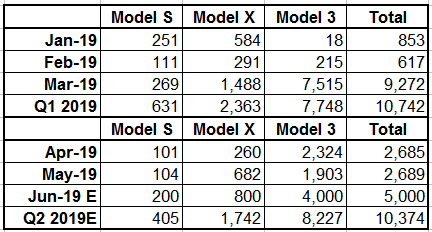

This is only for the hardcore $TSLA earnings model bros: @4xRevenue @CoverDrive12 @Andreas_Hopf @mtb7031 @Vikingbhoy @GatorInvestor @spudheadcapital @g_schelle etc.

$TSLA lies w/ their quarterly automotive revenues & gross profits. Here's how:

Fast forward to Q1'19 guidance on conf-call: "Model 3 ASP nearly $50K & gross margin approximately 20%"

(a) Automotive revenues reported: $3.5bn - $0.22bn (ZEV/GHG credits) + $0.5bn in lease buyback reserves.

(b) At $50K in ASPs for M3, revs were $2.5bn; That means.....

But Q1'19 S/X ASPs were cut by ~20%, if memory serves correctly. Which means the should've been $75K~$80K. Doesn't add up.

M3: 19.9%

S/X: 19.1%

I feel comfortable w/ this, but not w/ ASPs

M3: $48K (mix is bad, but what is clear is: +$400 px hike across the board, minus $2.4K/unit for Autopilot, which became free after Apr-12th).

S/X: ASP of $92K (I'm sure this is wrong, as $TSLA liquidated S/X inventory)