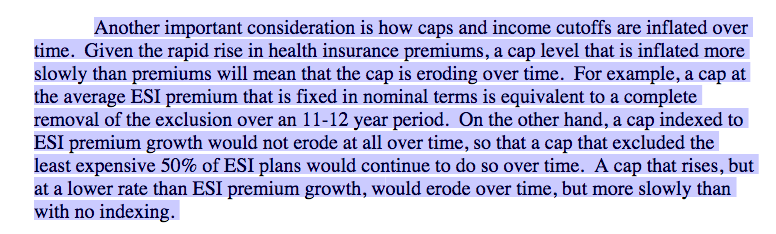

Here's what the economists wrote to Congress in 2015

cbpp.org/sites/default/…

Here's what the economists wrote to Congress yesterday

crfb.org/sites/default/…

Why is the total tax impact greater now than in 2015?

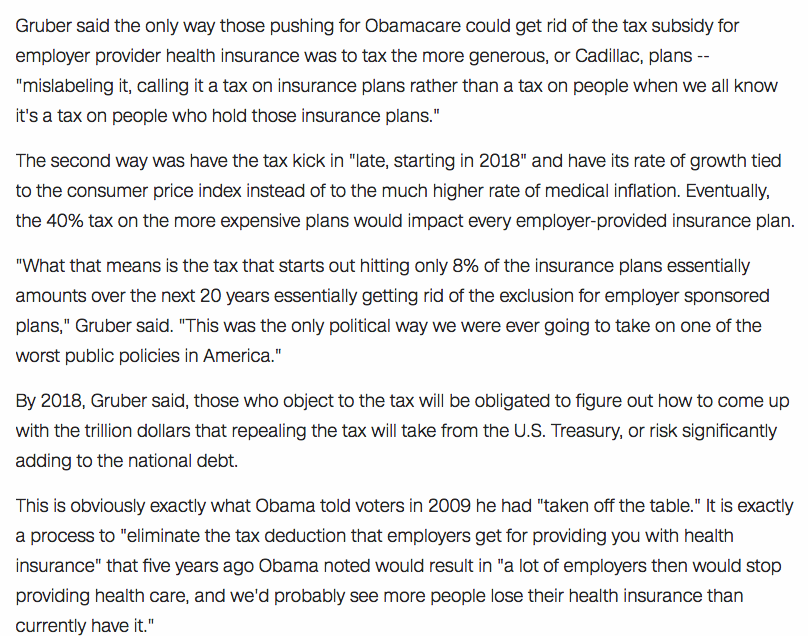

"As employers redesign health insurance plans (kick you off your plan) to hold costs within the tax-free amount, cash wages ... will increase."

cnn.com/2014/11/18/pol…

Also, special thanks to Max Baucus for flat out lying about it on the Senate floor.

fullmeasure.news/news/politics/…

finance.senate.gov/imo/media/doc/…