Surprisingly, a common finding is *not always.* A look at this literature:

1/

Seems valuable!

ssc.wisc.edu/~scholz/Teachi…

2/

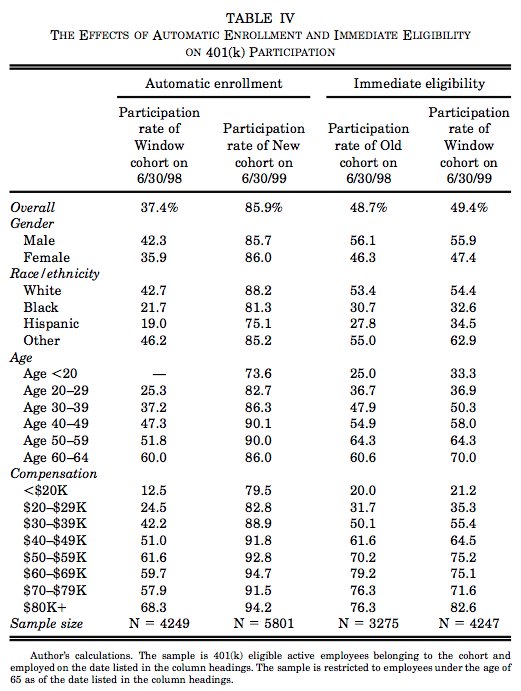

"Simulation results reported in a previous version of this paper ... show that default savings behavior under automatic enrollment may actually lead to lower total 401(k) savings after only a few years relative to more traditional 401(k) plans"

3/

scholar.harvard.edu/laibson/public…

4/

cdn.harvardlawreview.org/wp-content/upl…

7/

tahachoukhmane.com/wp-content/upl…

8/

fin/