I’m afraid I might not be able to present proof of remittance when the need arises.

My Response

===========

That’s a good question and it truly calls for concern by anyone affected.

(Sidenote: Though, the rule says 5 employees and above, but then it is advisable to register your members of staff for P.A.Y.E. and start making remittances ASAP)

That’s the first step in the equation...

The next thing is, a file will be opened for your company that will be resident at the L.I.R.S. office where your business is within jurisdiction. A PAYER ID will be generated specifically for your company alongside a few other revenue codes and will be...

It is on the strength of this PAYER ID and other revenue codes that P.A.Y.E. deductions from salaries of members of staff are paid into any of the designated banks and a Revenue Receipt with the Lagos State logo on it will be printed and given to you as...

But before this payment can be initiated and paid, L.I.R.S. will need to calculate the exact amount (though, you should reconcile it with your own calculation) each member of staff will be expected to pay monthly via a staff salary schedule (On excel sheet)...

The above is only a guide and a fore runner to the dynamics.

Now to answer your question.

On your payslip,...

Your surefire PROOF to show that your P.A.Y.E. tax which is deducted monthly is remitted accordingly is the LAGOS STATE REVENUE RECEIPT GENERATED BY THE BANK WITH YOUR COMPANY PAYER ID ON IT AND THE..

The schedule will show a breakdown of all the members of staff whose salaries were deducted and the amount paid by them. Yours will definitely be there if you are a member of staff of that company...

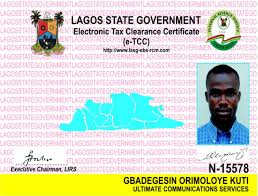

So, in the event you need to show evidence of remittance of P.A.Y.E. whilst you await the e-TCC Card, you can make photocopies of the revenue receipts and salary schedule...

I hope this helps and answers the gentleman's question.

Chidera ANELE

Accounting|Tax Consultant|ERP Consultant |Real Estate

PS

The attached e-TCC card image was taken from Google.com.