Here are five reasons why I don't believe Bitcoin's security model will ever require perpetual inflation👇

In essence, new transaction types will incentivize the use of privacy-preserving techniques that increase demand for block space:

medium.com/digitalassetre…

Post-quantum crypto algorithms require larger key sizes, which in turn increase the size of non-witness data in a transaction. For more, read:

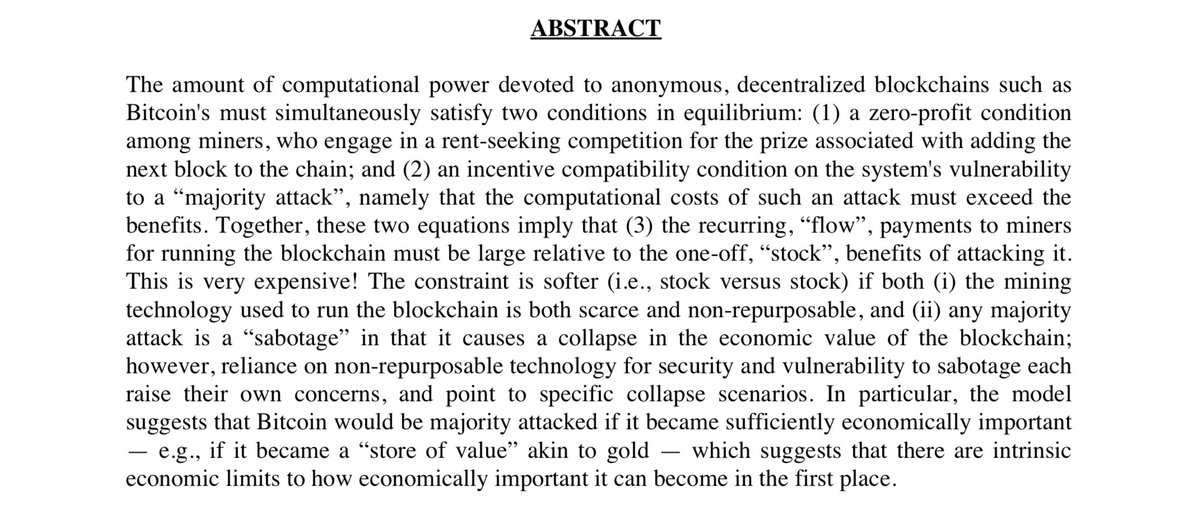

eprint.iacr.org/2018/213.pdf

blog.lightning.engineering/posts/2018/05/…

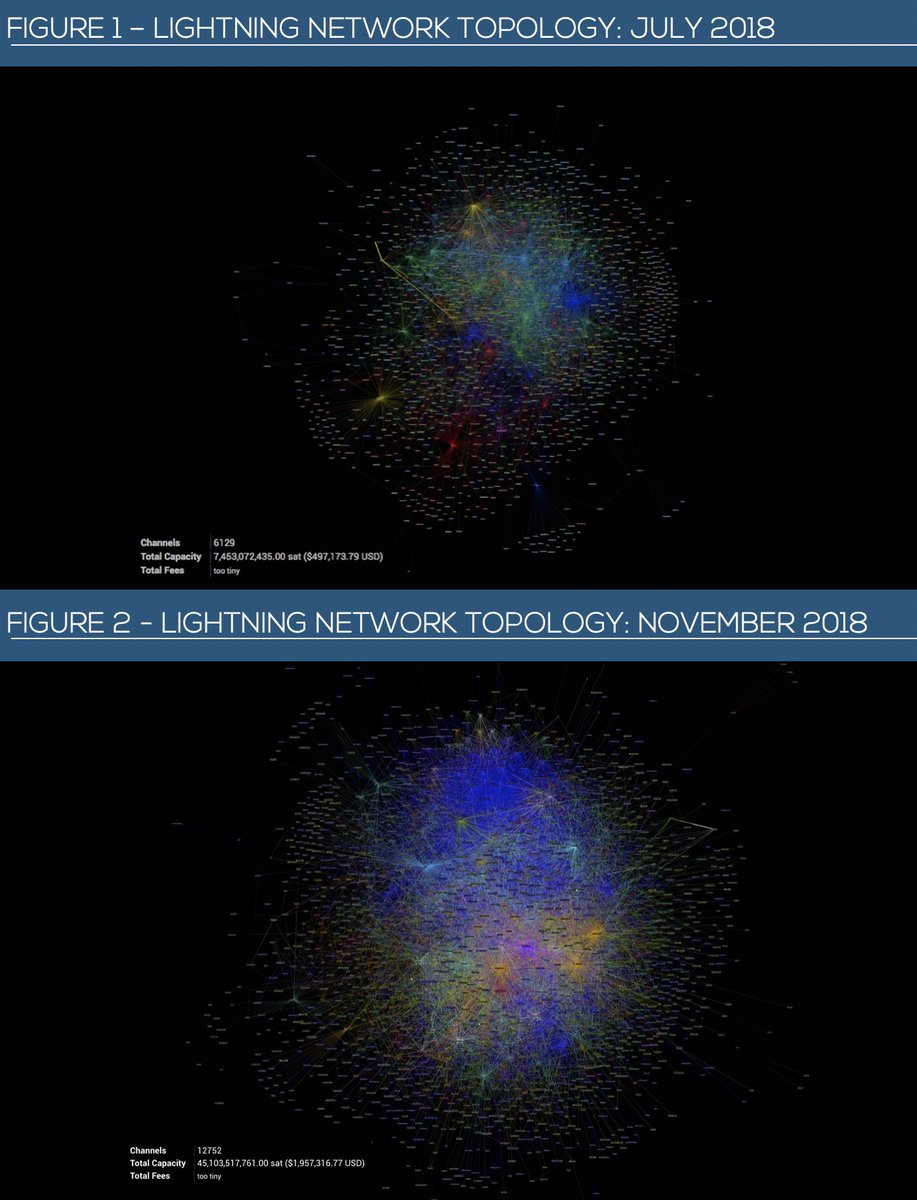

blog.bitmex.com/the-lightning-…

blockstream.com/2018/07/02/liq…

What other factors can you think of?