1. Home prices include the value of the mortgage interest deduction.

2. When limit that deduction, that value drops.

3. Home prices cascade: They move in tandem.

4. Bank loans are secured by home values.

5. Banks go under when home values fall....

7. Monetary policy must counter that kind of reckless fiscal policy.

8. Fed will increase interest rates to avoid runaway inflation.

9. Higher interest rates make mortgages less affordable

10. Home values drop further

The cycle of home value collapse caused by unregulated Wall Street push of subprime loans led to bank collapses of 2008....

Housing crash number 3 is on the way.

1. That's 4 million houses.

2. Housing prices is the only place where trickle down is real. The top price falls, the next one down falls and on and on. It is a cascade....

3. 1986 bill only went after second homes. Those prices fell, setting off the cascade. S&L industry collapsed. We paid $500 billion bailout.

But it gets worse.....

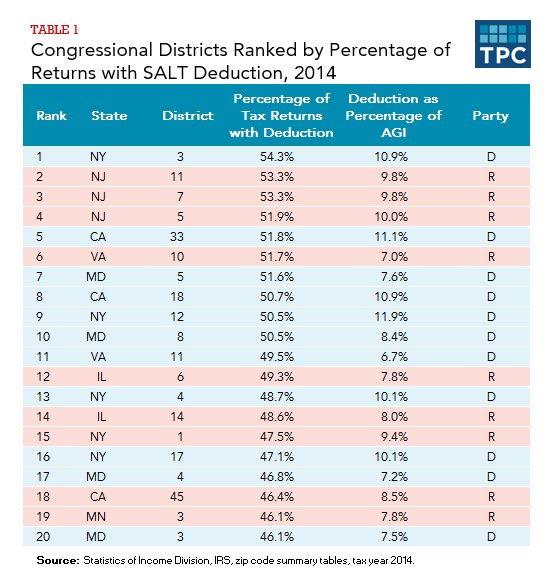

4. The tax bill allows deductibility for only $10,000 of property taxes and sales taxes combined.

5. That affects $500 billion.

6. That $500 bill is ALSO included in home values.

7. Red states, like Texas, rely on property and sales taxes to fund schools.....

This is what happens when you have a tax bill written without input from economists.