. @StateBank_Pak has released disaggregated #trade data for #Pakistan, for the first half of FY23. Some analysis on main trends in 🧵👇👇

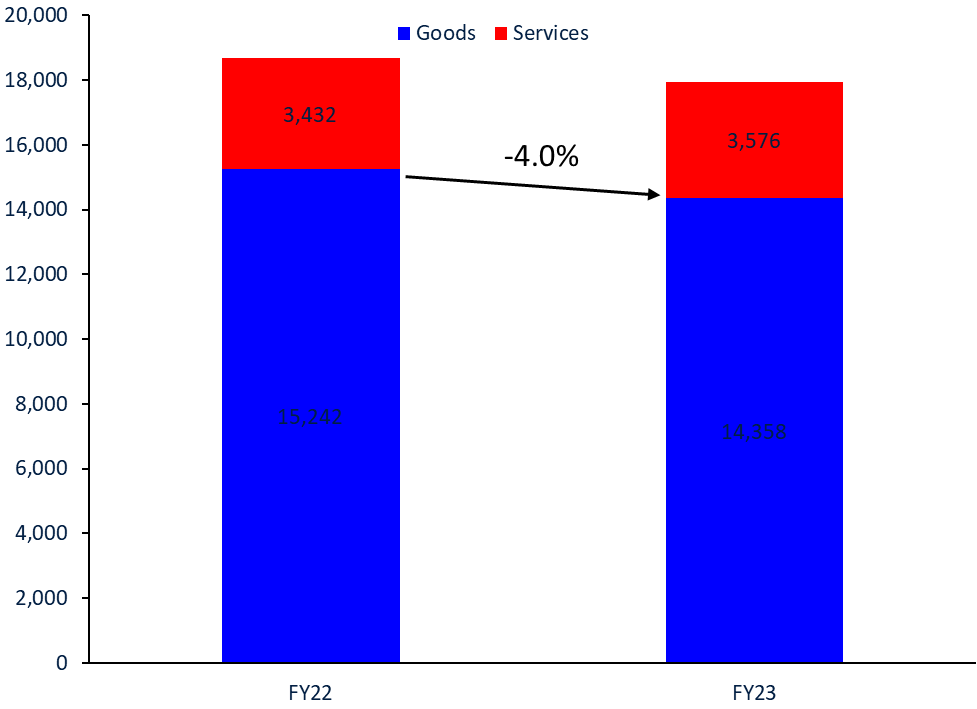

1) #Pakistan's #exports have declined in H1 FY23 relative to H1 FY22 by 4%. The fall is driven by goods #exports that fell by 5.8%.

2) By #destination, the largest #export contractions are observed to the USA, China, the UK and the UAE.

#Pakistan

#Pakistan

3) By sector, #textiles show growth, though timid, with non-textile #exports contracting - particularly for vegetable, minerals and base mineral products. High #export growth in foodstuffs.

4) Zooming in, and checking monthly growth rates show #textiles losing steam, and similarly, vegetable product #exports.

