If 17.4 cr PAN is linked with Aadhaar, tell us how many are filing returns? How many are included in the tax base.

The fallacy of your argument of duplication fell here apart!

#TipstoSCLawyers

If extending Govt/UIDAI logic, the PAN card holders who are not filing returns are fraud, so why it is not applicable to Aadhaar linked PAN too? 😂

the total 29.16 PAN holders which are a group of PAN including both linked & non-linked with Aadhaar.

CBDT has a database of active PAN cards, why this data is not quoted by Government/UIDAI?

Why you always want to tell about the total number of PAN cards issued, which includes dormant PAN cards of deceased persons too

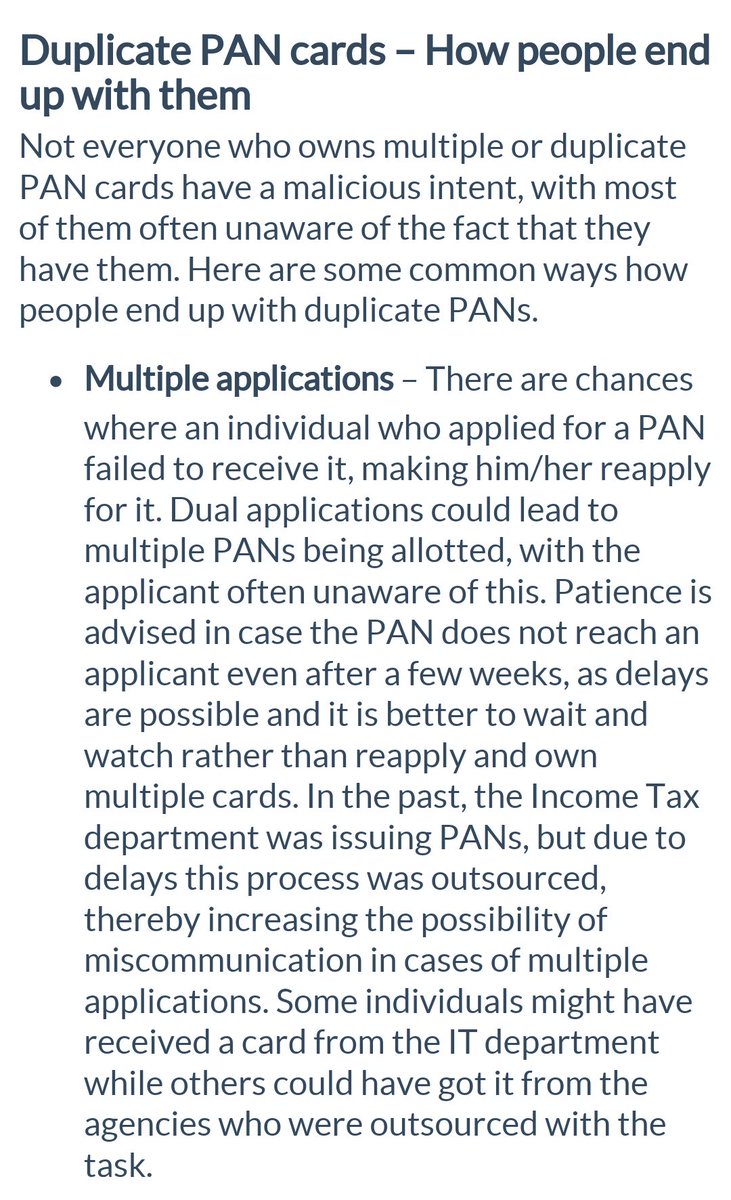

Yep, 0.31% duplicate PAN cards are the resident evil 😈

ZERO ???

When the PAN software is able to find out 11.3 lakhs duplicate PAN cards, why the great exclusion tool Aadhaar is not able to add a single duplicate PAN card to the tally?

Yep. @databaazi will give you the number of Aadhaar cards disabled due to de-duplication.

Enlighten us how this is different from duplication process of PAN?

