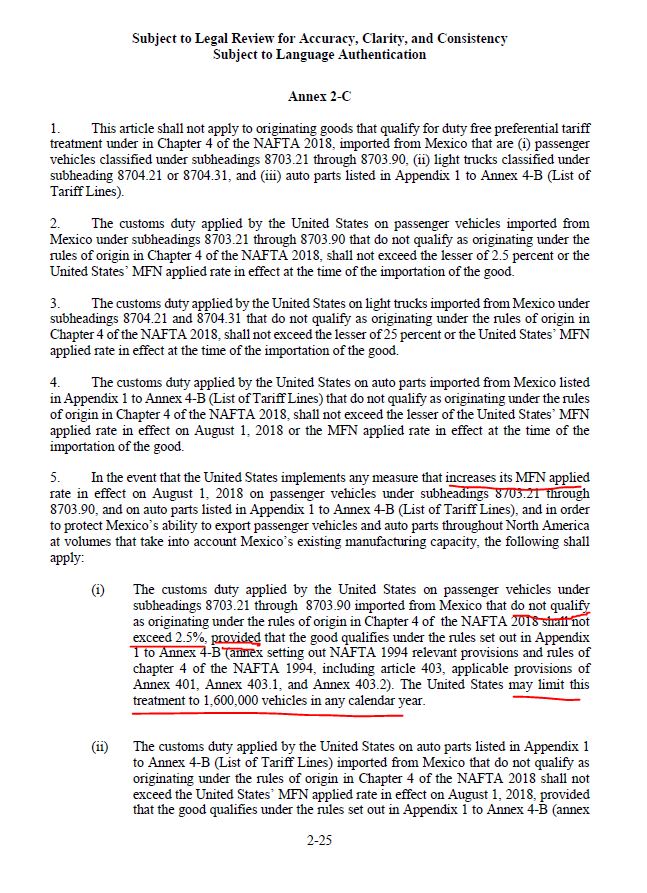

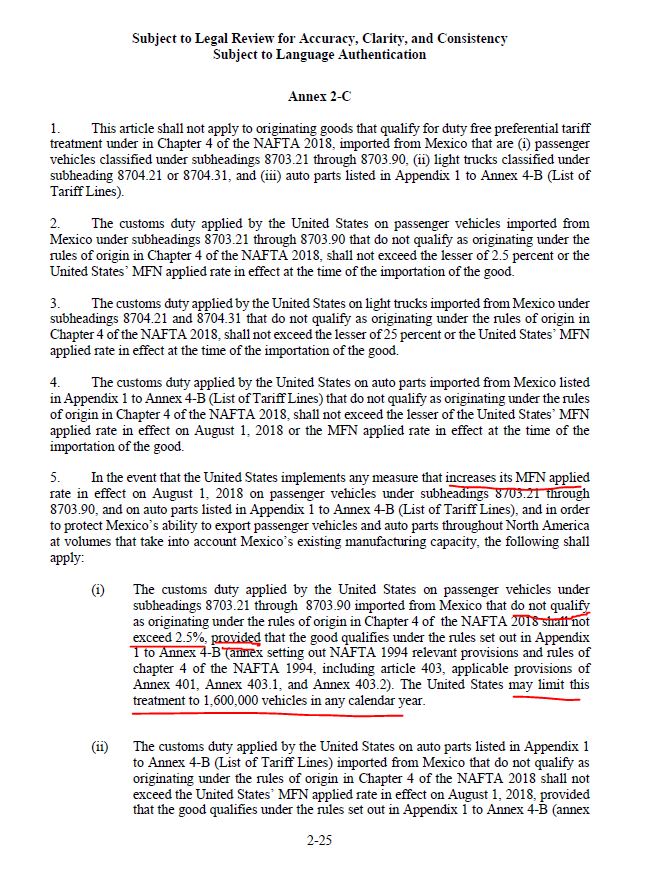

This is relevant because the new USMCA auto "rules of origin" (75% regional content, $16 wage provision, etc) make it costlier for Mexican-assembled vehicles to comply...

...and some companies may prefer not to comply and just pay the MFN tariff.

And Trump doesn't want that

ECONOMIC IMPLICATION: automakers in Mexico CAN'T adopt a strategy to now buy fewer parts from North America (eg, and more from Asia/Europe) to lower their costs and still receive the 2.5% tariff.

If they do that, they'll no longer satisfy the ORIGINAL Nafta rules of origin

But Annex 2-C also says that the US could limit Mexico's non-conforming auto exports to 1.6 m vehicles per year.

Note: Mexico exported 1.8 m passenger vehicles in 2017. It is unclear how many of those are conforming to the new USMCA ROOs.

ustr.gov/sites/default/…

These are some of the details in USMCA agreement that are now FINALLY public, alongside the autos 232 side letters.

These are what motivated me to write THIS on the WORRYING economic incentives created by Trump's new rules for autos

piie.com/blogs/trade-in…

North American auto production is now costlier with Trump's USMCA.

To stop MORE imports from coming in from Asia/Europe, his own rules will create the incentive for TRUMP to INCREASE that 2.5% auto tariff, whether under Section 232 or GATT Article XXVIII.

[Sorry, NOW END]