The SEC delayed Bitwise last week, but still hasn't made a decision on VanEck. Here's why that's a bad sign for ETF bulls.

Thread 👇

If the SEC decides to delay, it has to explain its "grounds for disapproval under consideration," meaning the reasons it thinks it might deny the ETF. The ETF sponsor & other interested parties can then submit comments in response.

But the SEC only delayed Bitwise that day. It didn't (and still hasn't) made a decision on VanEck. That's really unusual.

For example, when the SEC delayed Bitwise & VanEck at their 45-day deadlines in March, it issued both delays at once:

Denial is far more likely than approval. I'll give you a few reasons why.

VanEck's final deadline is October 18. An early decision likely means denial.

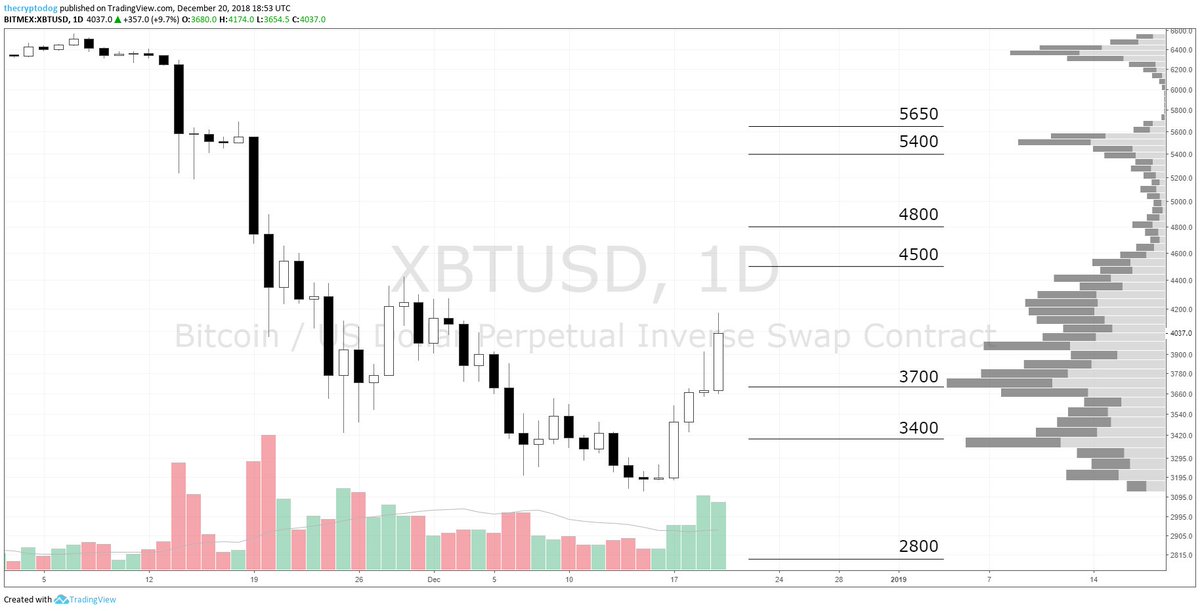

Bitcoin has been very volatile recently & investigations related to fraud & manipulation have ramped up (like NYAG & Bitfinex). The SEC has no reason or incentive to come out in favor of bitcoin in this environment.

The order cites several grounds for disapproval that apply to the whole bitcoin market structure & therefore to VanEck as well. See pages 47 to 51:

scribd.com/document/40998…

- the nature of the market for bitcoin

- the efficiency of that market

- the susceptibility of that market to manipulation

- how the market is similar to markets for other commodities

- the relationship between bitcoin futures and spot markets

- the cessation of bitcoin futures trading on CME

- the existence of surveillance-sharing agreements

- reports that a large percentage of reported volume is fake

As a result, if VanEck were to have any chance of approval, the SEC would need to delay & ask all these same questions to them as well.

The two ETFs are actually quite different. For example, they calculate price differently: Bitwise would use public exchanges while VanEck would use OTC markets. Maybe the SEC is willing to consider one but not the other.

Maybe SEC staff just hasn't had time to finish the VanEck delay order yet. These things take time & there's no reason why the SEC has to issue ETF delays at once.

But if it's not a delay, all signs point to denial.

- Delay: 75.0%

- Denial: 24.9%

- Approval: 0.1%

I'll keep you updated as the process plays out.

[end]