I’m gonna a try and live twitt the conference. See below for thread.

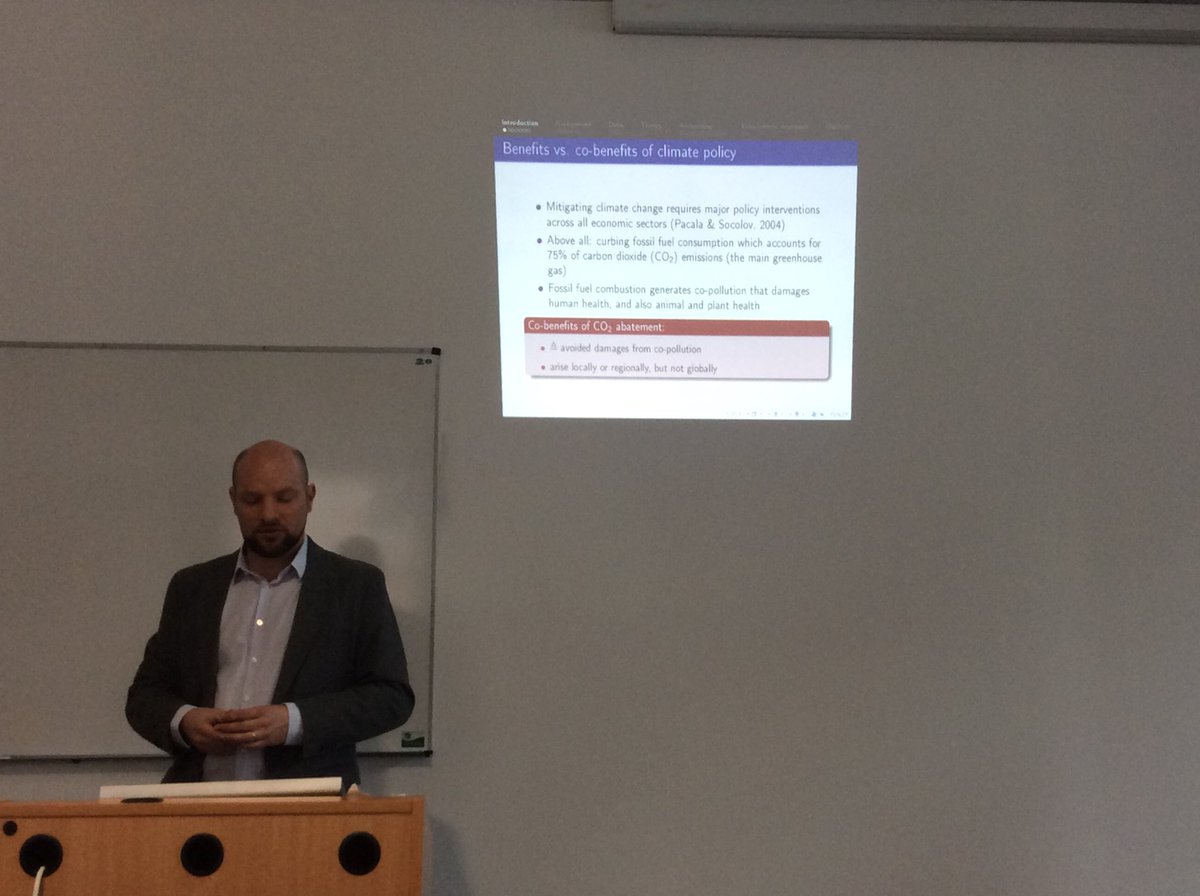

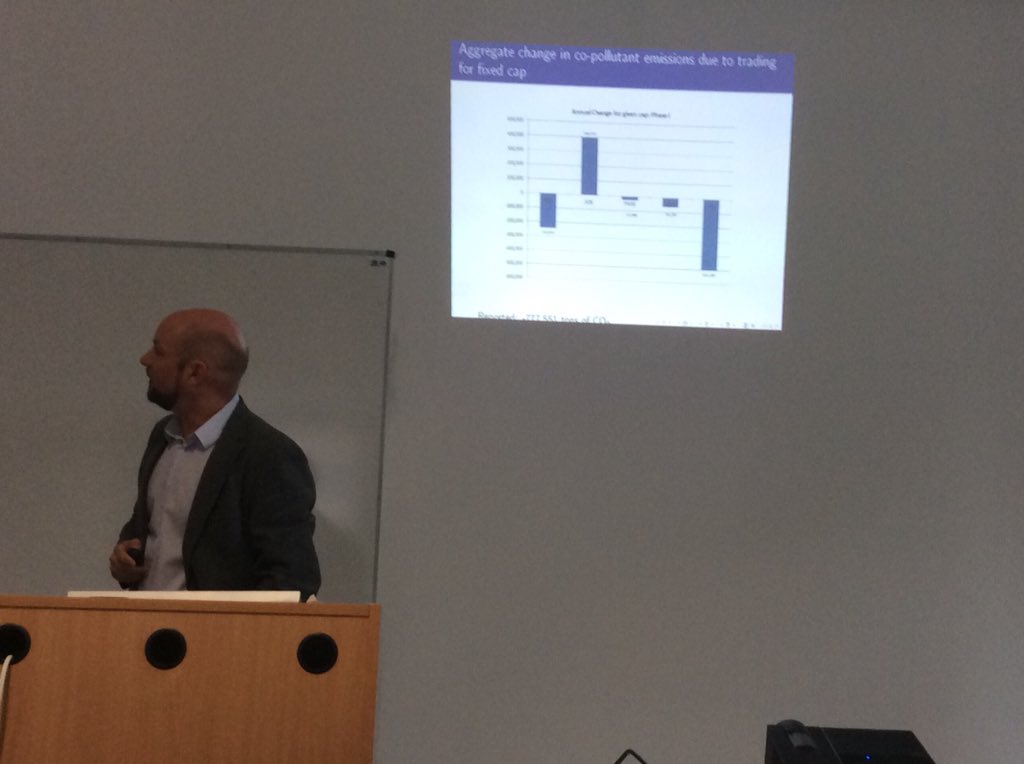

1/ is it the case?

2/ how has EU ETS altered the spatial distribution of pollution?

1/accounting approach using allocated permits as counterfactual.

2/ econometric approach

Same result: large increases in SOx due to EU ETS, decreases in other pollutants.

Main results: EU ETS seems to increase TFP.

