Thanks to @stroebel_econ and Theresa Kuchler for organizing

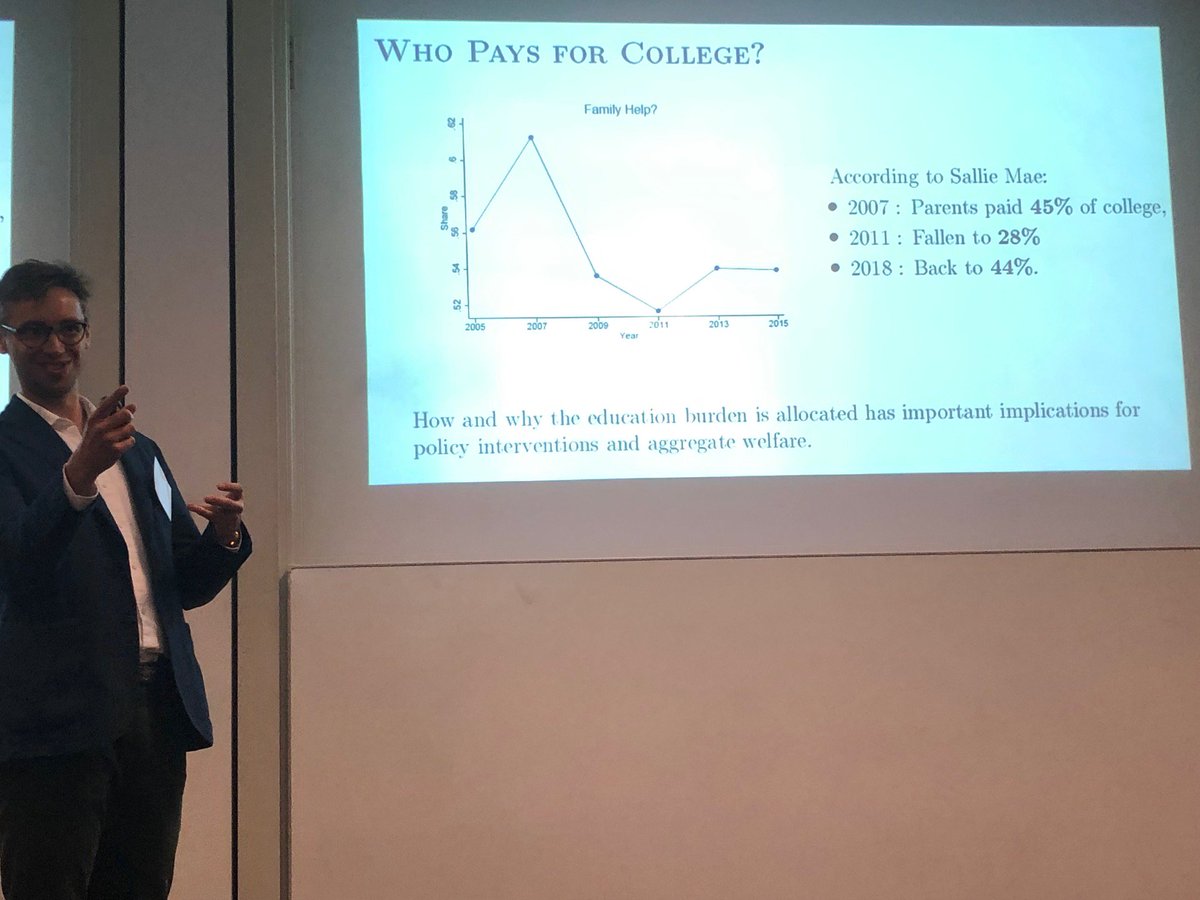

Document that parental support for children varies with housing cycles

Student loans also special, since not dischargeable in bankruptcy.

Very nice paper on understanding causal effects of foreclosure on owners, renters, and landlords.

- smaller homes

- worse neighborhoods on income and intergenerational mobility

- higher divorce rates (15 percentage points!)

But not as bad for renters, or landlords.

-> Suggests the financial shock *and* eviction shock together is bad

stern.nyu.edu/sites/default/…

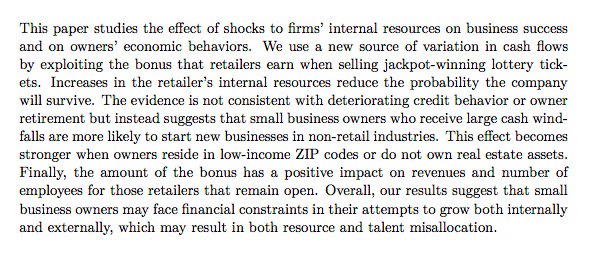

Retailers that sell jackpot ticket -> get bonus -> affects firm decisions

stern.nyu.edu/sites/default/…

On another topical student loan question: Income Based Repayment plans!

