I do think we need legislation to clarify whether & how digital tokens should be regulated, but this bill doesn't cut it. Here's my take on why it would create *more* regulatory uncertainty, not less.

Thread. 👇

scribd.com/document/40563…

The company could then be prosecuted by the SEC & forced to pay fines & refunds to investors.

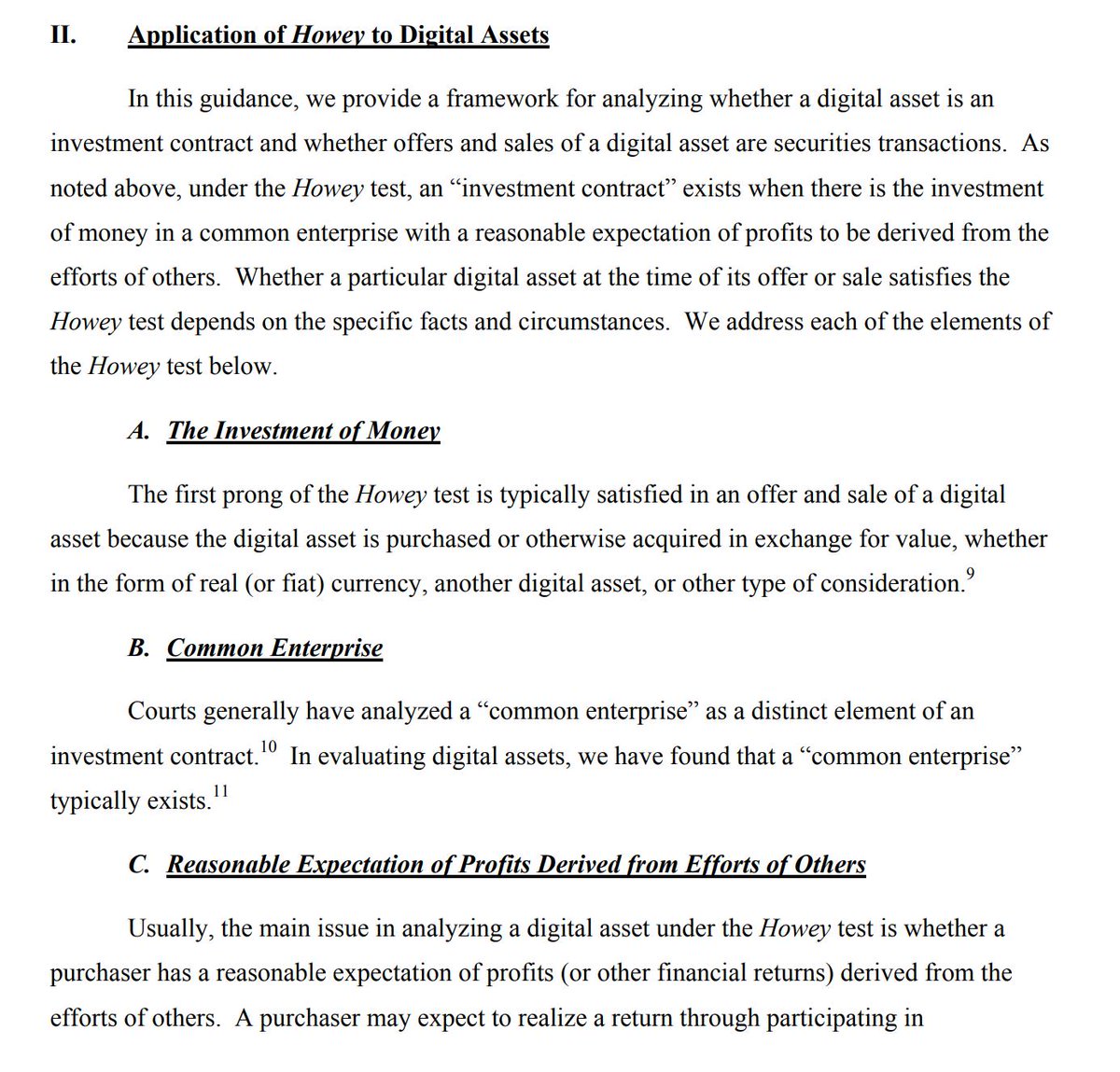

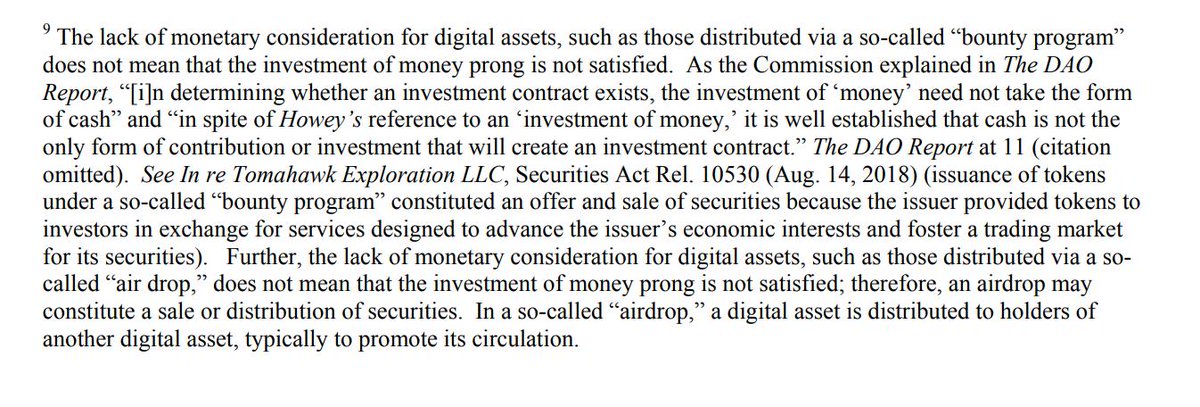

Under the Howey test, assets are investment contracts if they involve "an investment of money in a common enterprise with the expectation of profit based on the efforts of others."

As a result, the crypto industry has been plagued by regulatory uncertainty, left to guess what the SEC or a judge & jury will decide.

That means crypto companies wouldn't have to worry about Howey so long as they satisfy the TTA's digital token definition.

In my view, that's not the case: the digital token definition is *less* clear than Howey.

That's what the whole "sufficiently decentralized" thing was about last year & what the SEC focused much of its ICO guidance on last week.

There's a wealth of case law & commentary on what this means. It's not perfect, but at least we have something to go on.

I'll give you a few examples of what I mean.

What distinguishes "control" from mere influence? What type of relationship makes control "common?" What about rules for utility?

But don't even the most centralized non-blockchain databases "resist tampering" in some way? Do we want to include tokens on private servers with passwords?

I assume the goal is to exclude tokens that function like equity shares, but this language is broad. Can't a "financial interest" in a "partnership" mean just about anything?

Bottom line: I don't think this draft of the TTA resolves any of the uncertainty around the Howey test. It just replaces that uncertainty with different elements requiring years of litigation to unpack.

To start, you have Caitlin Long (@CaitlinLong_), who's done more work on crypto legislation than anyone. Like, actually.

Lewis explains why folks are "up in arms" over the TTA ().

Gabe cuts to the point, calling it "pure nonsense."

We *do* need action from Congress to move this industry forward, and revamping the securities laws is just the start. This is a huge project.

No doubt, this is a tough problem & nobody has a perfect answer. But we can't afford to trade one unclear standard for another, just for the sake of doing something. As it stands, that's what I think the TTA would do.

[end]