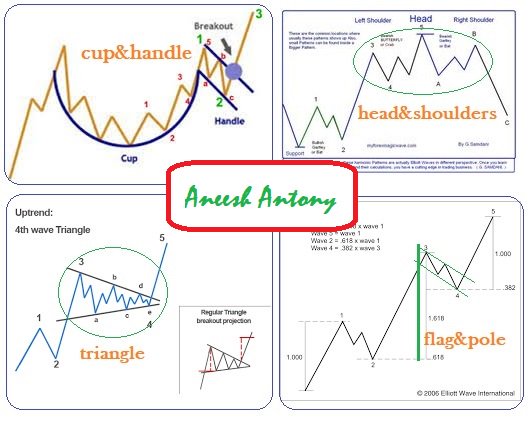

Least concerned yet the most important 2 aspects of candle patterns are;

1. Psychology behind the pattern

2. Location of the pattern formation

@PAVLeader @RajarshitaS @sanstocktrader @Abhishekkar_

Every bar we see is the result of a battle between bulls and bears. If we see a green bar, it doesn’t mean that there were no bears then; simply its that bulls were able to overpower the bears in the bar.

All other parameters we regularly chk such as size of the real body, length of wicks, location of real body w.r.t. the wicks etc give too much information if he/she dig deep into the psycho aspects while the bar was being formed.

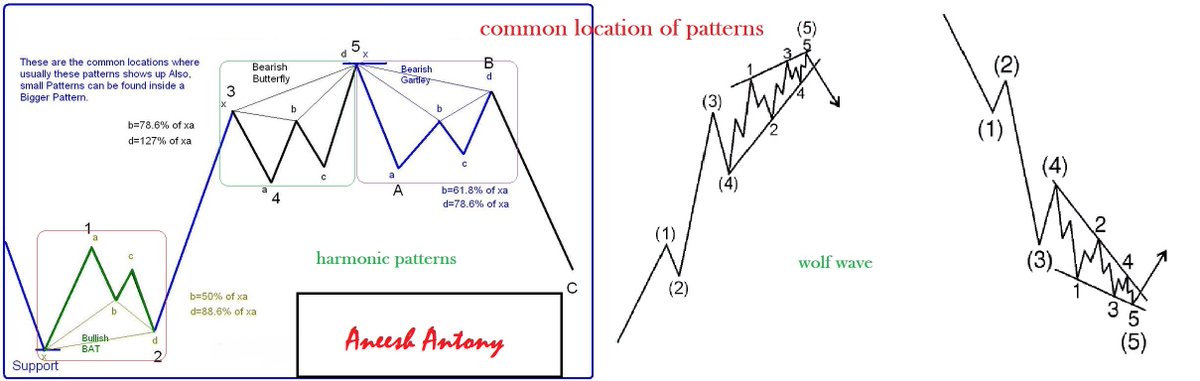

Another important aspect is the location of the pattern. Why does the price action does what its doing where its doing now? A question of much importance. An engulf pattern at various location would mean different things and would signal varying strength of the trend

For example; a bull engulf at support would mean a buy signal, bt the same pattern at resistance mean bulls are stronger than the bears and even if price fall , we shouldn’t short as bulls are still not yielded; bounce can be lethal and hit SL for the short

An understanding of the abv aspects would make wonders and enable the traders to make bar by bar analysis. The real revelation for a price action trader is that PAT isn’t abt merely memorizing candle pattern; rather its way deeper

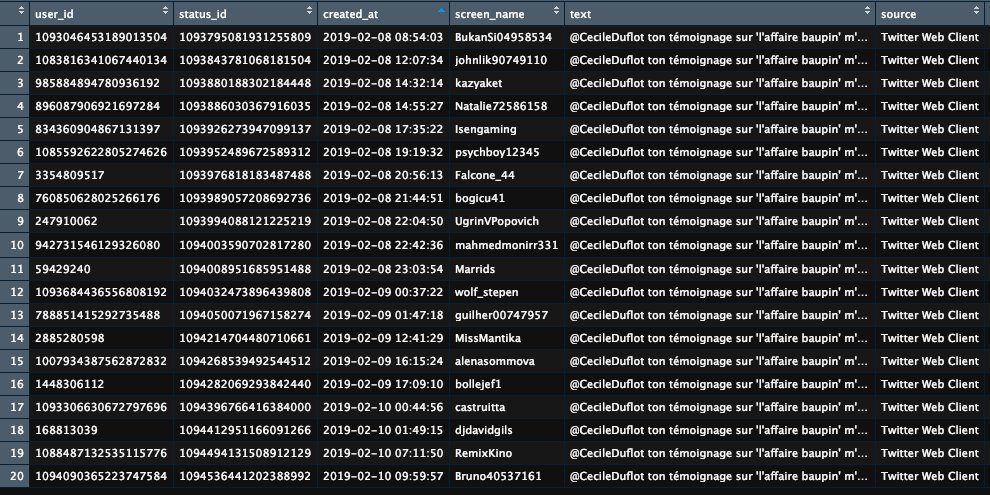

image used in the tweet is from follwing link

quora.com/Is-it-importan…

the texts are original and is not posted anywhere before. readers are requested to use discretion while reading. no commercial interest in the tweet