$USD #liquidity

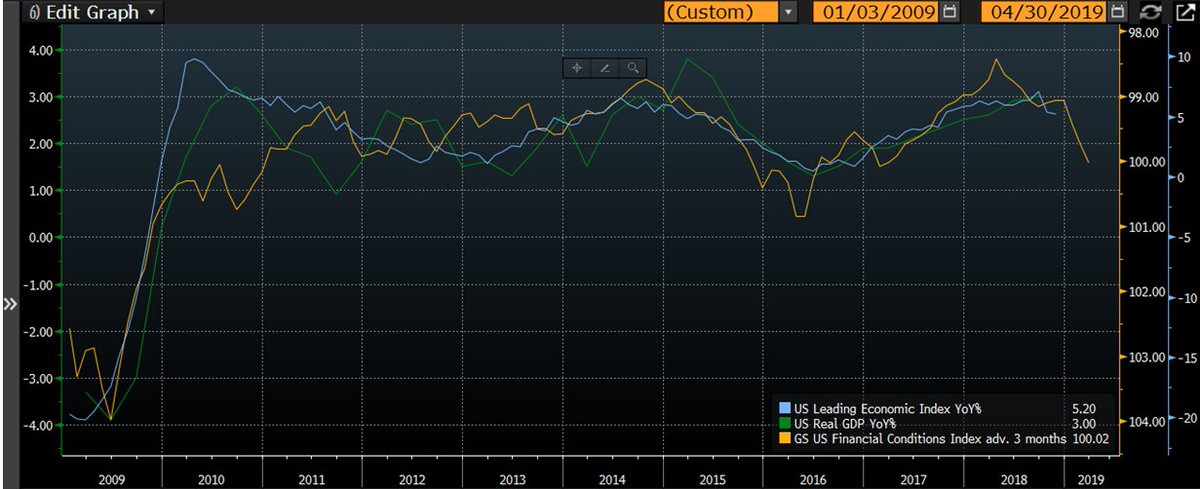

1/ While the US Dollar has pulled back in January it was not unexpected looking at net issuance by the US Treasury and the rate of change in excess reserves. Using a 3 month adv. on net issuance and excess reserves their may be further upside to the US Dollar.

1/ While the US Dollar has pulled back in January it was not unexpected looking at net issuance by the US Treasury and the rate of change in excess reserves. Using a 3 month adv. on net issuance and excess reserves their may be further upside to the US Dollar.

$USD #liquidity

2/ There was a small uptick in global liquidity in December 2018 in rate of change terms. This has supported many markets that were oversold. However, there has been no sizeable change in trend. Will know more once January data is released.

2/ There was a small uptick in global liquidity in December 2018 in rate of change terms. This has supported many markets that were oversold. However, there has been no sizeable change in trend. Will know more once January data is released.

#equities #liquidity

3/ If we have a closer look at the rate of change in the major central bank balance sheets we can see the contraction throughout 2018. The rate of change in the MSCI All World Index tracks it closely. Again notice the slight uptick in December 2018.

3/ If we have a closer look at the rate of change in the major central bank balance sheets we can see the contraction throughout 2018. The rate of change in the MSCI All World Index tracks it closely. Again notice the slight uptick in December 2018.

4/ #liquidity

Updated chart looking at the $USD, net issuance by the US Treasury, US excess reserves YoY% (inverted) & USTs held in foreign official accounts YoY% (inverted).

Updated chart looking at the $USD, net issuance by the US Treasury, US excess reserves YoY% (inverted) & USTs held in foreign official accounts YoY% (inverted).

6/ #liquidity

“We going to be in a position...to stop runoff later this year,” he said, adding that doing so would leave the balance sheet at about 16 percent or 17 percent of GDP, up from about 6 percent before the financial crisis about a decade ago.

reuters.com/article/us-usa…

“We going to be in a position...to stop runoff later this year,” he said, adding that doing so would leave the balance sheet at about 16 percent or 17 percent of GDP, up from about 6 percent before the financial crisis about a decade ago.

reuters.com/article/us-usa…

7/ #GrowthSlowing

Liquidity flow on effects.

Global manufacturing PMI slipped to a 32-month low in Feb (50.6 vs 50.8 - Jan). Output growth eased and new orders were near stagnation as global trade remained subdued.

Liquidity flow on effects.