#Pakistan

#Pakistan

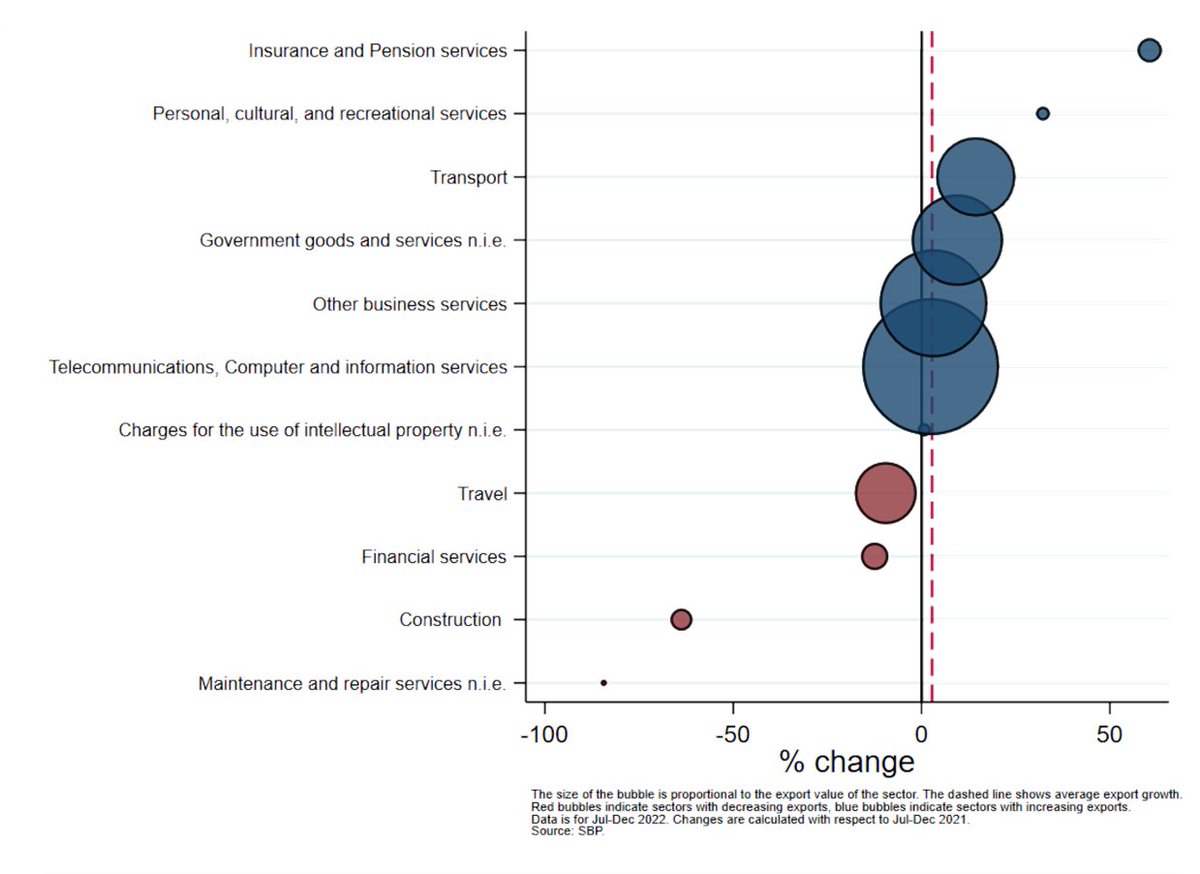

5) #services #exports expanded (except for travel and financial services), tho at a slower pace than in the past. #ICT #exports decelerated substantially.

