 💵🏡 / Average Hourly Earnings — What's your take on this chart? 😖

📊h/t @BLS_gov @nardotrealtor @JeffWeniger @NAR_Research @USDOL

#mortgagerates #realestate #realestateagent #interestrates

📊h/t @BLS_gov @nardotrealtor @JeffWeniger @NAR_Research @USDOL

#mortgagerates #realestate #realestateagent #interestrates

13/🧵 🇺🇸 Home Supply (Months): Existing vs. New Homes — "Lead-Lag"? @leadlagreport

📊h/t @nardotrealtor @JeffWeniger @NAR_Research @USHUD

#realestate #mortgagerates #interestrates $XHB $DHI $LEN $TOL $NVR

📊h/t @nardotrealtor @JeffWeniger @NAR_Research @USHUD

#realestate #mortgagerates #interestrates $XHB $DHI $LEN $TOL $NVR

14/🧵 Housing "Affordability" anyone? 🏡😭

📊h/t @nardotrealtor @JeffWeniger @NAR_Research

#realestate #mortgagerates #interestrates $XHB $DHI $LEN $TOL $NVR

📊h/t @nardotrealtor @JeffWeniger @NAR_Research

#realestate #mortgagerates #interestrates $XHB $DHI $LEN $TOL $NVR

15/🧵 Homebuilder sentiment entering 23'... 🏡🤮

📊h/t @nardotrealtor @JeffWeniger @NAR_Research @NAHBhome @insidefinance

#realestate #mortgagerates #interestrates $XHB $DHI $LEN $TOL $NVR

📊h/t @nardotrealtor @JeffWeniger @NAR_Research @NAHBhome @insidefinance

#realestate #mortgagerates #interestrates $XHB $DHI $LEN $TOL $NVR

16/🧵 @kbhome $KBH Q4/22' Jan. 23' #earnings call: "Sharply lower demand and a 68% cancellation rate." 🏡😳

#realestate #mortgagerates #interestrates $XHB $DHI $LEN $TOL $NVR

#realestate #mortgagerates #interestrates $XHB $DHI $LEN $TOL $NVR

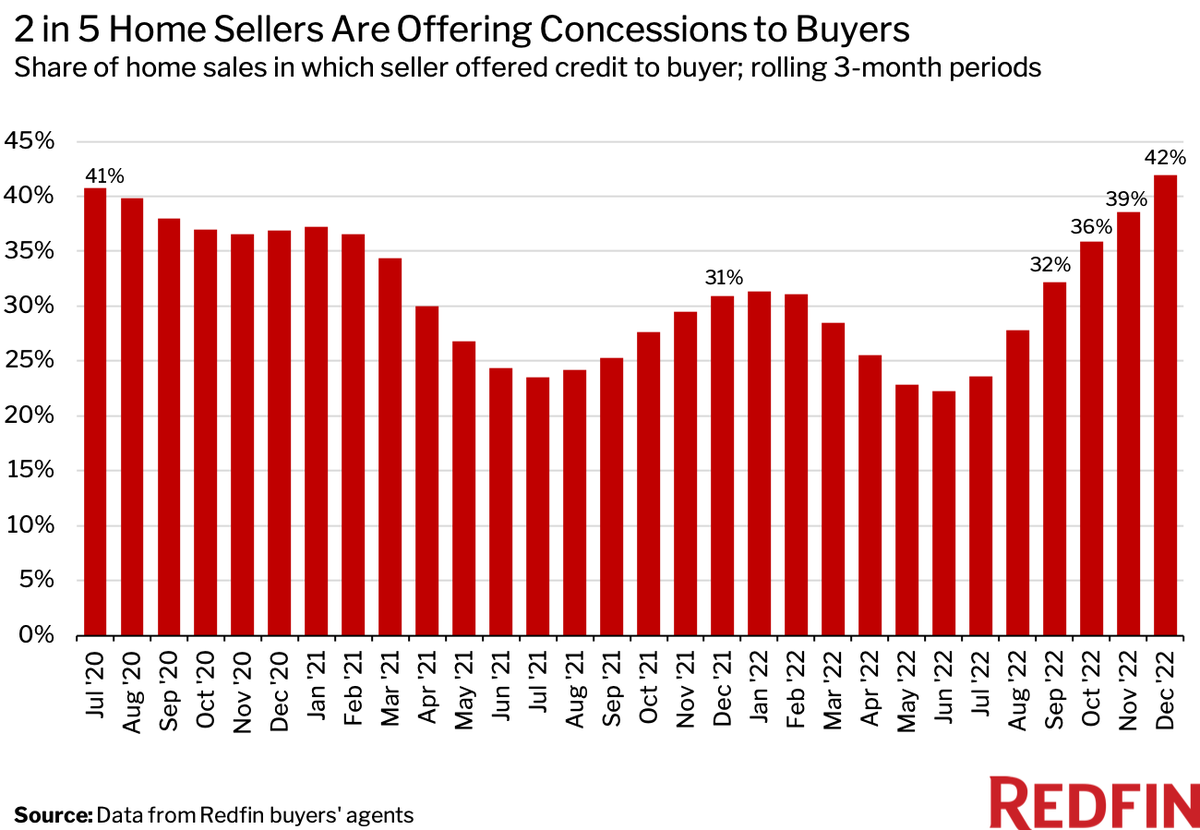

17/🧵 "A Record Share of Home Sellers Are Giving Concessions to Buyers" @Redfin

redfin.com/news/home-sell…

#realestate #mortgagerates #interestrates #realtor $XHB $DHI $LEN $TOL $NVR $KHB

redfin.com/news/home-sell…

#realestate #mortgagerates #interestrates #realtor $XHB $DHI $LEN $TOL $NVR $KHB

18/🧵 "A record 22% of home sales recorded by @Redfin buyer agents in the Q4 included both a concession & a final sale price below the listing price, while a record 19% included both a concession & a listing-price cut that occurred while the home was on the market." 🏡💵