Global manufacturing PMI slipped to a 32-month low in Feb (50.6 vs 50.8 - Jan). Output growth eased and new orders were near stagnation as global trade remained subdued.

https://twitter.com/IHSMarkitPMI/status/1101520724714549249

8/ #GrowthSlowing #Liquidity $USD

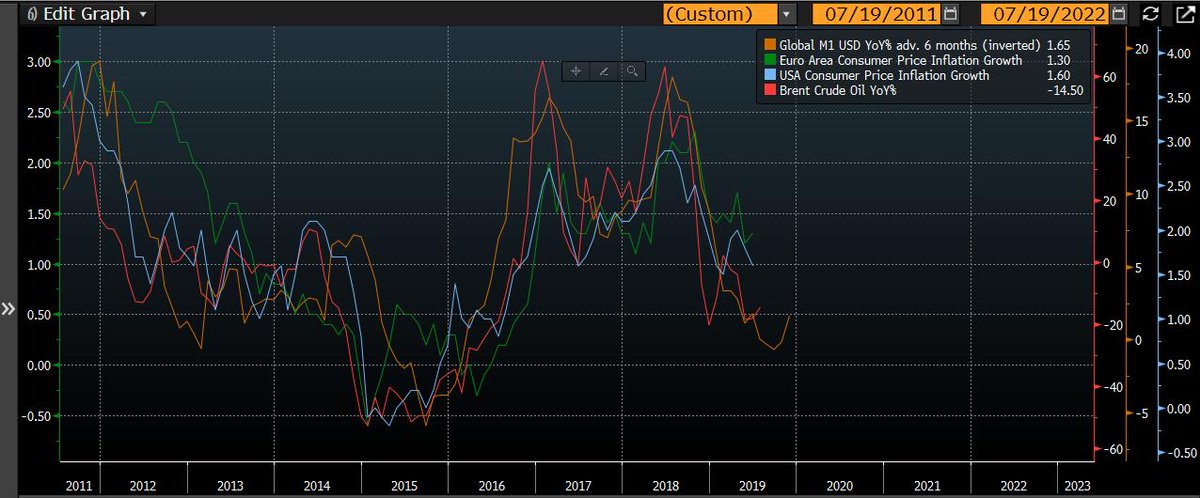

Updated charts for the end of February. Global M1 YoY% declined in January 2019 after moving up in December 2018.

Updated charts for the end of February. Global M1 YoY% declined in January 2019 after moving up in December 2018.

9/ #Liquidity $USD

Big drop of in net issuance due to the debt ceiling standoff. Rate of change in YoY for net issuance has dropped from over 100% to 40%. However, excess reserves continue to shrink., closing in on -30% YoY. Data as at 28/02/2019.

Big drop of in net issuance due to the debt ceiling standoff. Rate of change in YoY for net issuance has dropped from over 100% to 40%. However, excess reserves continue to shrink., closing in on -30% YoY. Data as at 28/02/2019.

11/ #Liquidity $USD

Cap on monthly redemptions in Fed balance sheet to be reduce to $15 billion from $30 billion per month starting in May. This likely to lead to a slowing in the YoY% change of excess reserves. Dollar down from here?

Cap on monthly redemptions in Fed balance sheet to be reduce to $15 billion from $30 billion per month starting in May. This likely to lead to a slowing in the YoY% change of excess reserves. Dollar down from here?

12/ #liquidity

Fed, ECB, PBOC, BOJ & SNB USD balance combined YoY% now negative and not showing signs of bottoming yet.

Fed, ECB, PBOC, BOJ & SNB USD balance combined YoY% now negative and not showing signs of bottoming yet.

19/ $USD #liquidity

Updated chart with net issuance data for April 2019. Note the the light blue line.

Updated chart with net issuance data for April 2019. Note the the light blue line.

20/ $USD #liquidity

MS - "Japanese investors tend to reduce their US Treasury holdings during Fed tightening cycles as rising hedging costs reduce the return of currency-hedged portfolios."

MS - "Japanese investors tend to reduce their US Treasury holdings during Fed tightening cycles as rising hedging costs reduce the return of currency-hedged portfolios."

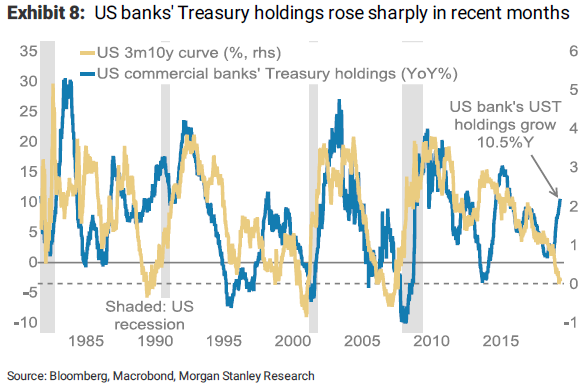

21/ $USD #liquidity

MS - "US banks have increased their holdings of US Treasuries. Tightness in short-term rates pushed the EFFR above IOER, and suggests that US institutions have turned to alternative funding sources, including FX currency swaps, to raise USD."

MS - "US banks have increased their holdings of US Treasuries. Tightness in short-term rates pushed the EFFR above IOER, and suggests that US institutions have turned to alternative funding sources, including FX currency swaps, to raise USD."

