Just a month into the new year and we already see some new myths floating around Financial Planning.

In this thread, we aim to debunk some of these myths & take a look at how financial planning can help you, the reader! (1/n)

#financialplanning #FinancialFreedom #MythVsFacts

In this thread, we aim to debunk some of these myths & take a look at how financial planning can help you, the reader! (1/n)

#financialplanning #FinancialFreedom #MythVsFacts

Myth #1 Financial Planning is Only for Rich People

At their core, a good Financial Planner helps YOU achieve YOUR GOALS. Everyone has goals, not just rich people.

A good financial plan will help map your goals & help make your 'plan' a reality. (2/n)

#financialgoals

At their core, a good Financial Planner helps YOU achieve YOUR GOALS. Everyone has goals, not just rich people.

A good financial plan will help map your goals & help make your 'plan' a reality. (2/n)

#financialgoals

Myth #2 I am too old/ too young for a Financial Plan

Age is no bar. You are never too young or too old to have a proper financial plan in place. Planning can help people build wealth over a period. (3/n)

#FinancialFreedom #financialplanner #retirementplanning

Age is no bar. You are never too young or too old to have a proper financial plan in place. Planning can help people build wealth over a period. (3/n)

#FinancialFreedom #financialplanner #retirementplanning

Myth #3 Just Plan Once & It's Done!

Your needs and desires can change over time. And with that, so will your plan.

Your Financial Plan needs to be designed in such a way that it accommodates such changes. (4/n)

#planforthefuture #financialgoals

Your needs and desires can change over time. And with that, so will your plan.

Your Financial Plan needs to be designed in such a way that it accommodates such changes. (4/n)

#planforthefuture #financialgoals

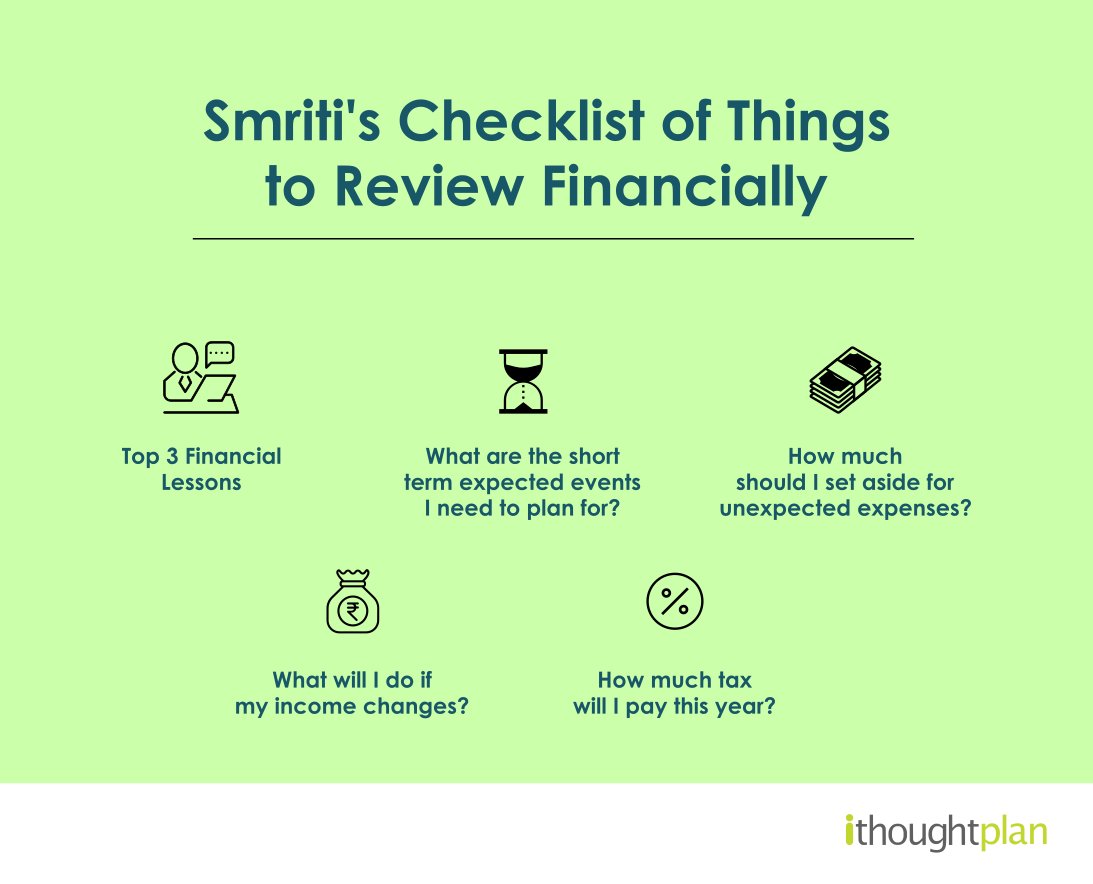

To achieve this, a proper review of your plan is needed at least once a year.

This allows you to track your goal progress, as well as any other changes that are required to get you back on track. (5/n)

#investmentreview #financialgoals

This allows you to track your goal progress, as well as any other changes that are required to get you back on track. (5/n)

#investmentreview #financialgoals

Myth #4 Financial Planning is Not Worth the Cost

A good financial plan is worth its weight in gold.

It can help you save the cost of making the wrong decision and locking your money into bad investments such as ULIPs and money-back policies. (6/n)

#insurance #ULIPs

A good financial plan is worth its weight in gold.

It can help you save the cost of making the wrong decision and locking your money into bad investments such as ULIPs and money-back policies. (6/n)

#insurance #ULIPs

Planning gives you direction and lays out your options. You can allocate money responsibly by determining and prioritizing your goals. (7/n)

#retirementplanning #financialplanning #FinancialFreedom

#retirementplanning #financialplanning #FinancialFreedom

If you find this thread useful, retweet it and help us reach more people like you. (8/n)

#financialplanning #financialgoals #FinancialFreedom #finances #savings #personalfinance

#financialplanning #financialgoals #FinancialFreedom #finances #savings #personalfinance

• • •

Missing some Tweet in this thread? You can try to

force a refresh