[1/12] To understand what else is needed to create a financial future based on #blockchain technology, just consider what the #Interledger #Protocol was NOT designed to do. 😉

[A #Thread 🧵]

[A #Thread 🧵]

[2/12] 🤔 What problem does #ILP genuinely address?

Just like the #internet will never agree on a single #protocol to fix everything, the world will never agree on a single #blockchain or ledger [#DLT].

What must be resolved is:

🔹 Addressing

🔹 Fragmentation

Just like the #internet will never agree on a single #protocol to fix everything, the world will never agree on a single #blockchain or ledger [#DLT].

What must be resolved is:

🔹 Addressing

🔹 Fragmentation

[3/12] ❗️ To make it easy and #ELI5-friendly here is everything in one picture:

When Alice wants to send money to @bob_way, #ILP will perform all the heavy lifting so she doesn't have to worry about #wallet addresses (#PubKeys) and the like.

When Alice wants to send money to @bob_way, #ILP will perform all the heavy lifting so she doesn't have to worry about #wallet addresses (#PubKeys) and the like.

[4/12] So, to return to my original assertion.

What problem did #ILP not intend to solve?

🔹 Public Key Infrastructure [#PKI]

🔹 Identity [#DID / #SSI]

🔹 Liquidity Management [#DeFi]

What problem did #ILP not intend to solve?

🔹 Public Key Infrastructure [#PKI]

🔹 Identity [#DID / #SSI]

🔹 Liquidity Management [#DeFi]

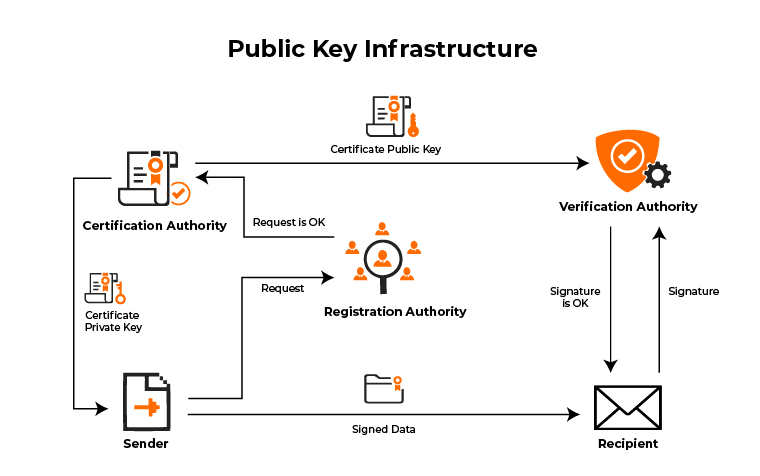

[5/12] — 1⃣ — Public Key Infrastructure [#PKI] —

The following are the primary characteristics of a #PKI:

🔹 Creating ...

🔹 Distributing ...

🔹 Signing ...

🔹 Revoking ...

... digital certificates and public keys

The following are the primary characteristics of a #PKI:

🔹 Creating ...

🔹 Distributing ...

🔹 Signing ...

🔹 Revoking ...

... digital certificates and public keys

[6/12] — 2⃣ — Public Key Infrastructure [#PKI] —

Traditional #PKI's rely on a centralized third-party #certification authorities (#CA) for trust

With #DLT, this might all be a thing of the past, since all functionality can be implemented through #DLT & [non]-custodial #wallets.

Traditional #PKI's rely on a centralized third-party #certification authorities (#CA) for trust

With #DLT, this might all be a thing of the past, since all functionality can be implemented through #DLT & [non]-custodial #wallets.

[7/12] — 1⃣ — Identity [#DID / #SSI] —

Identity should be #decentralized, #sovereign, and #unified.

As a result, the solution should be based on the #W3C recommended framework for digital identification and include:

🔹 Holders

🔹 Issuers

🔹 Verifiers

Identity should be #decentralized, #sovereign, and #unified.

As a result, the solution should be based on the #W3C recommended framework for digital identification and include:

🔹 Holders

🔹 Issuers

🔹 Verifiers

[8/12] — 2⃣ — Identity [#DID / #SSI] —

There are various competitors in the space, but not all of them allow the #DID holder to remain self sovereign

@iota's effort comes the closest to a full-fledged solution.

For further details, read this paper 👇

🔗 files.iota.org/comms/IOTA_The…

There are various competitors in the space, but not all of them allow the #DID holder to remain self sovereign

@iota's effort comes the closest to a full-fledged solution.

For further details, read this paper 👇

🔗 files.iota.org/comms/IOTA_The…

[9/12] — 1⃣ — Liquidity Management [#DeFi] —

To understand how to control #liquidity, we must first define it. 👇

#Assets ▶️ e.g. #Commodities or Real Estate

#Security ▶️ e.g. #Stocks or #Security #Tokens

#Cash▶️e.g. #FIAT or #CBDCs

To understand how to control #liquidity, we must first define it. 👇

#Assets ▶️ e.g. #Commodities or Real Estate

#Security ▶️ e.g. #Stocks or #Security #Tokens

#Cash▶️e.g. #FIAT or #CBDCs

[10/12] — 2⃣ — Liquidity Management [#DeFi] —

If we assume that everything will be #tokenized in the future, we will require the following to maintain #liquidity:

🔹 #CLOB-based #DEX

🔹 #AMM-based #DEX

🔹 On-/Off-ramps (for now)

If we assume that everything will be #tokenized in the future, we will require the following to maintain #liquidity:

🔹 #CLOB-based #DEX

🔹 #AMM-based #DEX

🔹 On-/Off-ramps (for now)

[11/12] There is more to properly deploying #DLT to the masses than simply linking every value-ledger with #ILP.

The basic principles for "making it work" are also:

🔹 #Liquidity Management

🔹 Self Sovereign #Identity

🔹 Redesigned #PKI

The basic principles for "making it work" are also:

🔹 #Liquidity Management

🔹 Self Sovereign #Identity

🔹 Redesigned #PKI

[12/12] Thank you to everyone who took the time to read my 🧵 about #ILP and what is needed to transform the system to a #DLT-based future! ❤️

If you enjoyed the thread, please follow me:

@krippenreiter

Please feel free to contribute by sharing here 👇

If you enjoyed the thread, please follow me:

@krippenreiter

Please feel free to contribute by sharing here 👇

https://twitter.com/krippenreiter/status/1629584960112795649?s=20

@threadreaderapp unroll

@WKahneman @digitalassetbuy @Fame21Moore @sentosumosaba @BCBacker @X__Anderson @stedas @Kevin_Cage_ @AlexCobb_ @IOV_OWL 👋

— My most recent 🧵 on #ILP and what is needed to introduce #DLT to the masses —

— My most recent 🧵 on #ILP and what is needed to introduce #DLT to the masses —

• • •

Missing some Tweet in this thread? You can try to

force a refresh