This seems to plead in favor of the famous Porter hypothesis that environmental regulation improves productivity.

Others have found a positive effect of EU ETS on regulated firms’ profits. Deeply troubling results!

aeaweb.org/articles?id=10…

Main result: intermittency interacts with market power to make gains from renewables lower than if they were pricing at marginal cost. This is because realized capacity is unknown.

Main result: profits seems to have increased in regulated vs similar unregulated firms.

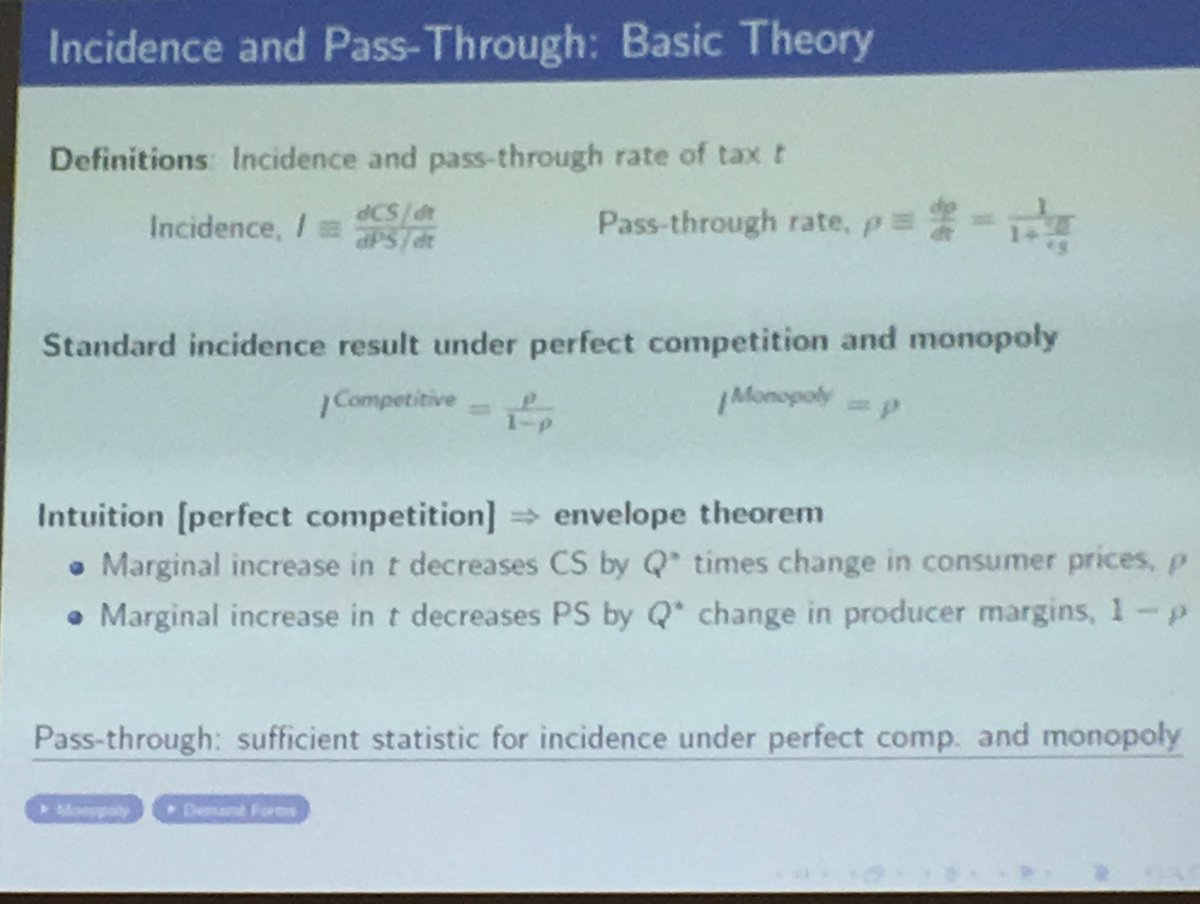

Main comment (I’m discussing the paper): differential pass through rates could bias results

A lot of GES emissions are priced today around the world (25%), but a lot of emissions are not.