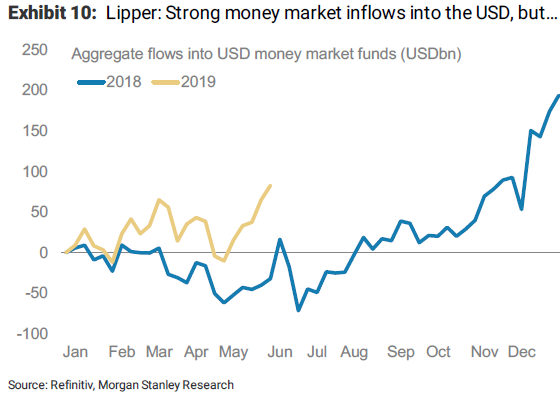

22/ $USD #liquidity

MS - "Other sources of demand have more than compensated for the impact of rising net supply on yields. Japan has reduced its Treasury holdings while

Europe has increased its exposure. Aggregate change in net foreign holdings is flat over the past year."

MS - "Other sources of demand have more than compensated for the impact of rising net supply on yields. Japan has reduced its Treasury holdings while

Europe has increased its exposure. Aggregate change in net foreign holdings is flat over the past year."

23/ $USD #liquidity

A decade ago, investors from Germany, France, Ireland, Spain, Luxembourg and Italy owned $250bn of US government debt. Combined holdings now stand at more than $770bn, according to UniCredit.

ft.com/content/4826b7…

A decade ago, investors from Germany, France, Ireland, Spain, Luxembourg and Italy owned $250bn of US government debt. Combined holdings now stand at more than $770bn, according to UniCredit.

ft.com/content/4826b7…

24/ $USD #liquidity

Global M1 contracting - -0.69%

Equities to reverse lower?

Dollar to rapidly strengthen?

Global M1 contracting - -0.69%

Equities to reverse lower?

Dollar to rapidly strengthen?

26/ $USD #liquidity

Central bankers are all talk & no show at the moment...🧐

G5 balance sheet contracting -6.25% YoY%

Central bankers are all talk & no show at the moment...🧐

G5 balance sheet contracting -6.25% YoY%

28/ $USD #liquidity #OOTT

Global M1 USD YoY% slight uptick to -0.10% with updated data from ECB.

Time for the SPX to join #oil & $VEU?🧐

Global M1 USD YoY% slight uptick to -0.10% with updated data from ECB.

Time for the SPX to join #oil & $VEU?🧐

29/ $USD #liquidity

US excess reserves contracting at -27.20% YoY. Less than previously but still a strong dollar contributing factor.

US excess reserves contracting at -27.20% YoY. Less than previously but still a strong dollar contributing factor.

30/ $USD #liquidity

G5 B/S slight uplift but still strongly negative at -5.74% YoY

Not much help here...🤣

G5 B/S slight uplift but still strongly negative at -5.74% YoY

Not much help here...🤣

31/ #liquidity

MS - "The $USD can be strong at the same time as #US asset prices are expensive only if foreign G10 central banks ease policy. Widening USG10 interest rate differentials push funds into the US, supporting both the US and asset prices."

MS - "The $USD can be strong at the same time as #US asset prices are expensive only if foreign G10 central banks ease policy. Widening USG10 interest rate differentials push funds into the US, supporting both the US and asset prices."

32/ #liquidity

Trade finance has been #USD funding dependent. BIS research shows that 35% of trade is financed by the banking system (rather than firms themselves), and 80% of trade finance is denominated in $USD.

Trade finance has been #USD funding dependent. BIS research shows that 35% of trade is financed by the banking system (rather than firms themselves), and 80% of trade finance is denominated in $USD.

33/ #liquidity

"Foreign investors have apparently understood long-term $USD valuation risks, and are reducing USD-denominated market exposure. Foreign FDI flows tend to follow security flows. US repatriation flows have remained strong, supporting the USD."

"Foreign investors have apparently understood long-term $USD valuation risks, and are reducing USD-denominated market exposure. Foreign FDI flows tend to follow security flows. US repatriation flows have remained strong, supporting the USD."

34/ #liquidity

Flows have been primarily driven by #US-based entities reducing international exposure and repatriating funds back into $USD-denominated holdings rather than foreign accounts investing in US long-term securities.

Flows have been primarily driven by #US-based entities reducing international exposure and repatriating funds back into $USD-denominated holdings rather than foreign accounts investing in US long-term securities.

35/ #liquidity

Great thread here on the importance of the $USD

Great thread here on the importance of the $USD

https://twitter.com/Trinhnomics/status/1130997262954270720

36/ #liquidity $USD

- Net issuance of USTs YoY% 👇to 5% in May 2019, waiting on June data.

- The contraction in excess reserves slowed to -19.30% from >-25% YoY.

