Attempt will be made in this presentation to simplify the concepts of Withholding Tax (WHT) & Value Added Tax (VAT) as business-related taxes

Tax can be imposed by all three tiers of government in Nigeria – Local Government, State Government and the Federal Government.

Local Government:

Tax

Shop and kiosks rates

Market levies

State Government Tax:

Personal income tax (P.A.Y.E.)

Business Premises Registration

Federal Government Tax

Company income Tax

Value added tax

Withholding tax – State and Federal.

Tax is used to redistribute wealth by taking more taxes from high income earners and spreading it on...

Tax is used to discourage consumption of goods which are considered undesirable to the society or dangerous to health.

PIT is the most common type of tax in Nigeria, and is applicable to workers, business owners, professionals, artisans, traders, etc...

Benefits in kind include such benefits as official car, official accommodation, cooks, gardeners, security etc.

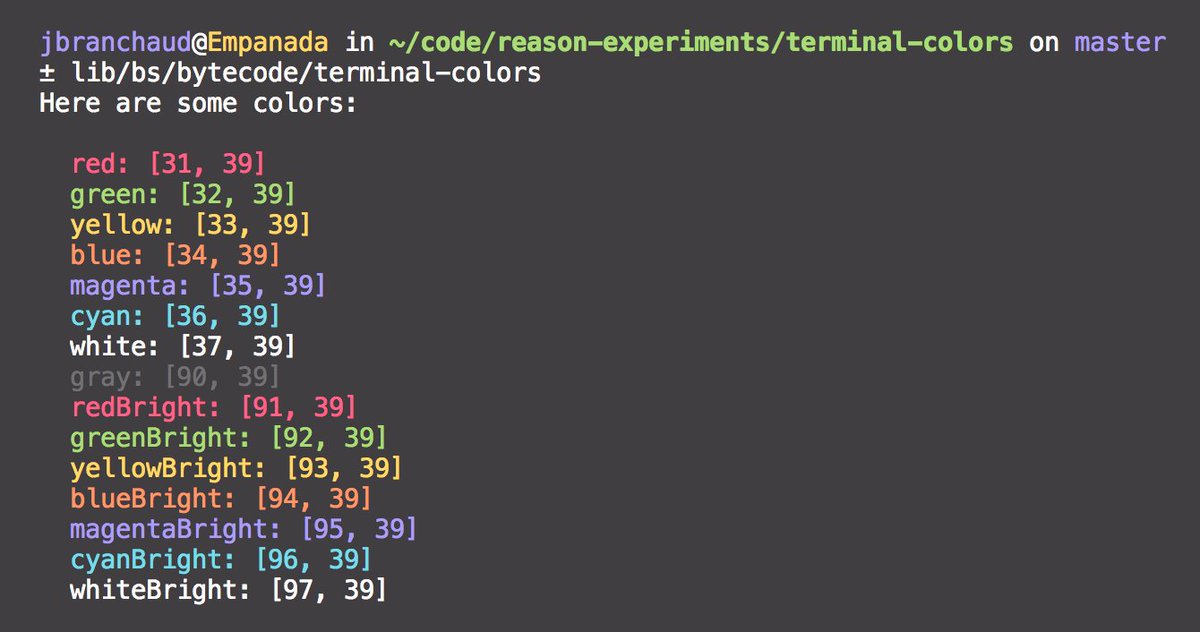

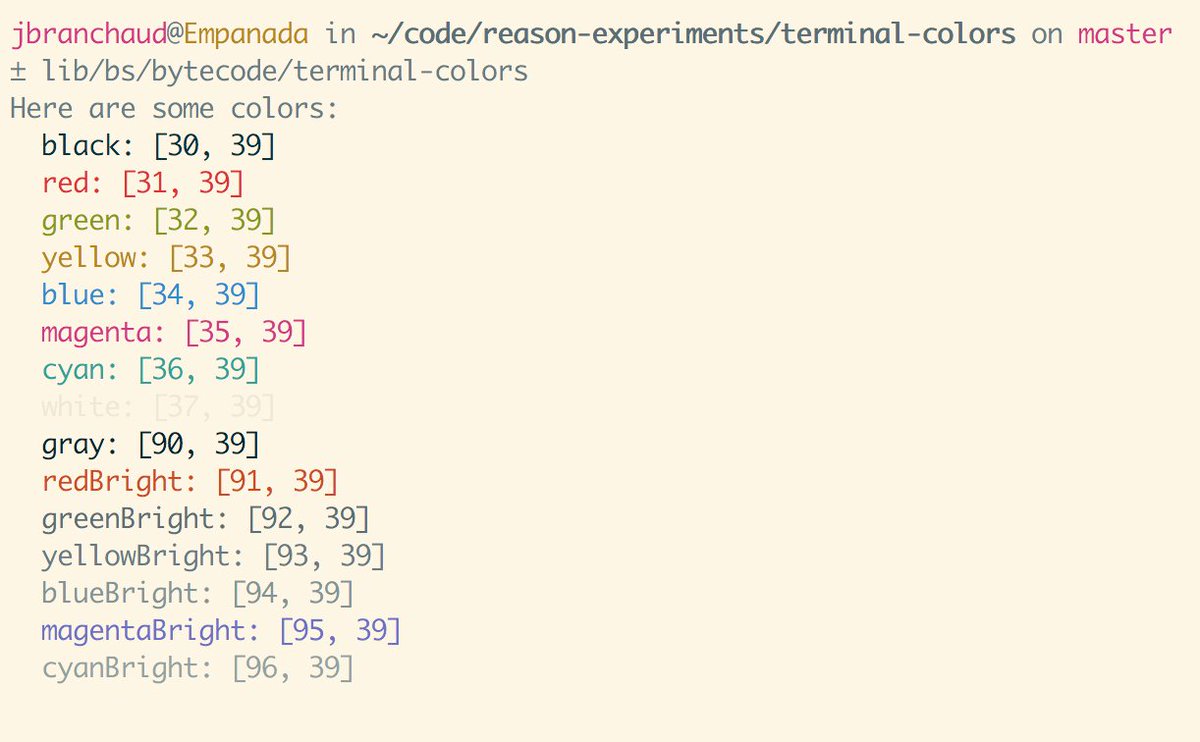

It can also be defined as a tax on spending/consumption levied at every stage of a transaction but eventually borne by the final consumer.

VAT on their purchases directly to the FIRS rather than pay it over to their vendors.

VAT payment is expected to be filed not later than 21st day of month following the transaction

For example, Kunle buys a Television set at N60,000 and 2 LCD players at N20,000 each from a retail outlet - Taiwo Supermarket. How much will Kunle pay in total?

VAT is compulsory. If you do not include VAT in your invoice, or if VAT included in your invoice is not paid, you are liable to pay it.

Always consider VAT as part of your invoice because you are not the one paying eventually if you are not the final consumer.

The basis of assessment of a company is on preceding year basis.

This means tax is charged on profits for the accounting year ending in the preceding year of assessment.

Note that the company is a separate legal entity and can pay tax in its name.

There is a further 2% Education Tax on assessable profit.

In filing for Companies Income Tax, audited financial statement are statutorily required.

It is an advance payment [to be deducted by every taxpayer, who is an agent of WHT at the point of settling suppliers’ bills] to be applied as tax credit...

The purpose is to bring prospective taxpayer into the tax- net thereby widening the income tax base.

Justification to comment on how government resources are managed, and Keeping of accounting records.

Generally, under Section 66 of the Companies Income Tax Act; tax collectors have the power to seize/auction off the goods.

“Any person who being obliged to deduct any tax under this Act or the laws listed in the First Schedule to this Act, but fails to deduct,...

It is important to pay the correct tax, more so that it is no longer possible to hide information from tax authorities.

It pays to pay tax- pay your tax…..