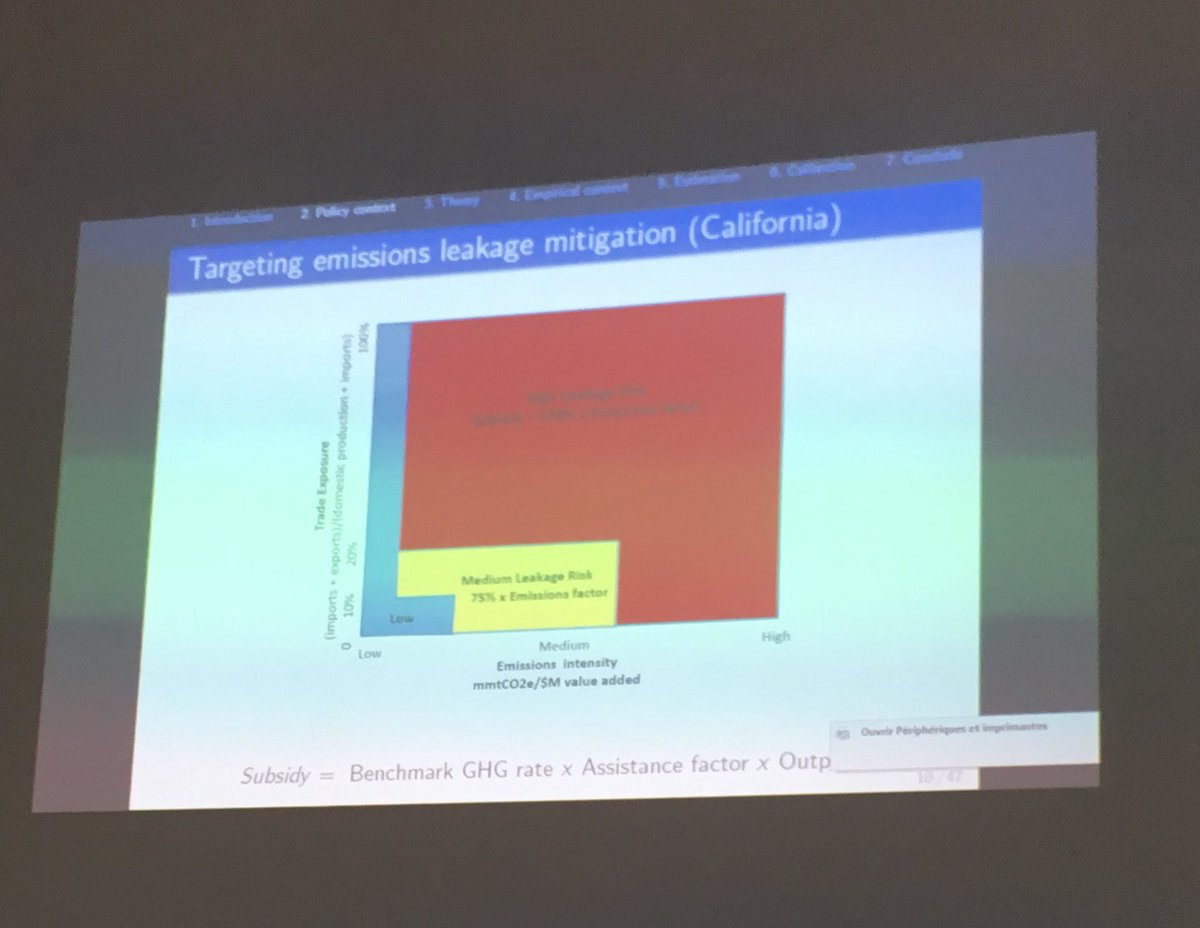

Consequence: decreases in regulated emissions might be undone by emissions in unregulated emissions. This is leakage.

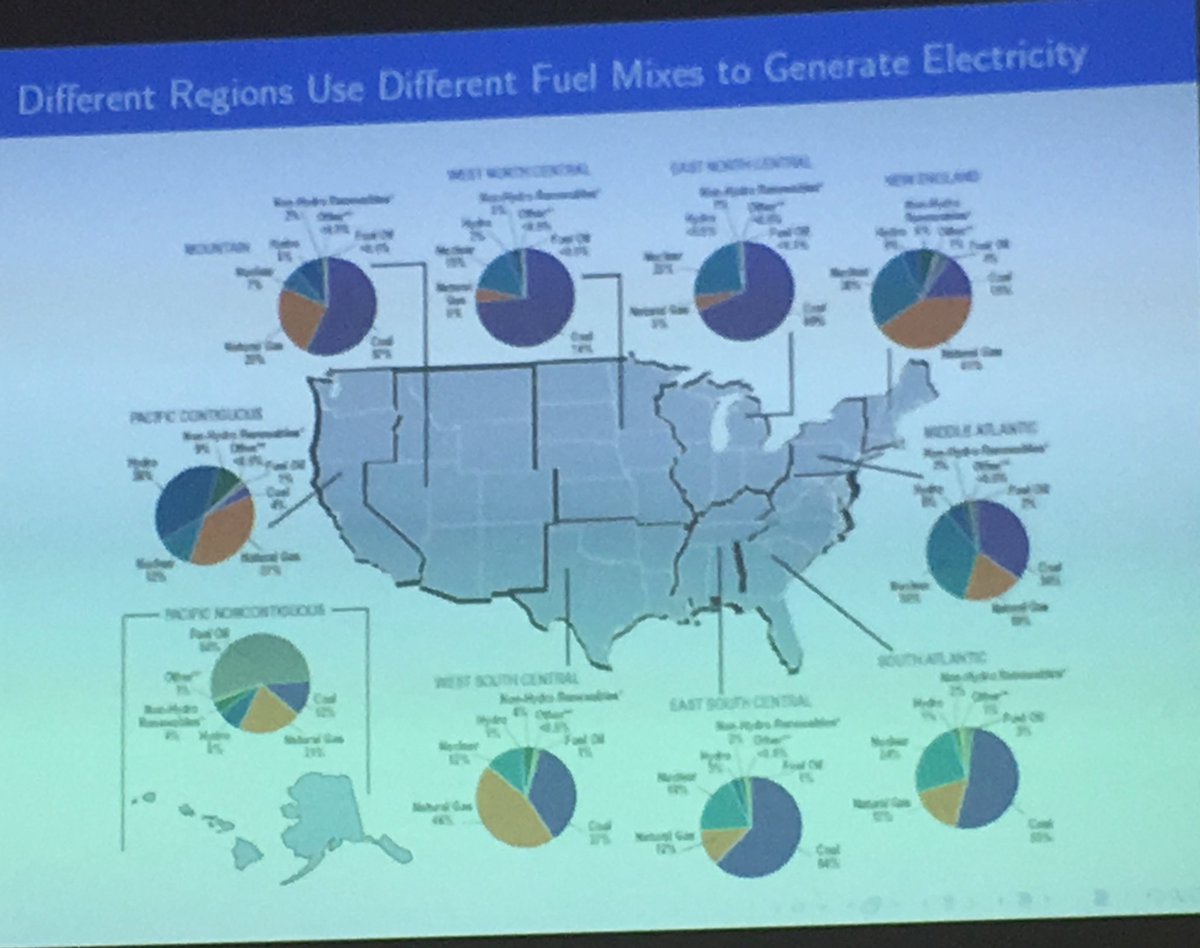

Elasticities seem to be coherent with energy intensity.