incometaxindia.gov.in/Acts/Finance%2…

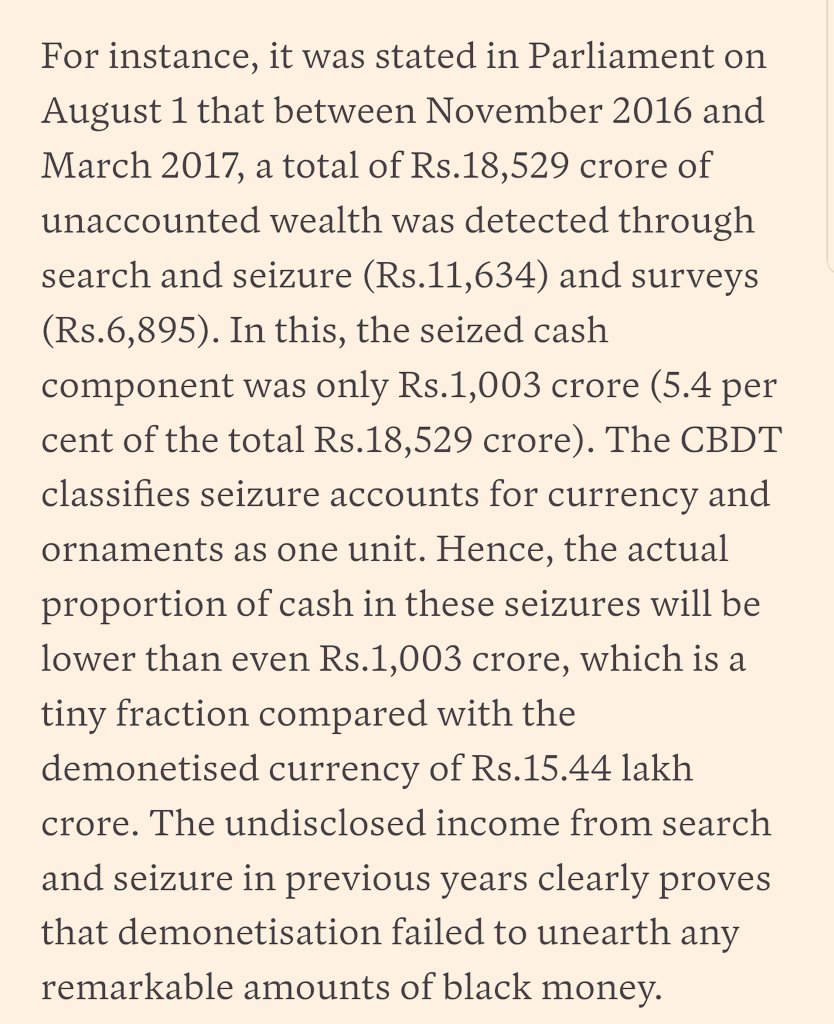

“There are 250 million PANs (permanent account numbers),” Nilekani says, "but only about 40 million who file returns."

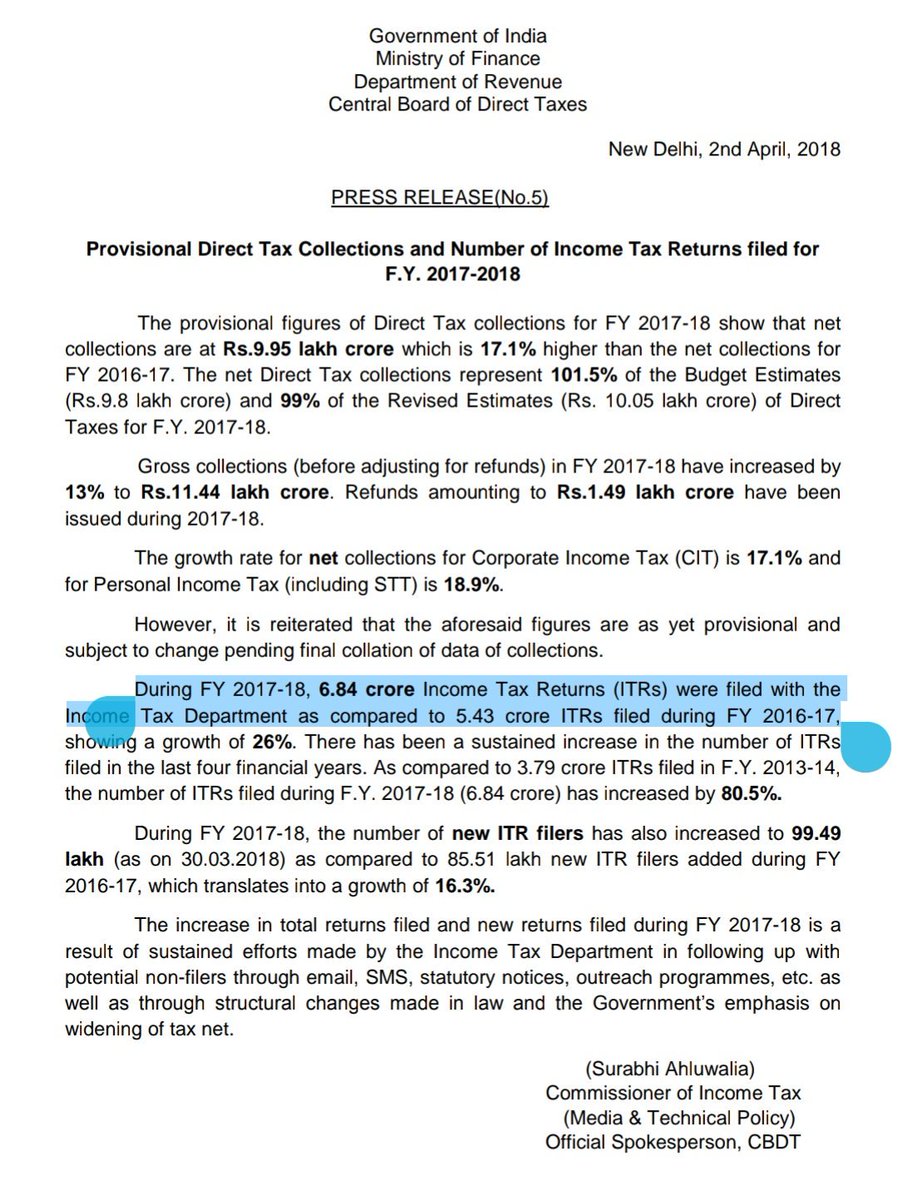

You have 17 crores Aadhaar linked PAN, why only 6 crores only paying Income tax? Please answer 🤣

livemint.com/Leisure/28JmBg…

thewire.in/author/james-w…

Let's crunch these numbers

They are the people who are registered with Efile portal of IT Dept, of course, it's a mix of active and dormant users!

Of course, the ones who registered in Efile portal & their PAN is linked with Aadhaar. This do not need to indicate whether they submitted returns or not. But most of them will be active tax payers.

They may be the people who are not registered in the Efile portal but filing returns still manually by post and who have linked their PAN with Aadhaar.

Less than 1% of the people who use e-portal!