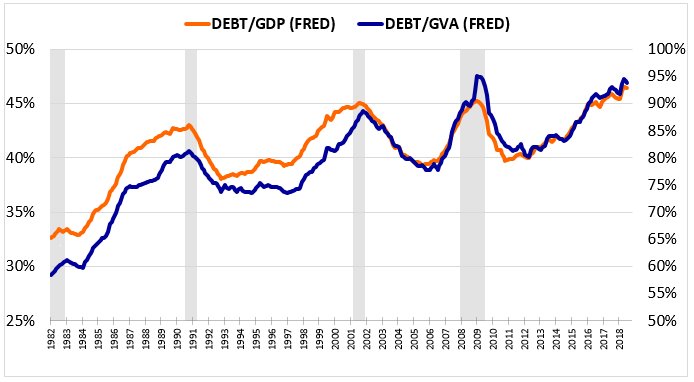

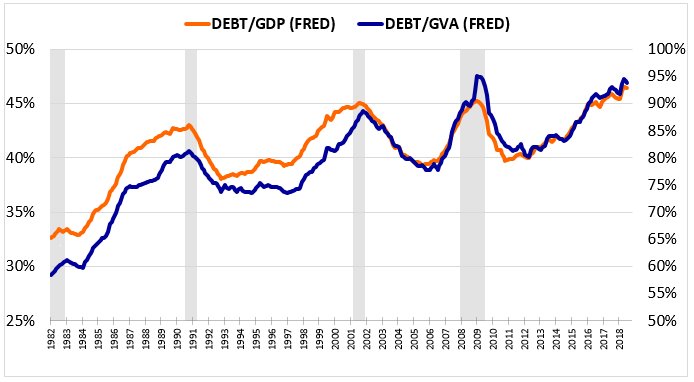

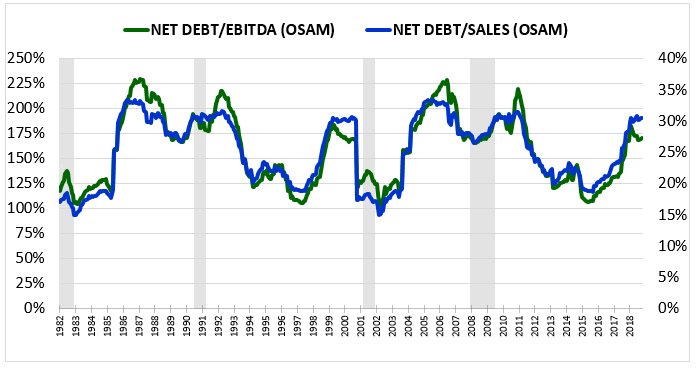

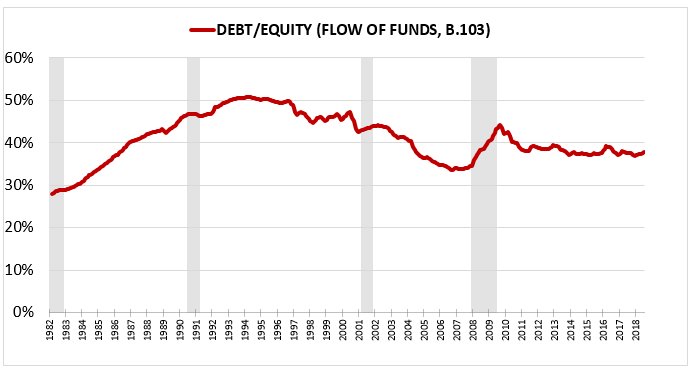

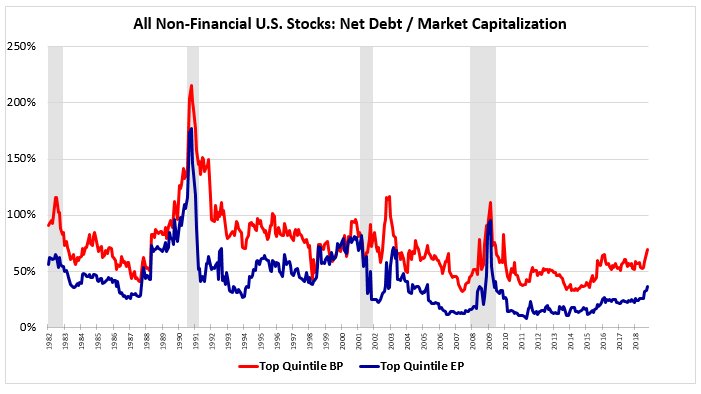

We screen to avoid companies with worrisome leverage and over-reliance on capital markets, so @Jesse_Livermore and I have been discussing the current state of corporate debt. We see lots of worrisome looking charts like this:

Get real-time email alerts when new unrolls (>4 tweets) are available from this author!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!