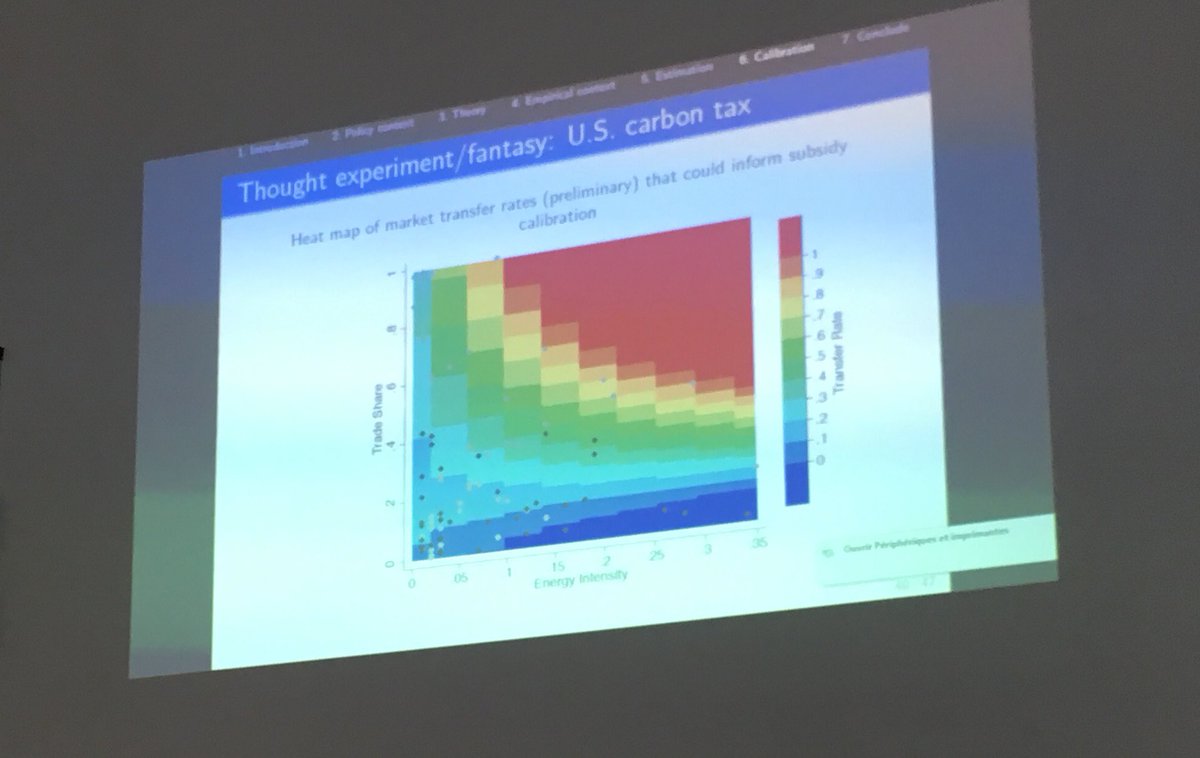

Then you can compare optimal subsidies to actual subsidies.

My comment: why not use modern empirical trade approaches with differentiated firms?

Critics of EU ETS argue opposite things:

1/ No impact on emissions

2/ Detrimental impact on exporting firms

Approach is to use matching DID on firms and plant data.

1/ Decrease in emissions

2/ No change in output

3/ Production seems to reallocate within firms across plants, but not across firms

