Previously shared this on a closed WhatsApp group of friends.

#optionstrading

(1/n)

A 15 delta Short strangle will end up with typically higher than 85% of trader's as winners.

This is the biggest attraction for traders new to #optionstrading

(2/n)

But this high win rate comes at a cost.

(3/n)

He typically has come from trading directional stock/Futures and low win rates has him frustrated.

His system hopping leads him to selling options.

(4/n)

#optionstrading

(5/n)

If he is "unlucky" AND "foolish" he lands up adding capital to his new found wonder strategy.

(6/n)

(7/n)

#OptionsTrading

(8/n)

#OptionsTrading

(9/n)

A few trades aren't enough for the probabilities to play out.

#OptionsTrading

(10/n)

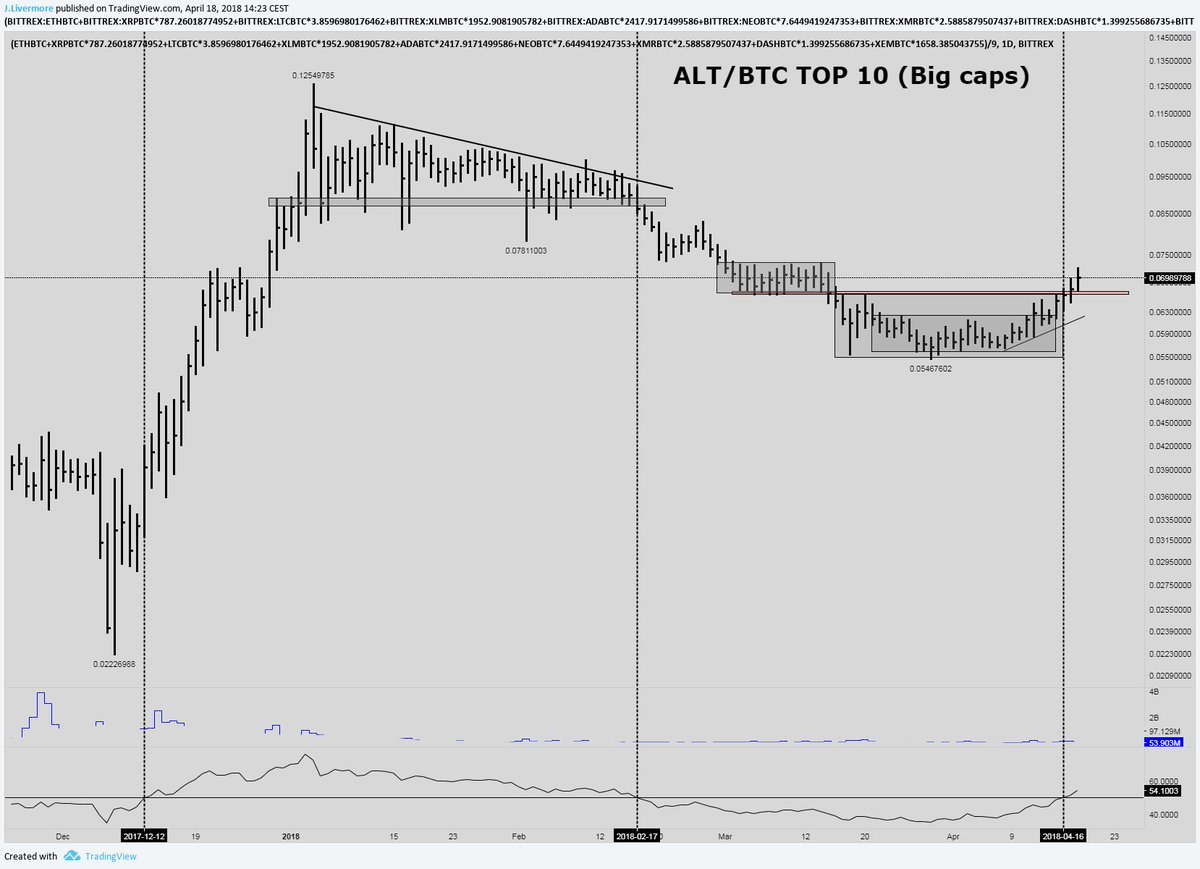

We are currently in one.

So trade small, trade often.

#OptionsTrading

(11/11)