- lower monthly payments

- basically eliminate loan delinquencies

- consumer more instead

- moral hazard. work less, due to higher implicit marginal tax rates of income repayment plans

Either case presents important potential frictions which may make income repayment plans work less well in general.

But as with any insurance plan some tricky hidden information/hidden action issues which would be great to see explored in future.

Stephanie Johnson, "Mortgage Leverage and House Prices"

stern.nyu.edu/sites/default/…

Reinforces idea that credit constraints, a key part of which is governed by payment size relative to flow income, pass through to house prices.

Here, Mexican gov giving out debit cards.

+ view: leaves people with more assets, takes advantage of changing tech and frictions

- view: also leaves people with debt

Increase employment, especially of *skilled* workers, suggesting capital-skill complementarity

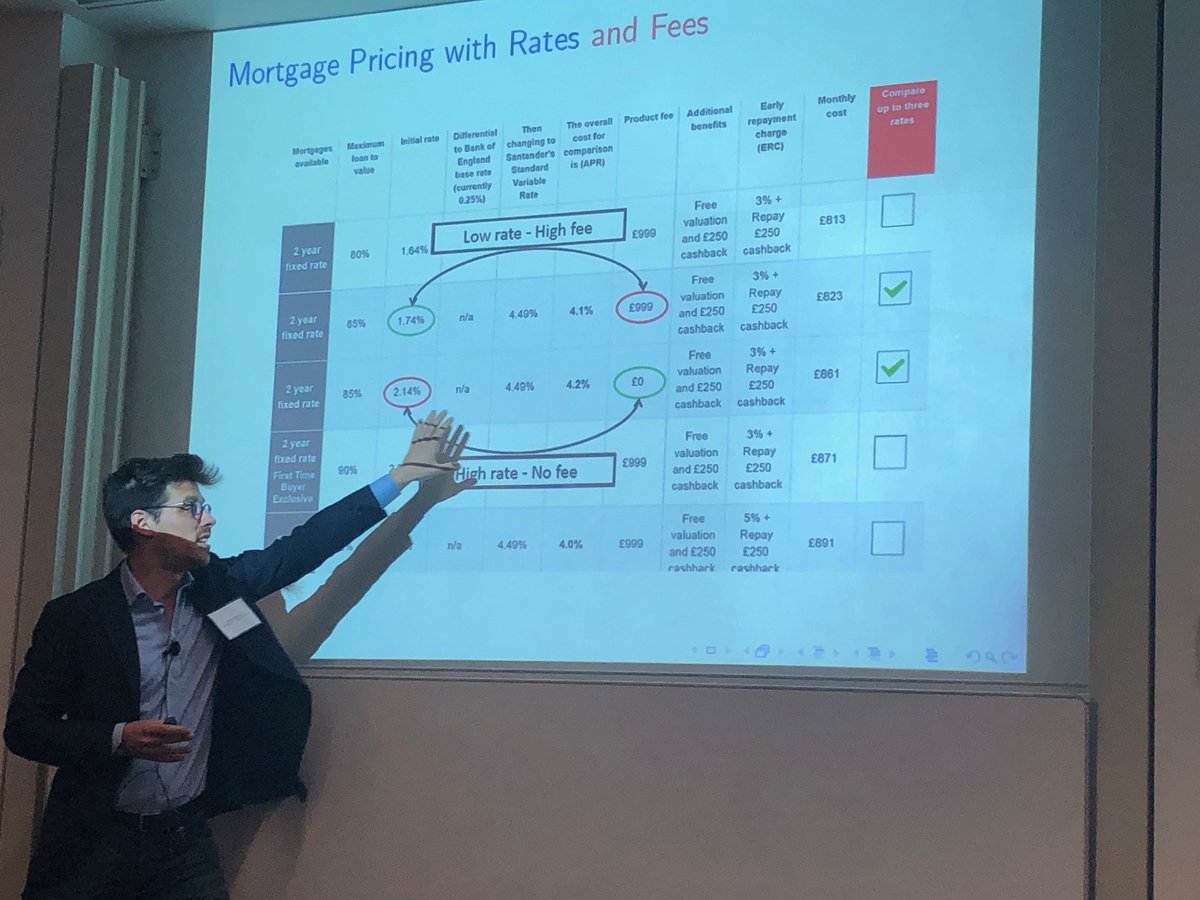

Or -- lenders setting some fees that reduces effect of these policies