4/ Probably no leakage

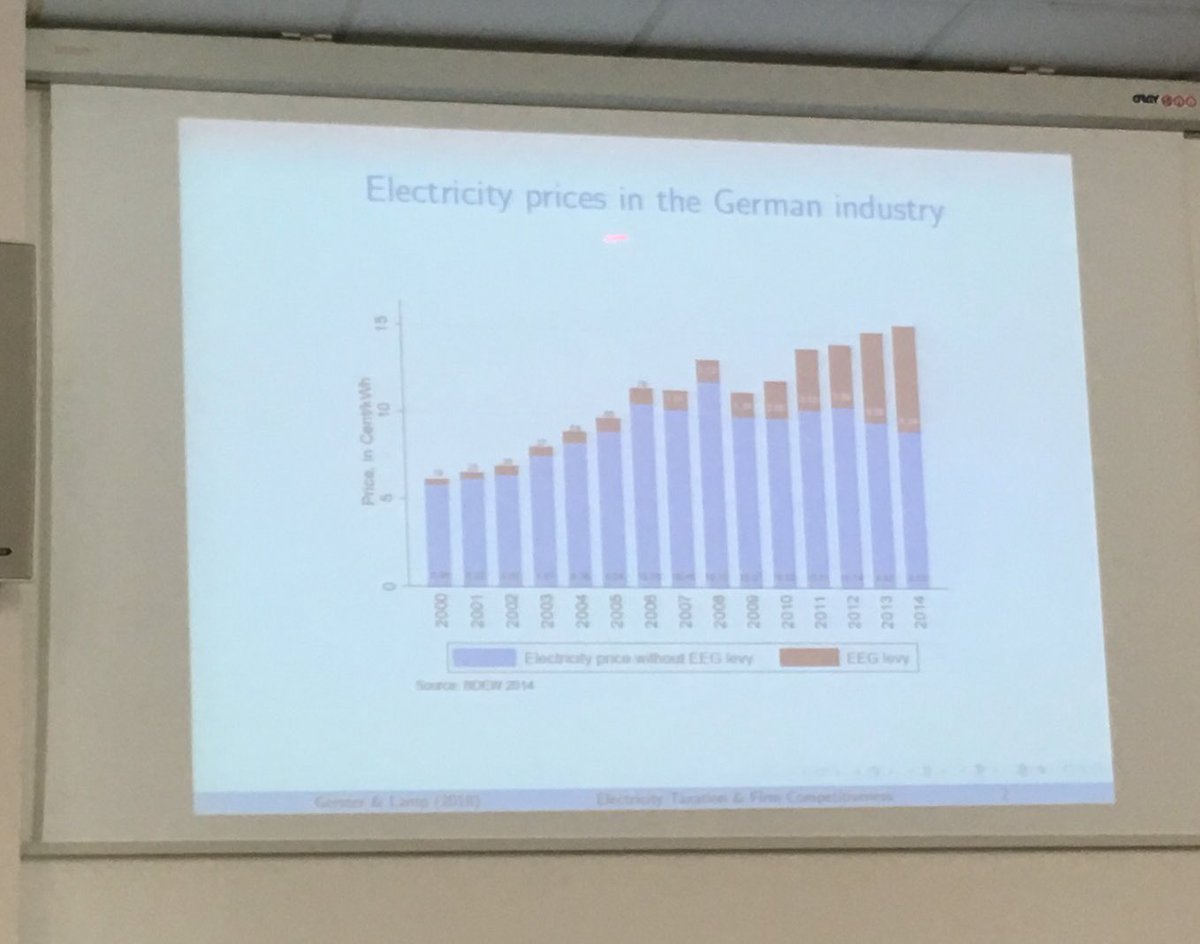

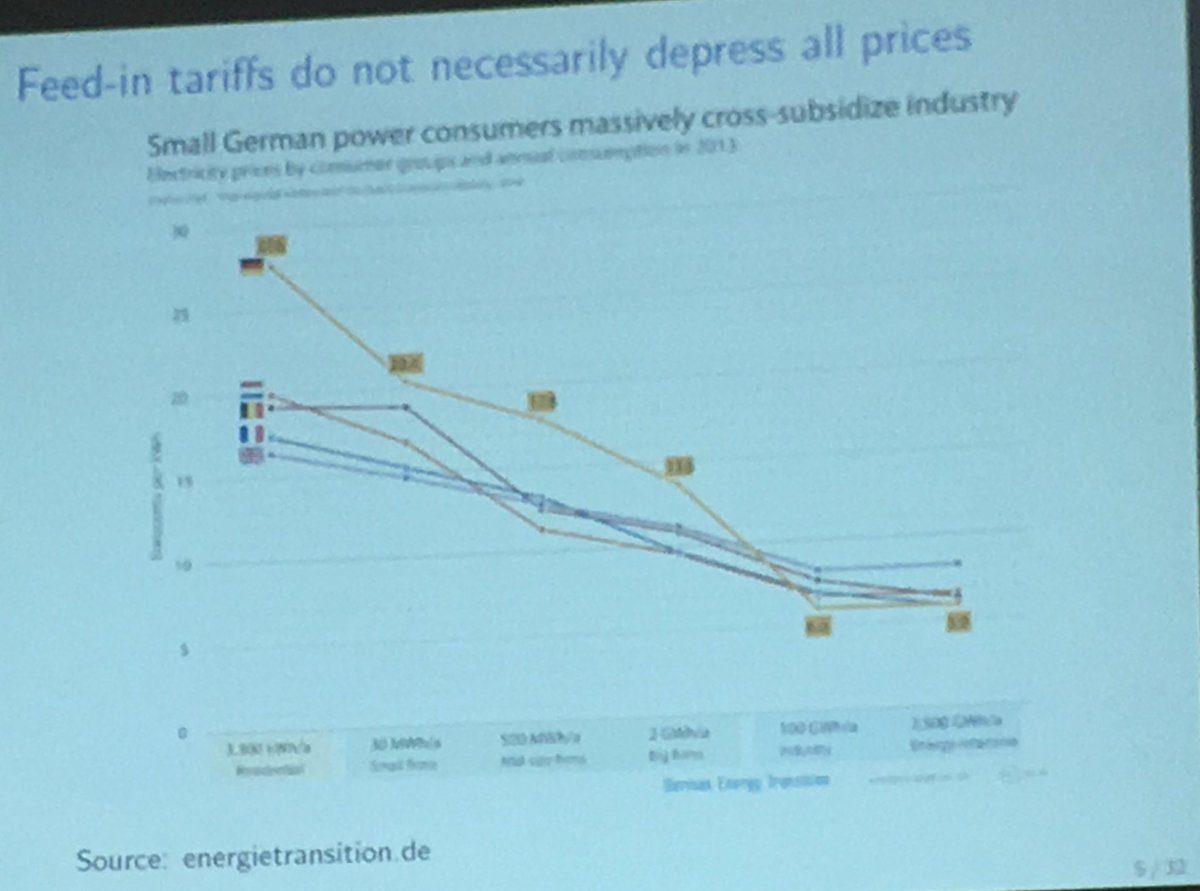

The tax (EEG) was used to finance renewable energy.

Method: use major reform of the tax that doubled the number of exempts firms in 2012.

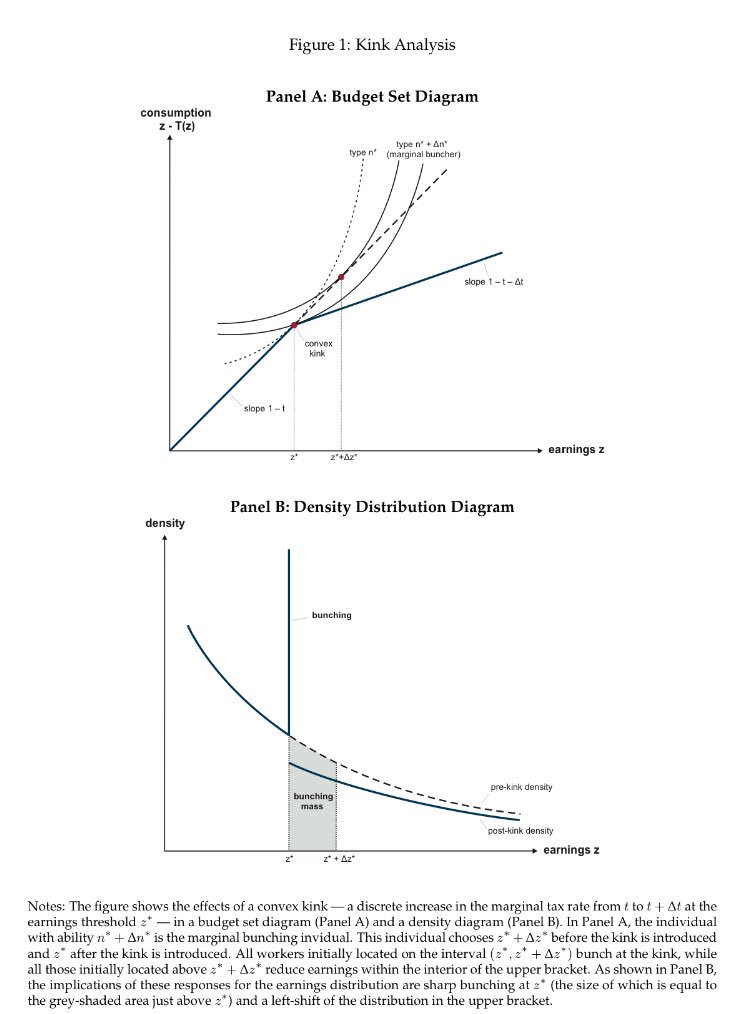

My main comment: why not use regression kink design: eml.berkeley.edu//~saez/course/…

Results by sector:

Live Twitt will resume tomorrow with Michael Greenstone’s keynote lecture.

Michael is the pope or Jedi master of empirical environmental economics.

