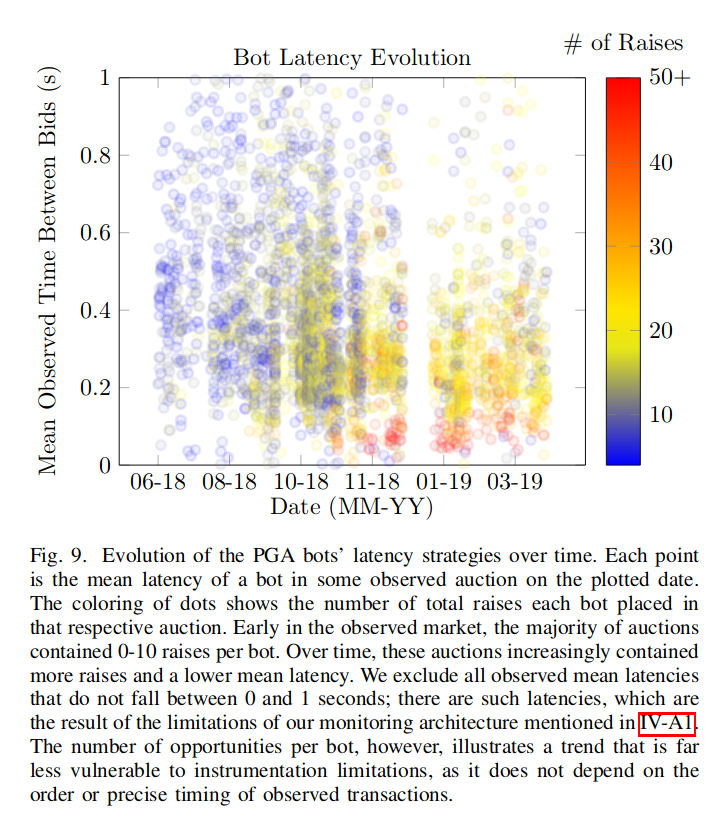

Consensus Instability in Decentralized Exchanges" - arxiv.org/abs/1904.05234

Key takeaways and some pretty graphs below! 👇

Please read it!!! It is the culmination of over 1.5 years of work of mine and others'.

You can explore PGAs in-depth on frontrun.me.

Even worse, miners can do what is called a time bandit attack, shown here, to subsidize their 51% attacks by rewriting history so they make dex trades *in the past*.