#WeekendReading The Universal Principles of Successful Trading by Brent Penfold

read good reviews of it many times in past

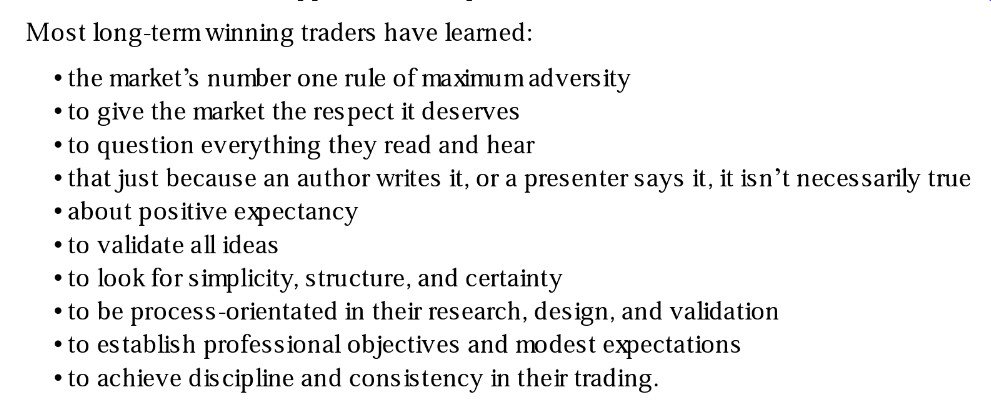

The best loser is the long-term winner.

—Phantom of the Pits

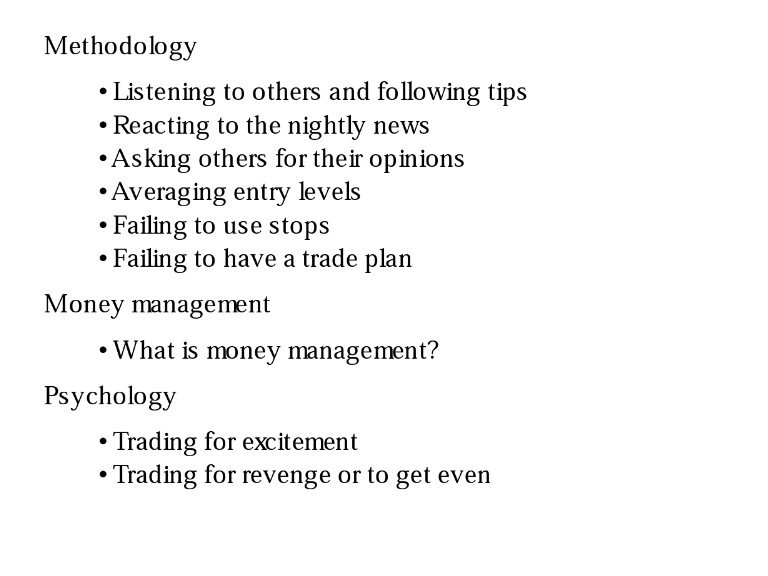

- methodology

- money management

- psychology

money management-amount of money u commit to trades

......

From The Universal Principles of Successful Trading

#SharedReading

- Brent Penfold

#LearningTogether

#SharedReading

From The Universal Principles of Successful Trading by Brent Penfold

#trading

Justifies my Twitter handle😉

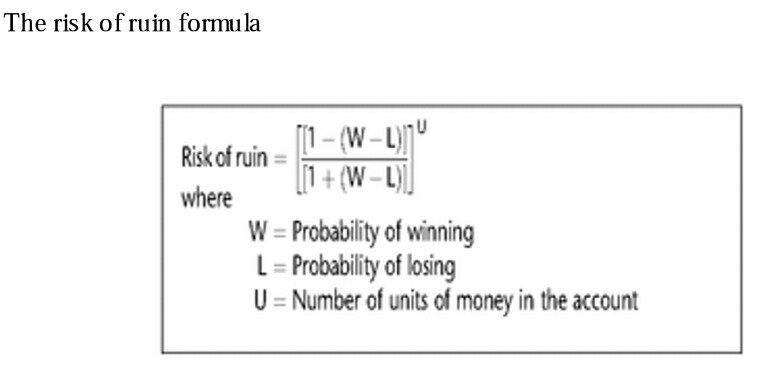

Formula to calculate the Risk of Ruin in Trading---

Reduce amount of money risked/trade

Increase accuracy or win rate

Increase average win 2 average loss payoff ratio

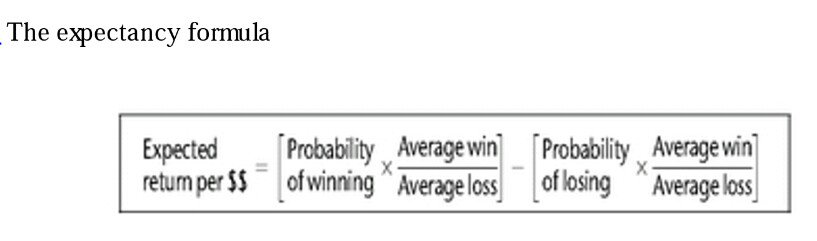

Expectancy formula from Brent Penfold book