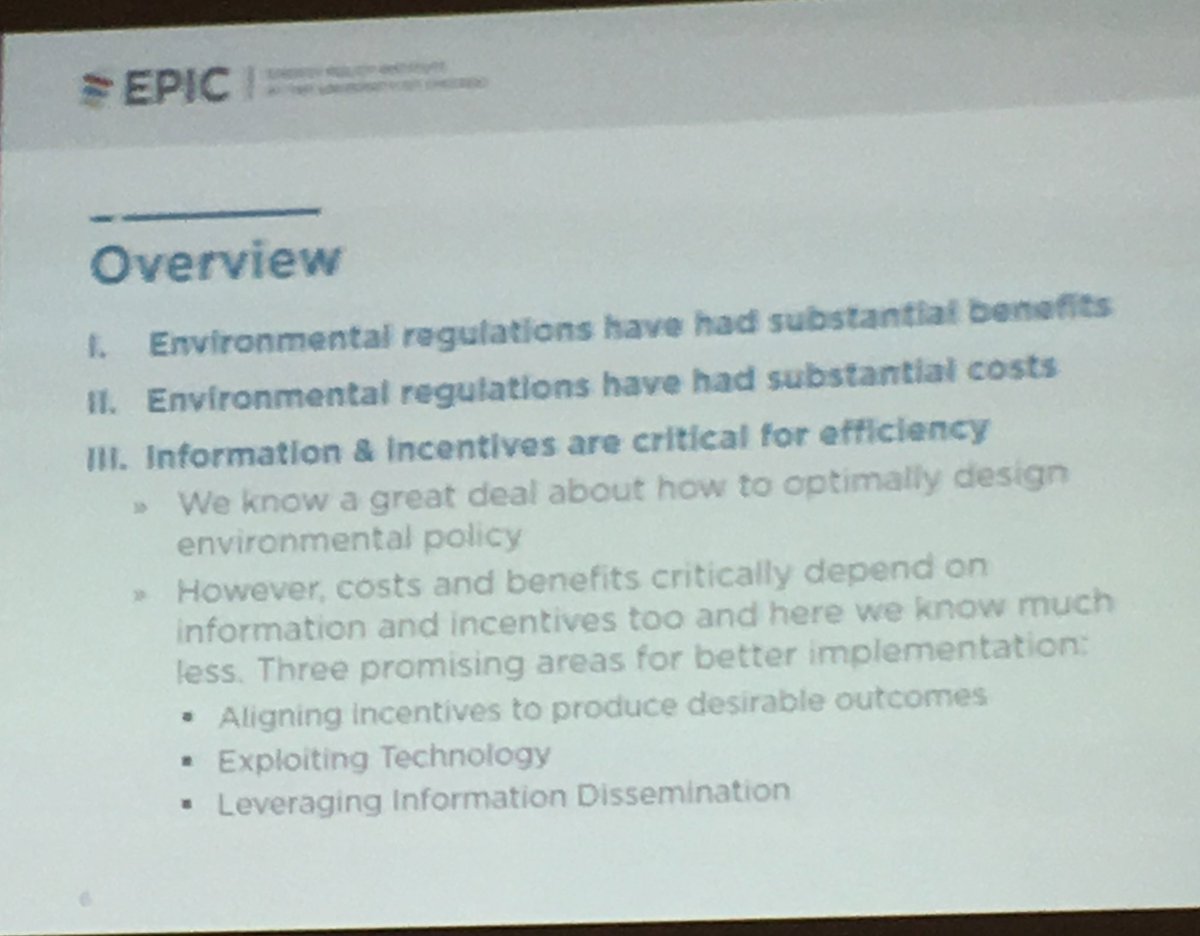

He’s gonna talk about the central role of information and incentives in determining efficiency of environmental regulation.

Non compliance with environmental regulation is widespread.

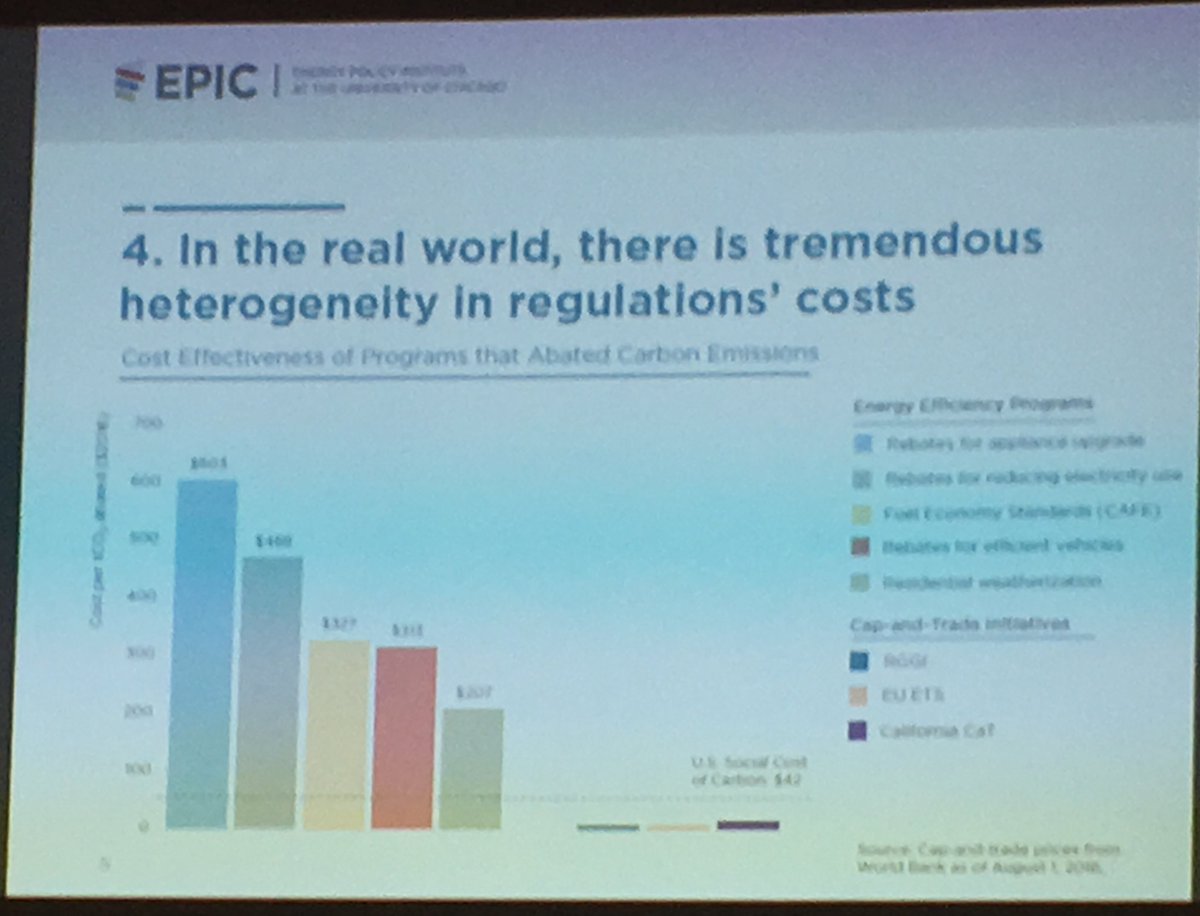

Most programs abating carbon emissions are too costly

In China, more pm10 decreases life expectancy.