- Net issuance of USTs YoY% 👇to 5% in May 2019, waiting on June data.

- The contraction in excess reserves slowed to -19.30% from >-25% YoY.

37/ #liquidity

The weaker $USD was also flagged by @AndreasSteno & @enlundm in this @NordeaMarkets FX Weekly on May 5th 2019.

e-markets.nordea.com/#!/article/487…

The weaker $USD was also flagged by @AndreasSteno & @enlundm in this @NordeaMarkets FX Weekly on May 5th 2019.

e-markets.nordea.com/#!/article/487…

40/ #liquidity

Central banks making a poor attempt to help.

G5 Central Bank Balance Sheet $USD accelerates to -3.86% YoY.

Central banks making a poor attempt to help.

G5 Central Bank Balance Sheet $USD accelerates to -3.86% YoY.

41/ #liquidity

Global M1 $USD YoY% up to 1.67%.

Overlays

- Broad Dollar Trade Weighted Index 2.80% YoY

- WTI Crude Oil -12.50% YoY

- SPX Adjusted EPS Daily 2.90% YoY

Global M1 $USD YoY% up to 1.67%.

Overlays

- Broad Dollar Trade Weighted Index 2.80% YoY

- WTI Crude Oil -12.50% YoY

- SPX Adjusted EPS Daily 2.90% YoY

42/ #liquidity

US Treasury net issuance running at 5% YoY, sharply down from a late 2018 high of close to 150% YoY.

The contraction in excess reserves continues at -26.10%.

Combined contraction of -24.78% YoY.

US Treasury net issuance running at 5% YoY, sharply down from a late 2018 high of close to 150% YoY.

The contraction in excess reserves continues at -26.10%.

Combined contraction of -24.78% YoY.

43/ #liquidity $USD

“Based on updated projections, there is a scenario in which we run out of cash in early September, before Congress reconvenes. Request that Congress increase the debt ceiling before Congress leaves for summer recess."

cnbc.com/2019/07/12/tre…

“Based on updated projections, there is a scenario in which we run out of cash in early September, before Congress reconvenes. Request that Congress increase the debt ceiling before Congress leaves for summer recess."

cnbc.com/2019/07/12/tre…

44/ #liquidity $USD

Great thread here by @EVMacro

Great thread here by @EVMacro

https://twitter.com/EVMacro/status/1152023817897697280?s=20

@EVMacro 46/ #liquidity

Who's winning the money supply race?

In trillions of $USD

- EU 9.6

- China 8.30

- Japan 7.40

- US 3.80

- Swiss .70

Who's winning the money supply race?

In trillions of $USD

- EU 9.6

- China 8.30

- Japan 7.40

- US 3.80

- Swiss .70

@EVMacro 48/ #liquidity

US Treasury cash balance at the Fed + Foreign Repo Pool 6 month moving average vs. Broad $USD Trade Weighted Index. So what happens if $120bln-$150bln is raised from the market to rebuild the US Treasury cash balance? Hmm...🤔🧐😁

US Treasury cash balance at the Fed + Foreign Repo Pool 6 month moving average vs. Broad $USD Trade Weighted Index. So what happens if $120bln-$150bln is raised from the market to rebuild the US Treasury cash balance? Hmm...🤔🧐😁

@EVMacro 52/ #liquidity $USD

Net issuance to ramp into Sept 30th as US Treasury rebuilds cash balance. Expect YoY rate of change to increase from current levels.

Net issuance to ramp into Sept 30th as US Treasury rebuilds cash balance. Expect YoY rate of change to increase from current levels.

@EVMacro 53/ #liquidity $USD

"The projected T-bill issuance for Aug is now $157bn &

Sept issuance is now -$1bn. New forecasts reflect UST's estimates of an end-of-Sept cash balance of $350bn & the end-of-Dec cash balance of $410bn. Corp tax receipts alleviate borrowing needs in Sept."

"The projected T-bill issuance for Aug is now $157bn &

Sept issuance is now -$1bn. New forecasts reflect UST's estimates of an end-of-Sept cash balance of $350bn & the end-of-Dec cash balance of $410bn. Corp tax receipts alleviate borrowing needs in Sept."

@EVMacro 55/ #liquidity $USD

Broad $DXY pushing higher.

Now above level from 2016-2017.

Foreign Repo Pool continues to build.

Cash balance set to ramp higher.

Broad $DXY pushing higher.

Now above level from 2016-2017.

Foreign Repo Pool continues to build.

Cash balance set to ramp higher.

@EVMacro 58/ #liquidity $USD

Assuming no change in the foreign repo pool balance & a 200 billion cash balance build. Hmm... 🤔

Assuming no change in the foreign repo pool balance & a 200 billion cash balance build. Hmm... 🤔

• • •

Missing some Tweet in this thread? You can try to

force a refresh