=================

Let’s assume you want to import 10 units of ‘Hair Clippers for Men’ from China for resale as a newbie who’s just taking a plunge into Mini Importation business...

These two questions are critical to helping you need to make informed decision before investing your hard earned money...

Let’s also assume dollar exchange rate to yuan is $1 = 6.3 yuan

Let’s also assume dollar exchange rate to naira is $1 =N370...

1) Product Cost

10 units = 320 yuan

320 yuan = $51

$51 x N370 = N18,870

Now, each item weighs 0.65kg and you have 10 units to import.

0.65kg x 10pcs = 6.5kg

6.5kg x $8 = $52

$52 x N370 = N19,240

3) Custom Clearing Cost

To clear an item that weighs 1kg cost N380

6.5kg x N380 = N2,470

Let’s just assume you’ll spend $50 ad on Facebook & Instagram

$50 x N370 = N18,500

5) Internet Subscription = N5,000

6) Deliver cost:

- Within Lagos = N1,500 x 5units = N7,500

7) Fueling for power = N2,500

N

Product cost (10 units) 18,870

Product weight cost 19,240

Advertising cost 18,500

Internet subscription 5,000

Deliver cost (Within & without) 17,500

Fueling for power 2,500

Total cost 84,080

How do you determine the selling price of your product?

Unit cost (i.e. Cost of buying one) of product = N84,080/10units = N8,408

For example, Markup by 239% and unit cost is N8,408

Selling price = 239% x N8,408 = N20,095.

So, selling price = N20,095

Less your total cost = (N84,080)

Profit N116,870

Your ROI is a positive 138%.

========

Dive deep into this business if you know you can turnover the sale of the product in the shortest possible time.

Next article, I’m going to be looking at the qualitative aspect of pricing strategy for SMEs.

I hope this helps.

Chidera ANELE

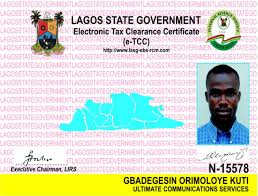

Tax Consultant