The #SuiNetwork mainnet is nearing its launch.

Though the ecosystem is growing remarkably quickly, being in its early stages, TVL may be slow to catch up.

Here’s how SYNTHR is accelerating this 🧵🔽

Though the ecosystem is growing remarkably quickly, being in its early stages, TVL may be slow to catch up.

Here’s how SYNTHR is accelerating this 🧵🔽

The network uses Move - a revolutionary open-source programming language for developing smart contracts initially created by @Meta to power the Diem blockchain.

Several other blockchains, including @0LNetwork , @Aptos_Network , and @StarcoinSTC are building upon it.

Several other blockchains, including @0LNetwork , @Aptos_Network , and @StarcoinSTC are building upon it.

In particular though, @SuiNetwork is designed to keep #Gas prices much more consistent (and low).

Its object-centric design also allows for independent transactions to be processed in any order, in effect making it highly scalable.

Its object-centric design also allows for independent transactions to be processed in any order, in effect making it highly scalable.

However, though Sui is growing in popularity, by virtue of the nascency of its building blocks, #TVL migration could take some time.

With SYNTHR, this will be accelerated manifold.

With SYNTHR, this will be accelerated manifold.

SYNTHR’s deployment on #Sui will not only provide this opportunity within itself, but also open up the doors for exponentiation via others.

Four major functionalities will enable this 🔽

Four major functionalities will enable this 🔽

1⃣. SYNTHR as a synthetic asset protocol will enable users to mint and trade on-chain #derivatives that track financial assets on the #blockchain.

2⃣. SYNTHR will allow users of @SuiNetwork to trade more assets than ever before, by enabling valid transfer of value (aka funds) into #SuiNetwork from other networks (and vice versa) with minimal #Slippage cost.

(If you're a trader, you know the power this holds 🐸)

(If you're a trader, you know the power this holds 🐸)

3⃣. SYNTHR's NuclearPort will also allow newer users to take #trading positions on Sui whilst still holding their preliminary capital (aka collateral) on a legacy chain like #Ethereum.

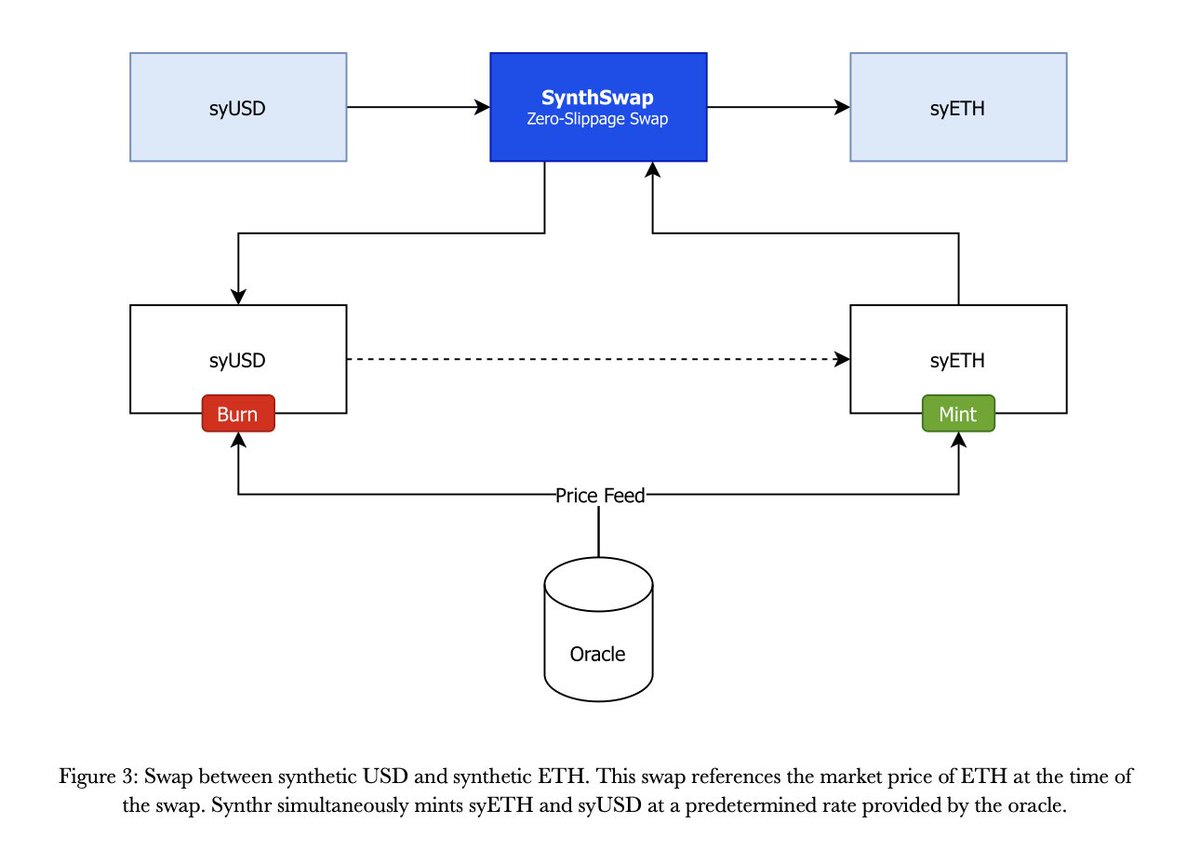

4⃣. SynthSwap, the protocol's internal slippage-free DEX, will allow users to #swap syAssets using simultaneous minting and burning of syAssets at oracle price feeds, providing users with access to liquidity 24/7.

SYNTHR’s low-slippage cross-chain swaps'll drive adoption; this is bound to drive up the usage of supported networks, leading to further innovation.

This could be the start of a positive feedback loop that would turn Sui into an economic powerhouse, much like #Ethereum is today.

This could be the start of a positive feedback loop that would turn Sui into an economic powerhouse, much like #Ethereum is today.

Sui is thriving; it’s a well-built network, with several great projects.

SYNTHR opens up a new world of opportunity to @SuiNetwork users, and looks forward to being a core infrastructure protocol deployed on it 🐸

🟢 sui.directory/project/synthr/

SYNTHR opens up a new world of opportunity to @SuiNetwork users, and looks forward to being a core infrastructure protocol deployed on it 🐸

🟢 sui.directory/project/synthr/

• • •

Missing some Tweet in this thread? You can try to

force a refresh