The ITC argument is that locking in current policies on data flows and other non-tariff barriers reduces the risk that foreign markets will be taken away.

This increases firm incentives to invest in ways that are beneficial to the overall economy, and leads to higher GDP.

This motivation relates to the seminal research of @KyleLHandley and Nuno Limao. They have published work showing how trade agreements that limit and lock in tariffs reduce trade policy uncertainty for GOODS trade.

Here, the ITC is applying that same logic to SERVICES trade.

The logic makes sense.

This also provides intuition for HOW it is possible to generate expected POSITIVE changes to US GDP arising from USMCA...

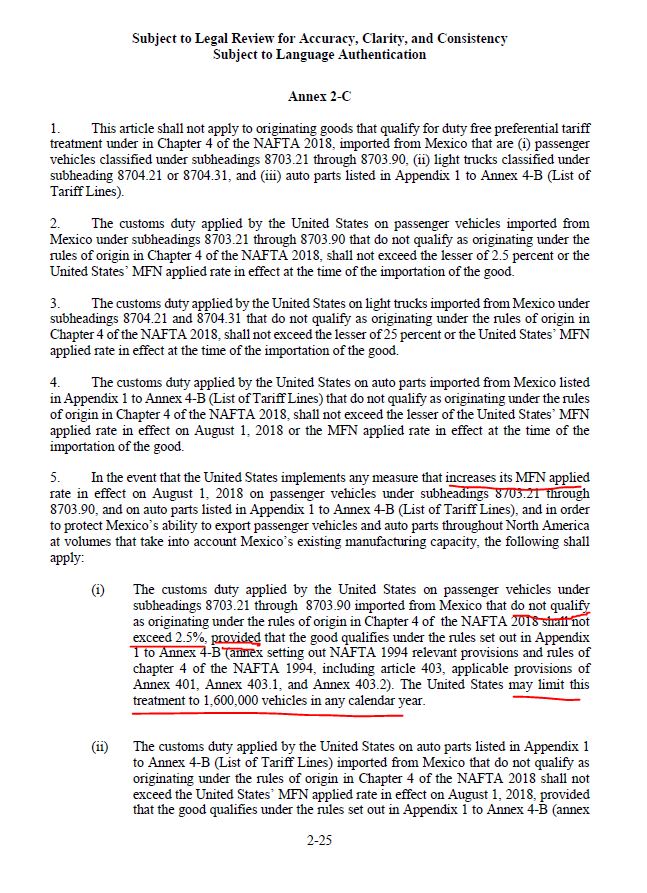

..even when most of the provisions on GOODS actually increased costs to the US economy and would be on net negative for GDP.

But it is important to interpret the USMCA provisions and these results correctly.

Much of the gains do not arise through overall improvements to the "goods" side of the economy.

Indeed, for autos, there is expected to be a net cost to the US economy of Trump's approach.

The gains arise through reductions in policy uncertainty and are largely in non-tariff barriers and services trade.

Here is the full report from the ITC - enjoy!!!

usitc.gov/publications/3…

Here are links to some of the research by @KyleLHandley and Nuno Limao on reducing trade policy uncertainty

“Trade under T.R.U.M.P. policies,” Economics and Policy in the Age of Trump, CEPR, ed. Chad Bown, 2017

--> wam.umd.edu/~limao/handley…

“Trade and Investment under Policy Uncertainty: Theory and Firm Evidence,” American Economic Journal Policy, 2015

--> wam.umd.edu/~limao/tpu_fin…

“Policy Uncertainty, Trade and Welfare: Theory and Evidence for China and the U.S.” AER 2017

wam.umd.edu/~limao/aer_fin…

And here, of course, is an @Trade__Talks episode on trade policy uncertainty

END/

tradetalkspodcast.com/podcast/trade-…