Let's talk about the winners, the losers, and all the others caught in between.

Thread 👇

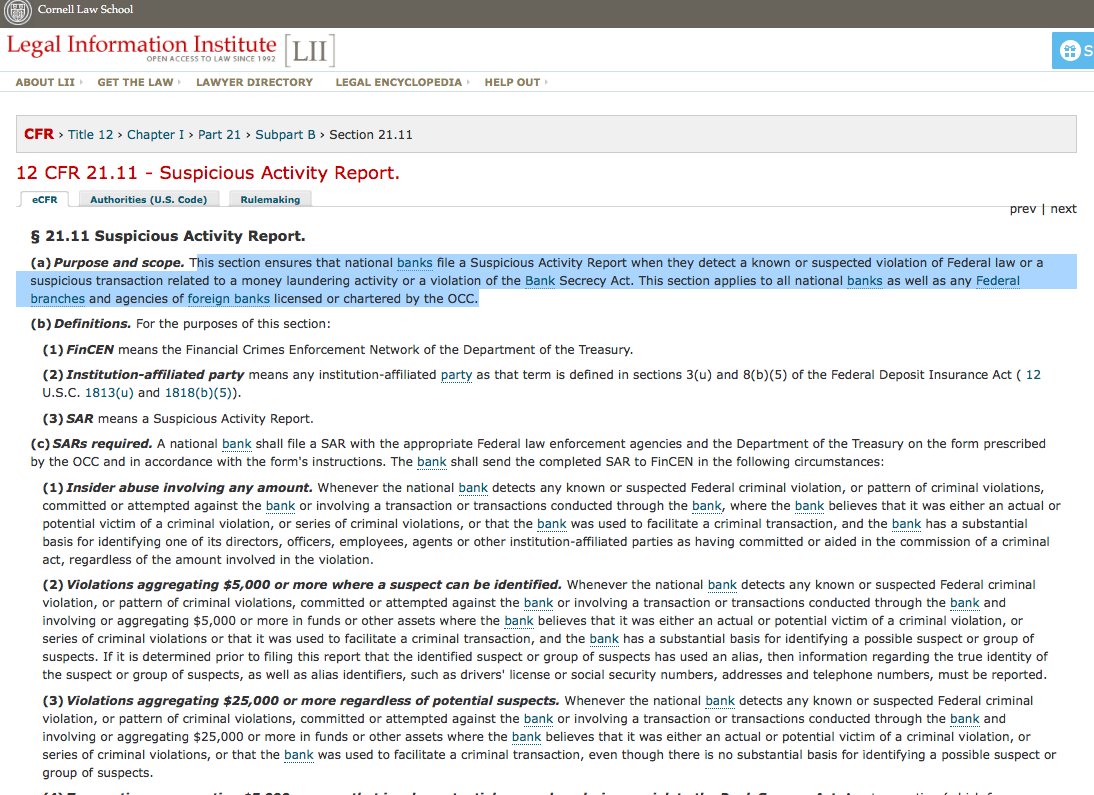

Most of it simply (but helpfully) summarizes all the legal analysis that FinCEN has published over the years, starting in March 2013 when they first announced that AML applies to crypto.

cloudup.com/cDs4Fw4oMuP

Assuming a preference *not* to spend time & money on AML compliance, let's call those free from regulation "winners" & those subject to it "losers."

Don't @ me.

Money transmitters accept currency (or value substituting for currency) from one person & transmit it to another person or location.

Failure to comply can be either a civil or criminal offense.

So, who's in the clear & who needs to hire counsel?

FinCEN says they're not money transmitters because they don't accept or transmit funds on the wallet user's behalf. The user "has total independent control" over his/her funds at all times. Makes sense, right?

FinCEN says they aren't money transmitters if they only provide "a forum where buyers and sellers...post their bids and offers [&] the parties themselves settle any matched transactions through an outside venue[.]"

You may have heard the argument that coders are liable for the operation of their code after launch, even in open source. FinCEN rejects that notion in the context of money transmission: coders aren't regulated based on code alone.

The same basic logic applies here: the operator of a trustless mixer provides a tool to users, but doesn't accept or transmit users' funds. So, the operator is "engaged in trade and not money transmission."

FinCEN says traders who buy & sell digital assets solely for their own accounts are investors, not money transmitters. Okay, good.

It's not so simple for every type of trader, though...which brings me to the first set of losers.

FinCEN calls them "P2P exchangers" and defines them as "natural persons engaged in the business of buying and selling" crypto.

To me, this seems obviously directed at LocalBitcoins traders, who FinCEN says are money transmitters.

Last month, one such trader was sentenced to two years' incarceration for failing to register as a money transmitter. He's not the first to go to prison.

cointelegraph.com/news/californi…

If traders who buy & sell for their own accounts are mere investors, why can't LocalBitcoins arbitrageurs be investors too? 🤷♂️

FinCEN's ICO guidance is complex, but to boil it down: ICOs are money transmitters if they sell tokens that aren't securities & retain the ability to issue & redeem those tokens. Here's Gabe for the ironic implications of this rule:

If you own ATMs that accept crypto in exchange for fiat (or vice versa), FinCEN says you're a money transmitter. This should be obvious, but FinCEN has never said it explicitly in the context of crypto ATMs before. Consider it done.

The guidance says DApp developers aren't money transmitters, but...

Huh? If DApps have owners or operators, they're not DApps, right? The D stands for "decentralized," last I knew.

In any event, how could a piece of software implement an AML compliance program? Regulations are no good if they're impossible to follow.

The guidance doesn't say a single word about Lightning. We could speculate about FinCEN's views based on the other topics covered in the guidance, but I think the best take here is none at all. FinCEN needs time.

If the government wanted to kill crypto, FinCEN would likely be the best option aside from Congress, so it's a good sign that this guidance is logical & balanced.

Now let's hope FinCEN's enforcement efforts are well-reasoned too.

[end]