“Data is the worst possible boyfriend or girlfriend that you’ve dated in high school. It is going to disappoint you everyday, you just do not know exactly how."

Michael estimates that 15 years of CAAA triggered loss of 600000 jobs and hundreds of billions of dollars in output loss.

Annual economic cost of this regulation on industries is estimated to be around 24 billion dollars.

How to design robust policies, especially yin LdC?

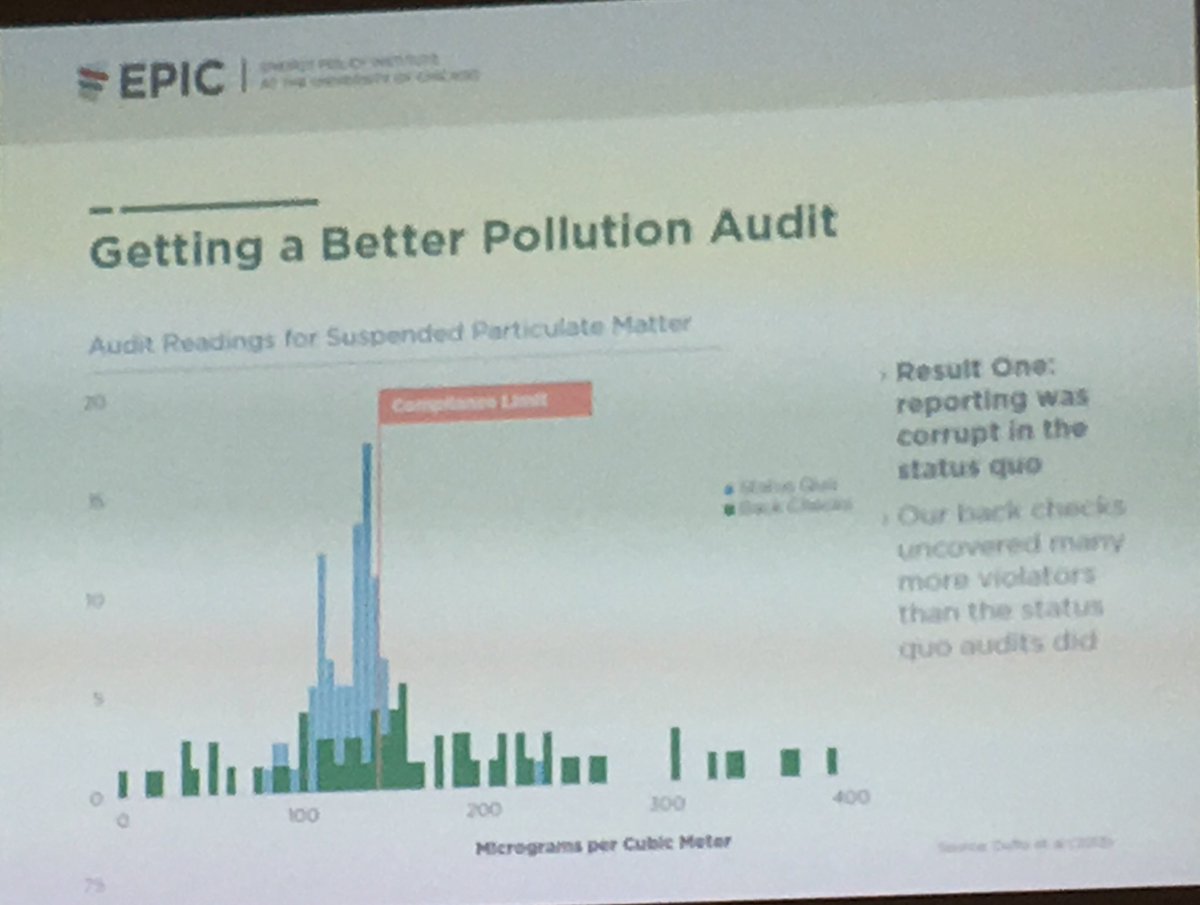

Case in point: corrupt auditors in India reported everyone was in compliance with regulation whereas true inspections detected massive violations.

There was no decline in pollution.

At least, that’s how Michael and his coauthors interpret their data using a structural model.

