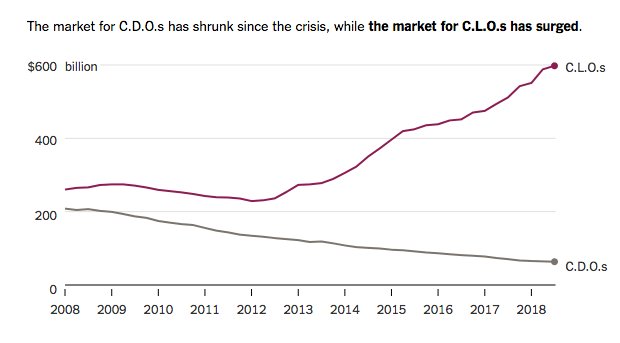

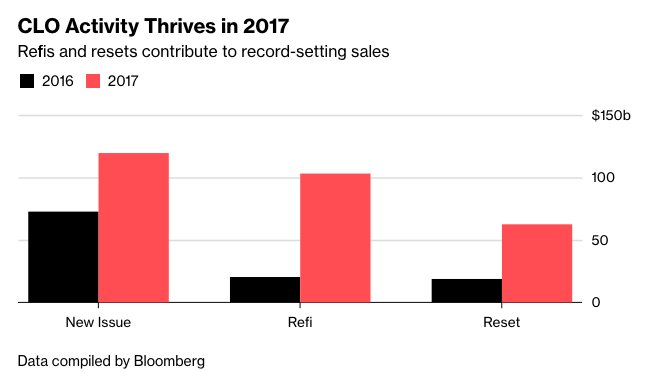

The riskier stuff consists of levered loans -- adjustable interest rate, low covenant protection -- and often securitized in CLOs (now CLO-squared too wsj.com/articles/hedge…)

nytimes.com/2018/10/19/bus…

But the stuff we have today has the potential to be different. For one - the weak covenants can enable asset tunneling

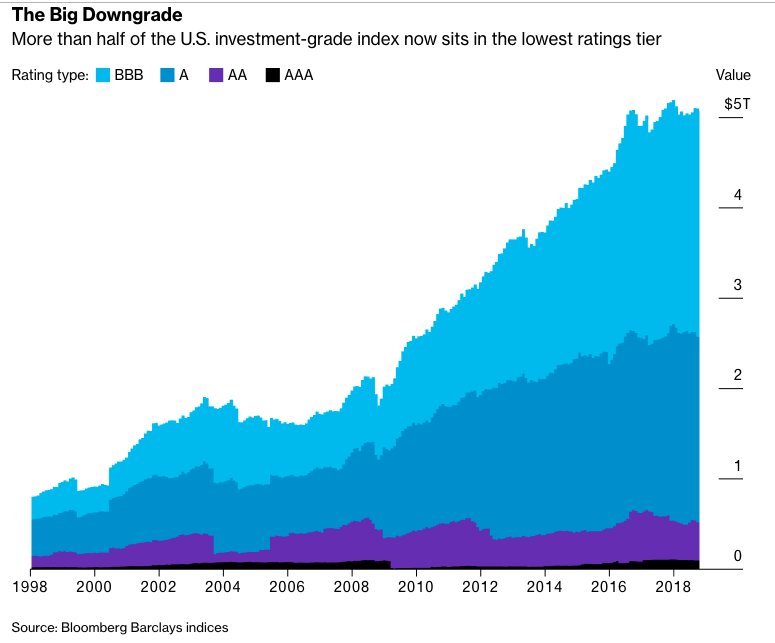

bloomberg.com/news/articles/…

bloomberg.com/markets/fixed-…

ftalphaville.ft.com/2018/10/19/153…

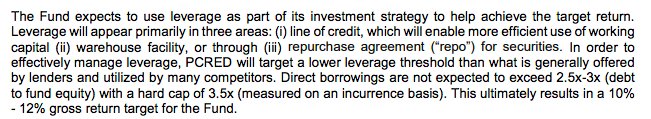

Or debt fund. Here is an example in commercial mortgages, a PIMCO fund holding with repo

psers.pa.gov/About/Board/Re…

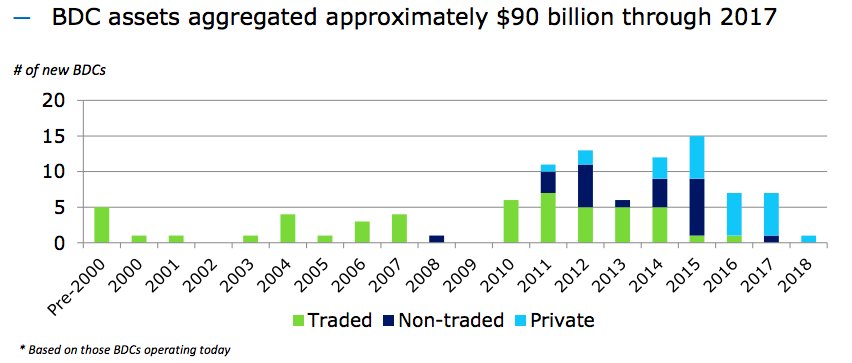

Maybe not super huge or risky - but the fact that this sector was 0 pre-crisis highlights the shift in corp lending

publiclytradedprivateequity.com/portalresource…