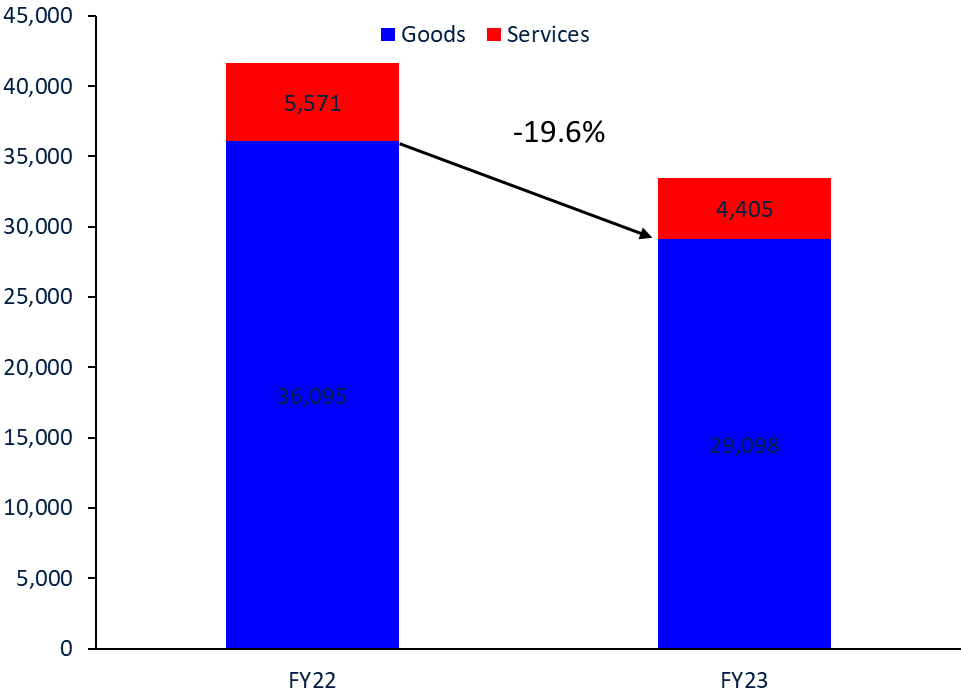

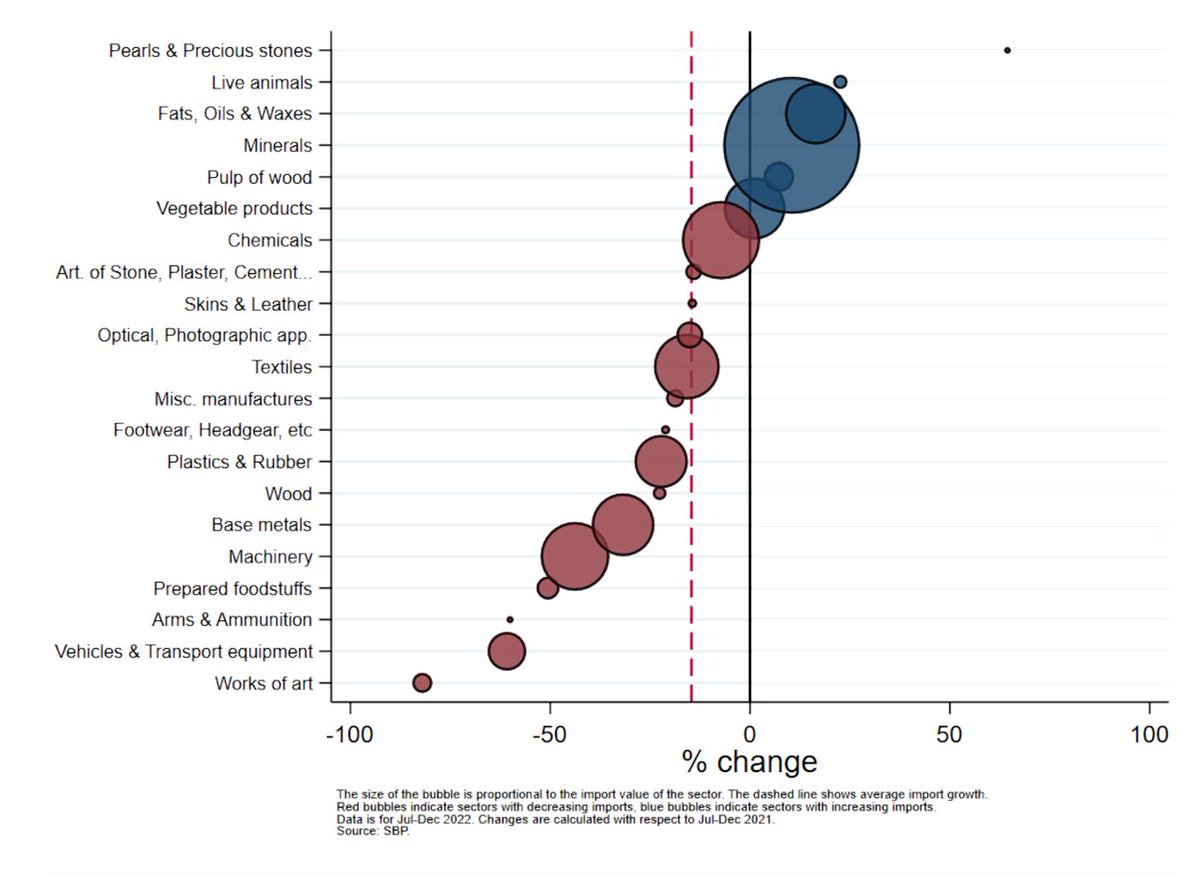

6) #Imports contracted substantially (by 19.6%), with almost equal declines in #goods and #services.