1/ Using machine learning to target inspections better

2/ Using better monitoring technology: continuous monitoring

3/ Making pollution emissions public

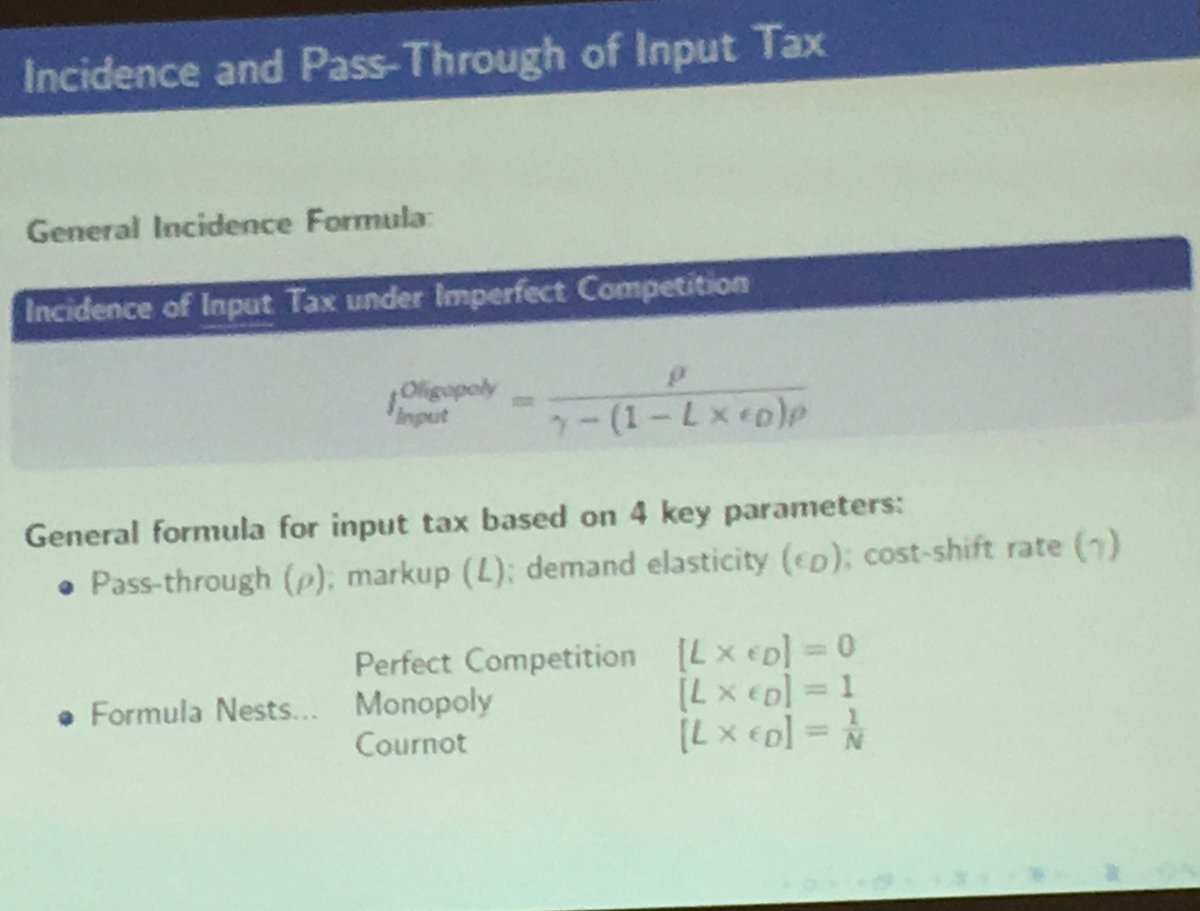

Do industries pass through their cost increases to consumers?

Reed is going to estimate all the parameters in this formula for energy inputs, in order to estimate the potential incidence of a carbon tax.

Approach dates back to Hall 1988 and has been extended by Jan de Loecker recently.

Energy tax credits and solar tax credits generally favor rich people that pay taxes, own houses and can make the investment, as @BorensteinS has shown in previous work.

Mar describes the supply curve as a cost minimizing decision.

1/ Mandates and subsidies leverage more on changes in the production side and tax decreases consumption more.

2/ Leakage seems to be the main justification for decreasing prices for industrials.

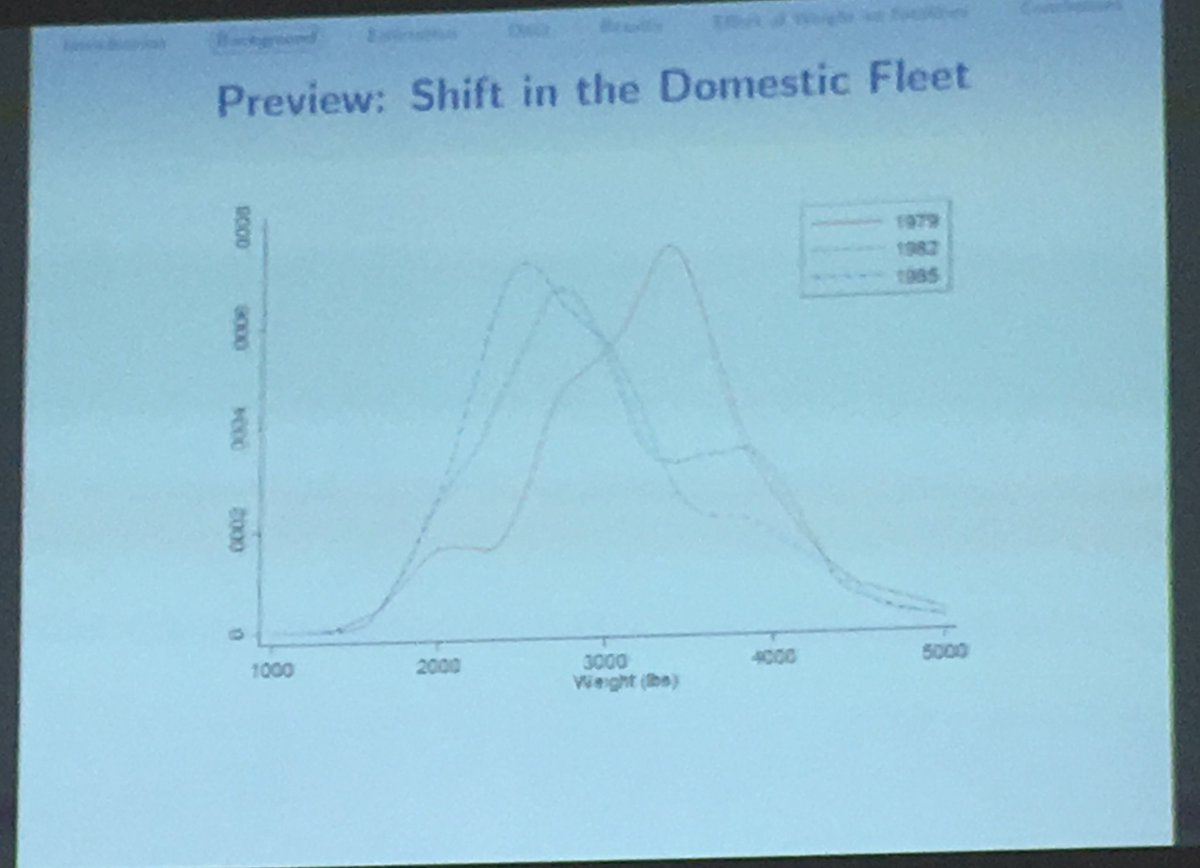

Problem is that CAFE lowers weight of vehicles, which is associated with increased fatalities.

The main problem is that of weight dispersion: big cars are more dangerous when facing lighter cars.

Final effect of CAFE on fatalities is thus complex to assess.

Pb: how to estimate stringency of regulation?

Here: stringency is firm specific deviation from pre Cafe standard.

Results: this is mainly the weight of smaller cars that react to the stringency of the standard.

This increases dispersion.

Driving a lighter vehicle also does increase fatalities.

Now you can recompute the fleet in the absence of Cafe and estimate total fatalities. Same number of accidents with different weights.

Results: CAFE does not kill, the average weight effect dominates.

Not end of conference, but I have some appointments this afternoon (I have to do some actual work at some point ;)

Apologies to the speakers from this afternoon.

Hope you have enjoyed the live-twitt. It was sure fun to do. Great inspiring research!