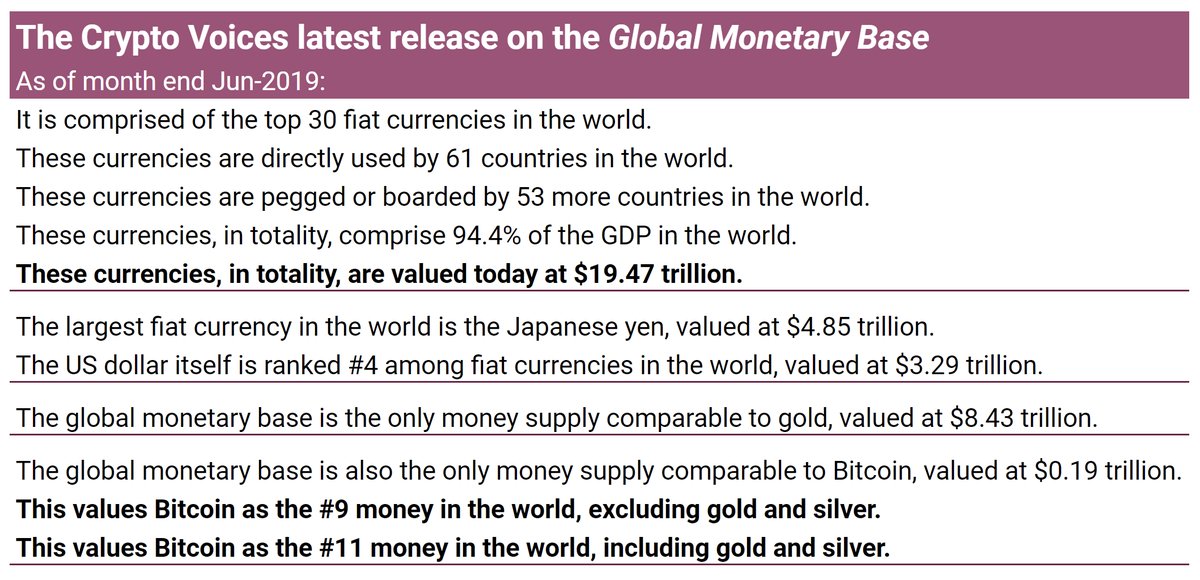

If you don‘t know his excellent podcast show @crypto_voices (shout out to co-host @fernandoulrich as well!), make sure to give it a listen.