19/🧵 "We’re in the second biggest home price correction of the post-WWII era." @NewsLambert @FortuneMagazine 🏡📉

#realestate #interestrates #realtor #housingmarket $XHB $DHI $LEN $TOL $NVR $KHB

fortune.com/2022/12/28/hou…

#realestate #interestrates #realtor #housingmarket $XHB $DHI $LEN $TOL $NVR $KHB

fortune.com/2022/12/28/hou…

20/🧵 “Housing markets will continue to weaken in the face of rising #mortgagerates, but price declines may be tempered in some markets by still tight supplies relative to demographics." 🏡 @SPGlobal

#realestate #interestrates #housingmarket $XHB $DHI $LEN $TOL $NVR $KHB

#realestate #interestrates #housingmarket $XHB $DHI $LEN $TOL $NVR $KHB

21/🧵 "#recession expectations & the cost-of-living crisis will further reduce demand & push prices lower in 2023, especially in overvalued markets. A market crash or full correction of price bubbles is not expected owing to the relative strength of labor markets." @SPGlobal

22/🧵 Mortgage Application Index back to 2014 levels... 📉🏡

📊h/t @NewsLambert @MBAMortgage

#realestate #interestrates #housingmarket $XHB $DHI $LEN $TOL $NVR $KHB

📊h/t @NewsLambert @MBAMortgage

#realestate #interestrates #housingmarket $XHB $DHI $LEN $TOL $NVR $KHB

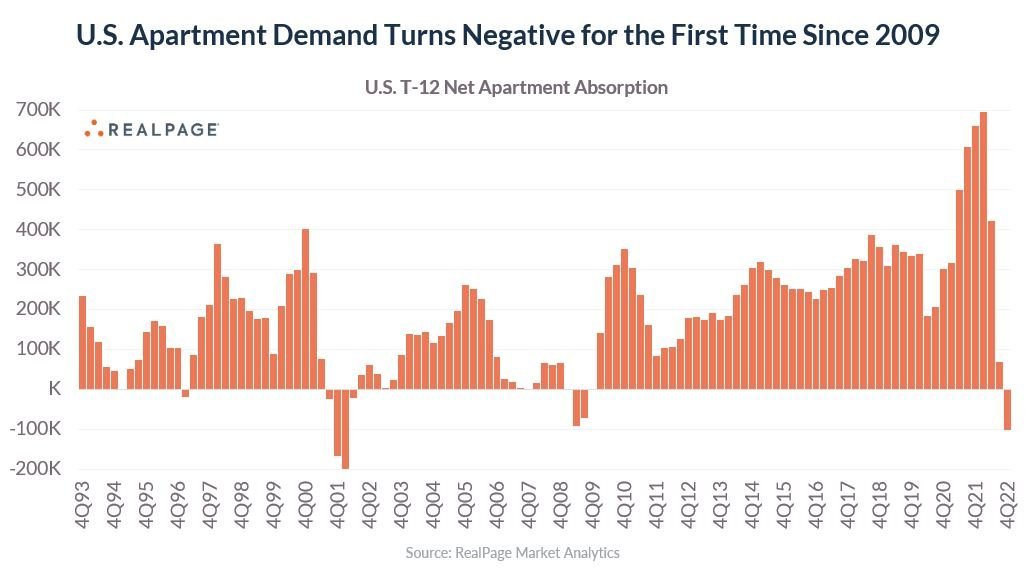

23/🧵 For those in multi-family 🏢 housing market, keep a close eye on your local supply/demand dynamics shift...

📊h/t @RealPage @fkronawitter1

#realestateinvesting #interestrates #housingmarket #mortgagerates #realtor

📊h/t @RealPage @fkronawitter1

#realestateinvesting #interestrates #housingmarket #mortgagerates #realtor

24/🧵 BUYERS: Negotiate, Negotiate, Negotiate... 🤝🏡 @redfin

#realestateinvesting #interestrates #housingmarket #mortgagerates #realtor $RDFN

#realestateinvesting #interestrates #housingmarket #mortgagerates #realtor $RDFN

25/🧵 @kbhome "68% cancellation rate in Q4/22'..." 😳⚠️🏡

📊h/t @nickgerli1

#realestateinvesting #interestrates #housingmarket #mortgagerates #realtor $XHB $DHI $LEN $TOL $NVR $KHB

📊h/t @nickgerli1

#realestateinvesting #interestrates #housingmarket #mortgagerates #realtor $XHB $DHI $LEN $TOL $NVR $KHB

• • •

Missing some Tweet in this thread? You can try to

force a refresh