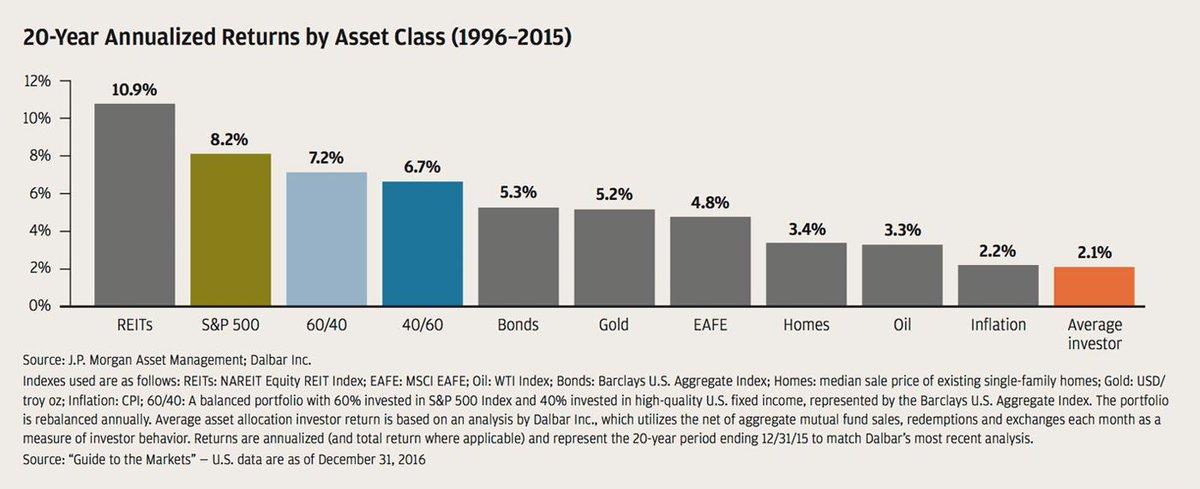

As if liquidity has some magic about it? First of all, there is an illiquidity premium, meaning private assets tend to outperform public assets, broadly speaking. Secondly, liquidity creates volatility and chaos...

Look at $SPY. Last quarter was...

I can tell you, the real estate deals I did, are. And they don't swing around like stupid.