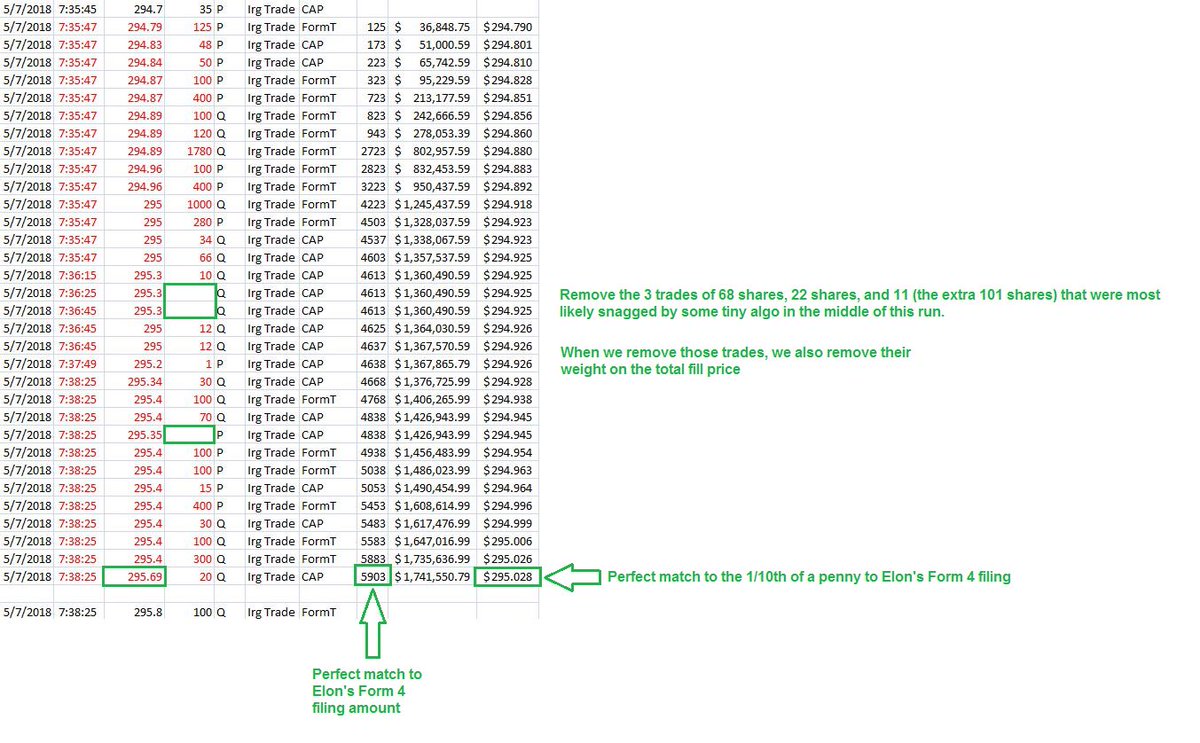

First step, look at the reported price on the Form 4

So, go pull up the entire time & sales data set and put it into excel to figure out when the trade could have taken place.

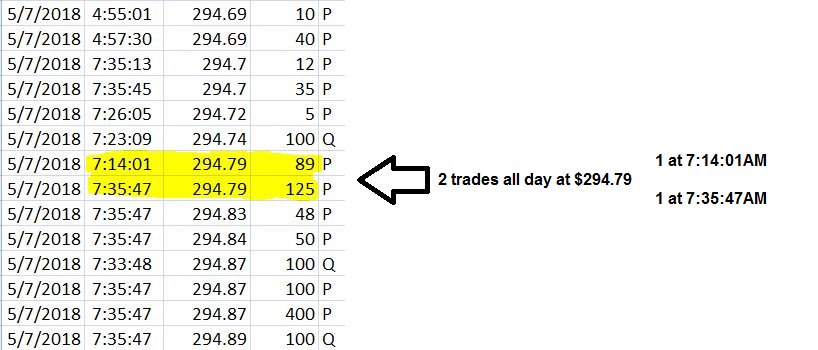

There were only 2 prints at this price = 2 possibilities

Not a possible solution set. So, move on to the 2nd possible outcome

Almost perfect. But, let's make it more perfect .............

