Side note: It's fun to watch @trengriffin annotate someone's career.

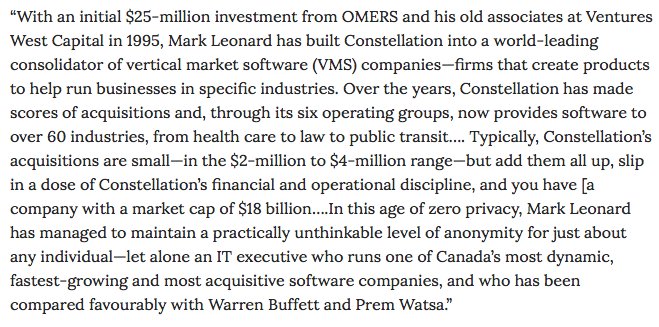

25iq.com/2018/04/07/bus…

But magnitude is also important. Great businesses have the ability to reinvest capital at a high ROIC, which is a rare amongst smaller companies.

Constellation doesn’t operate, but tries to be helpful. Requires a leadership team open to assistance.

/fin