#bh2019

#bh2019

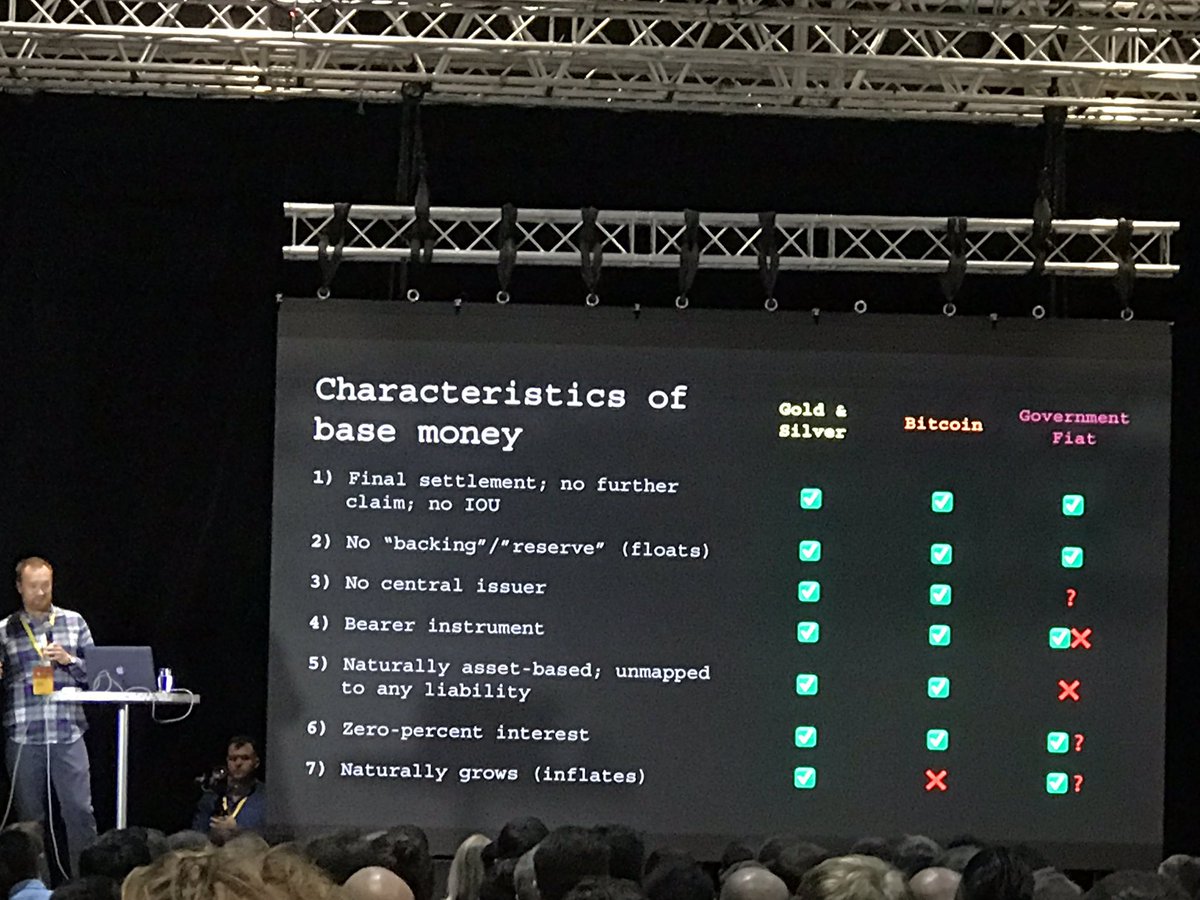

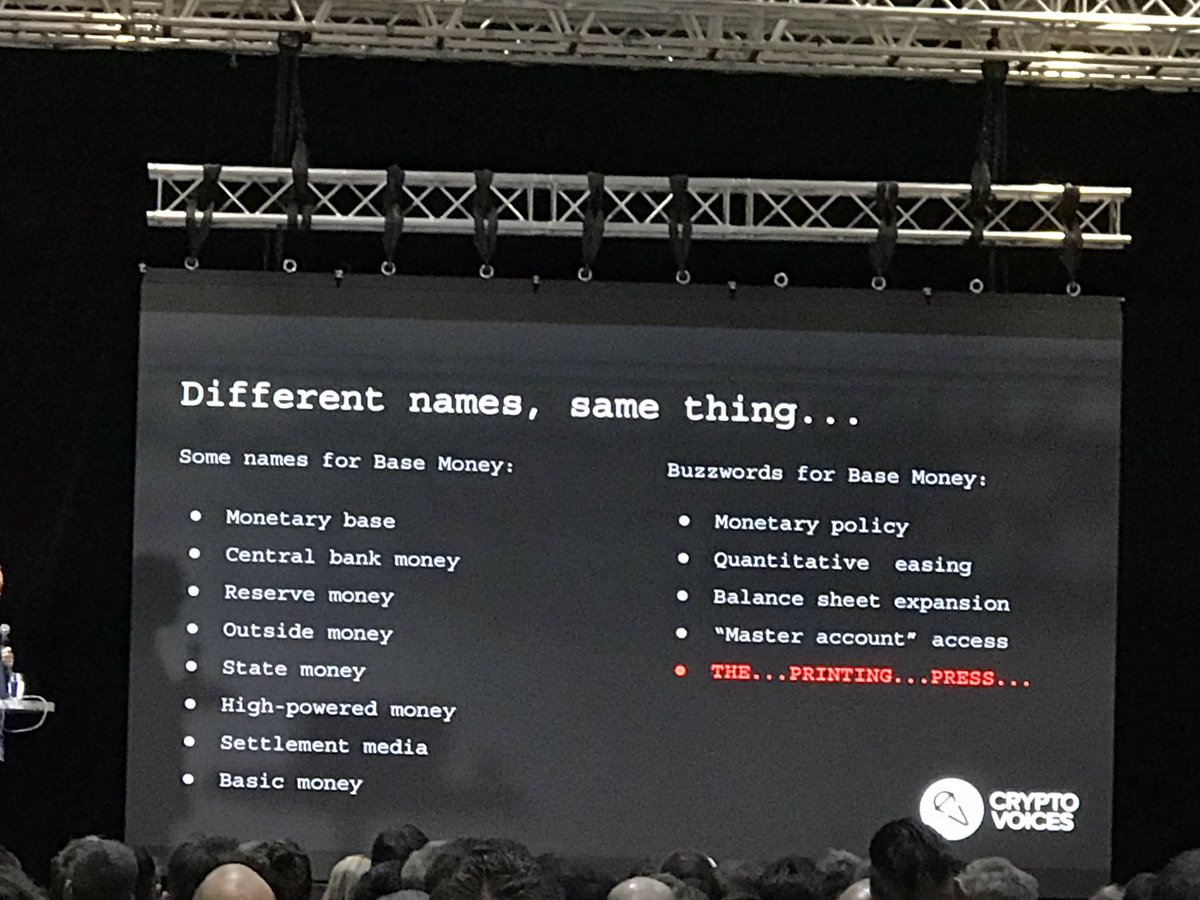

- Commodities (shells, beads, precious metals)

- Paper: physical cash

- Digital: central bank reserves, Bitcoin?

1) Physical: bank notes and cash

2) Digital: central bank reserves held by (commercial) clearing banks at — you would have guessed it — the central bank.

* Personal note: That is unless the social contract changes.

#bh2019

Not the way that most Bitcoiners would like to scale the system, but nevertheless has helped a great deal.

This doesn‘t mean that the total monetary supply hasn‘t changed, though.

@PositiveMoneyUK has also published good resources on this topic: positivemoney.org/publications/

It‘s a very interesting middle state: not really an IOU, but not really base money either.

#bh2019