Any decent broker, and especially any decent trader, would have advised against that execution ....

And why would someone do that?

In essence, Musk paid a giant premium in exchange for moving his stock price as quickly as possible.

SEC Manipulation: "rigging quotes, prices or trades to create a false or deceptive picture of the demand for a security."

Its ridiculous and disgusting the level of apathy that passes for financial journalism.

@RudyHavenstein

Institutional shareholders ... you were most likely advised.

@zerohedge

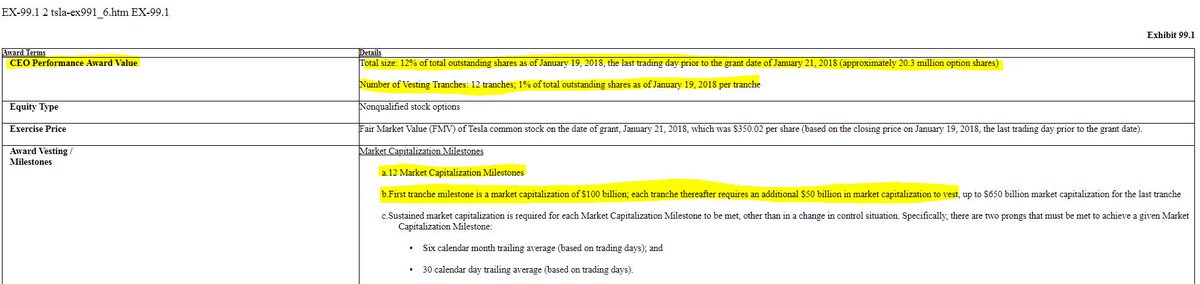

>300 generates confidence/buying

<290 generates fear/selling

$10M properly timed = cheap insurance on the 10-Q. Premkt had printed 293s prior to his trades

Perception is reality

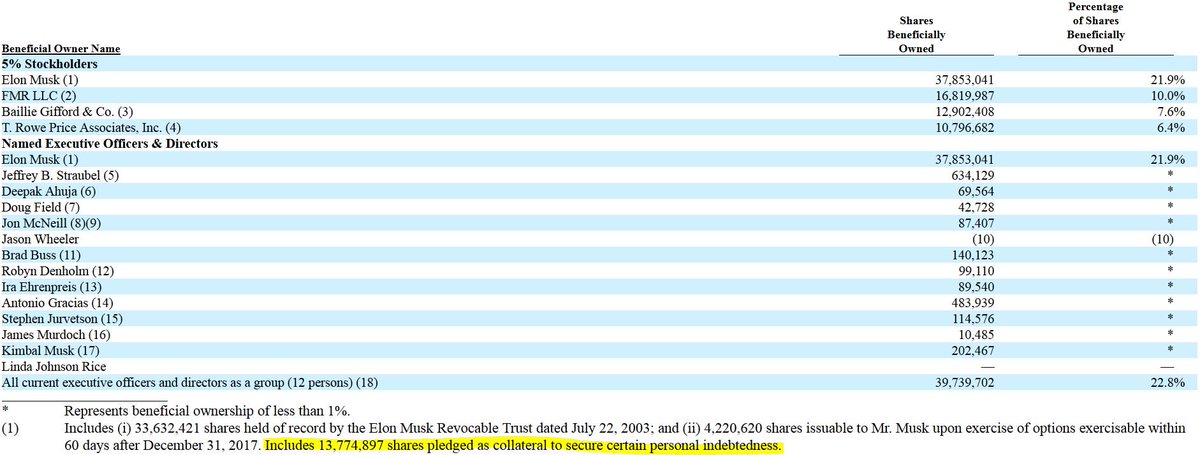

He already owned 33.6M shares (not inc options).

He had never made an open mkt purchase.

Vote of confidence or manipulative trade to buy time?

What's logical?

forbes.com/sites/jimcolli…