#Pakistan

#Pakistan

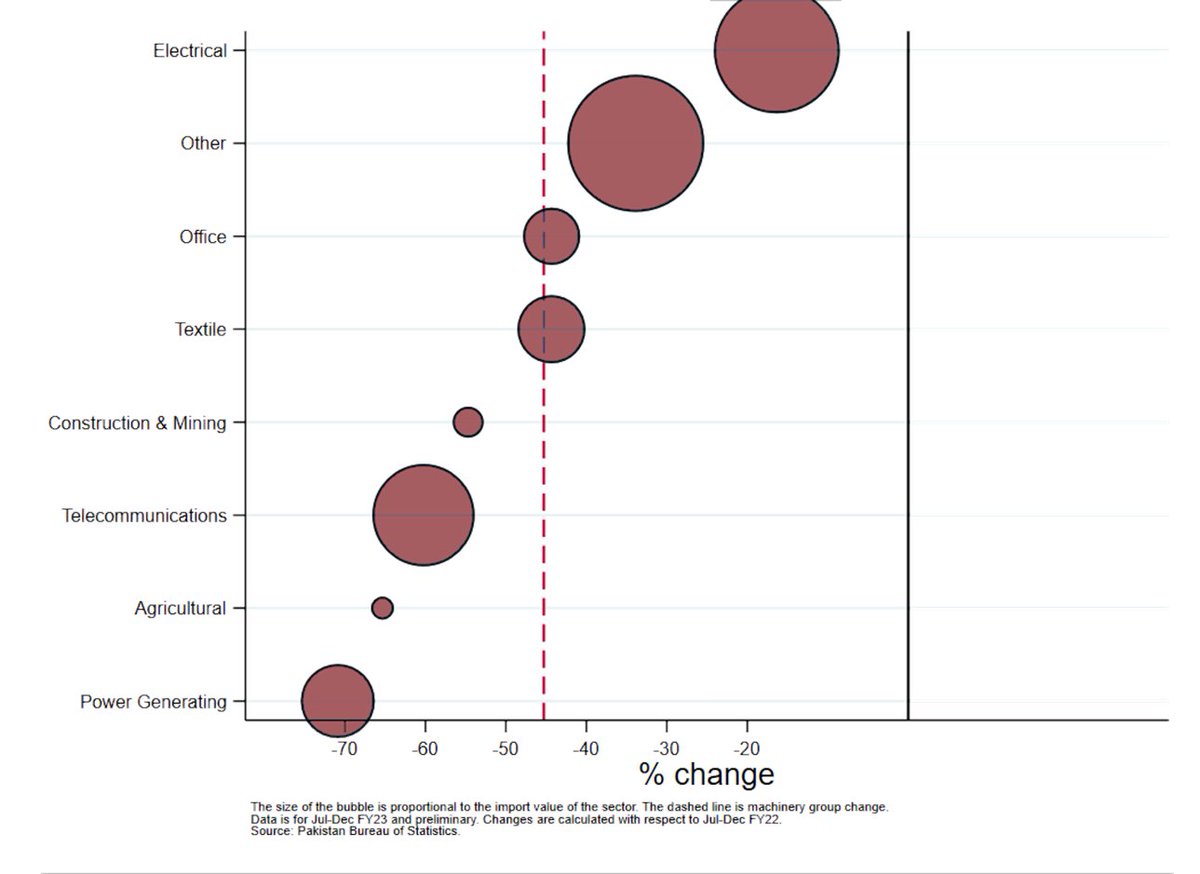

7) By sector, the #import contraction is marked for #machinery, #textiles (possibly anticipating a decline in garments' #exports) and #chemicals.

#Pakistan

#Pakistan

8) Zooming in and checking monthly data shows the steady decline in #imports of #machinery and #intermediate inputs.

10) Moving forward, the pace of recovery of the world economy, and the reduction of uncertainty will be crucial for the recovery of #exports. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh