consistently thought that at Berkshire this mark-to-market change would produce what I described as “wild and

capricious swings in our bottom line.”

#WarrenBuffet 2018 Letter

that in no way diminishes the importance of our investments to Berkshire.

#WarrenBuffet 2018 Letter

deliver substantial gains, albeit with highly irregular timing.

#WarrenBuffet 2018 Letter

2 – is a metric that has lost the relevance it once had. Three circumstances have made that so.

#WarrenBuffet 2018 Letter

gradually morphed from a company whose assets are concentrated in marketable stocks into one whose major value

resides in operating businesses. Charlie and I expect that reshaping to continue in an irregular manner.

#WarrenBuffet 2018 Letter

our equity holdings are valued at market prices, accounting rules require our collection of operating companies to be

included in book value at an amount far below their current value, a mismark that has grown in recent years.

#WarrenBuffet 2018 Letter

is likely that – over time – Berkshire will be a significant repurchaser of its shares, transactions that will take place at

prices above book value but below our estimate of intrinsic value.

#WarrenBuffet 2018 Letter

transaction makes per-share intrinsic value go up, while per-share book value goes down. That combination causes

the book-value scorecard to become increasingly out of touch with economic reality.

#WarrenBuffet 2018 Letter

extremely capricious: Just look at the 54-year history laid out on page 2. Over time, however, Berkshire’s stock price

will provide the best measure of business performance.

#WarrenBuffet 2018 Letter

characteristics. We also need to make these purchases at sensible prices.

#WarrenBuffet 2018 Letter

then answered his own query: “Four, because calling a tail a leg doesn’t make it one.” Abe would have felt lonely on

Wall Street.

stock-based compensation shouldn’t be

counted as an expense. (What else could it be – a gift from shareholders?) And restructuring expenses?

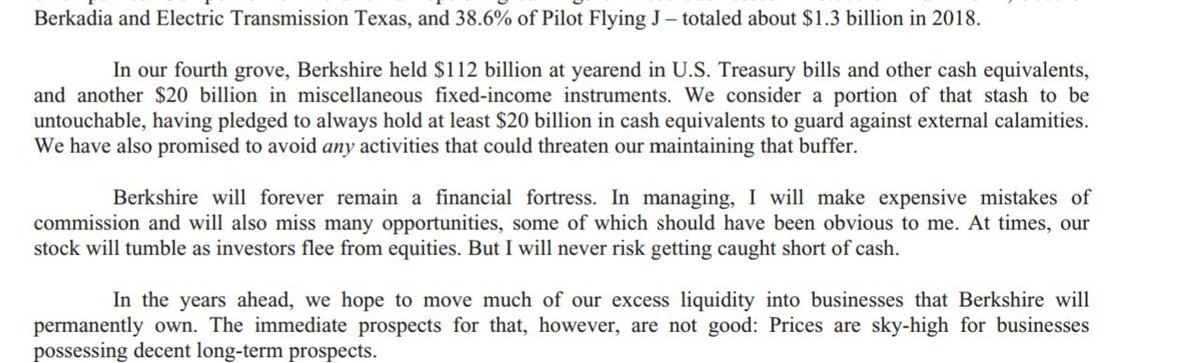

1) Guard against external calamitie.

2) Will never risk getting caught short of cash.

Learnings for Corporate America and Corporate India... like Reliance ADAG @Moneylifers

behave next week or next year. Predictions of that sort have never been a part of our activities.

is focused on calculating whether a portion of an attractive business is worth more than its market price.

Buffett Investment Philosophy

we were to sell certain of our wholly-owned businesses.

our wonderful companies even if no tax would be payable on its sale. Truly good businesses are exceptionally hard to

find. Selling any you are lucky enough to own makes no sense at all.

five groves into a single entity. This arrangement allows us to seamlessly and objectively allocate major amounts of

capital, eliminate enterprise risk, avoid insularity, fund assets at exceptionally low cost.

destructive, a fact lost on many promotional or ever-optimistic CEOs.

American Tailwind. We are lucky – gloriously lucky – to have that force at our back.

we like and trust. And now our new management structure has made our lives even more enjoyable.