❌ Real estate (you just own real estate)

❌ Stocks (you just own stocks)

❌ Bonds (you just own bonds)

These are all assets, indeed, and they each have benefits, but also counterparty risk and varying liabilities.

😬 A banknote (BUT, it is the liability of a central bank, hopefully they manage it well...)

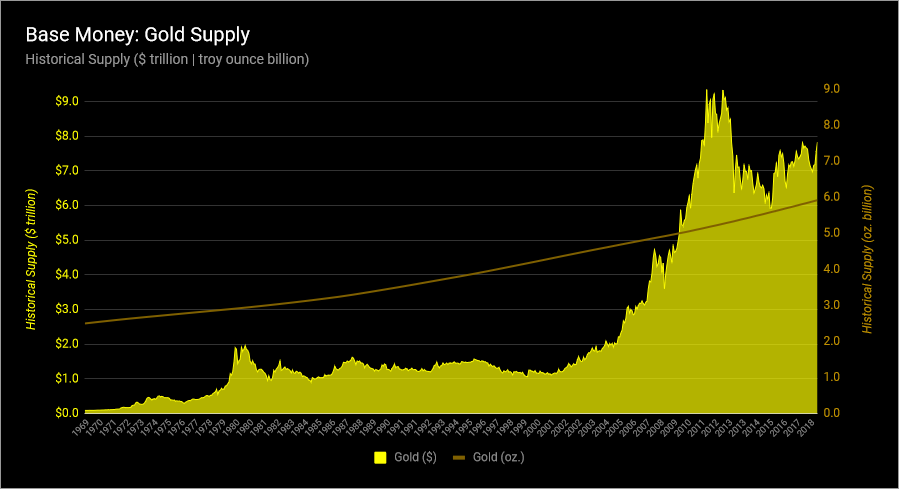

✅ A gold coin (AND it is no one else's liability)

✅ A bitcoin (AND it is no one else's liability)

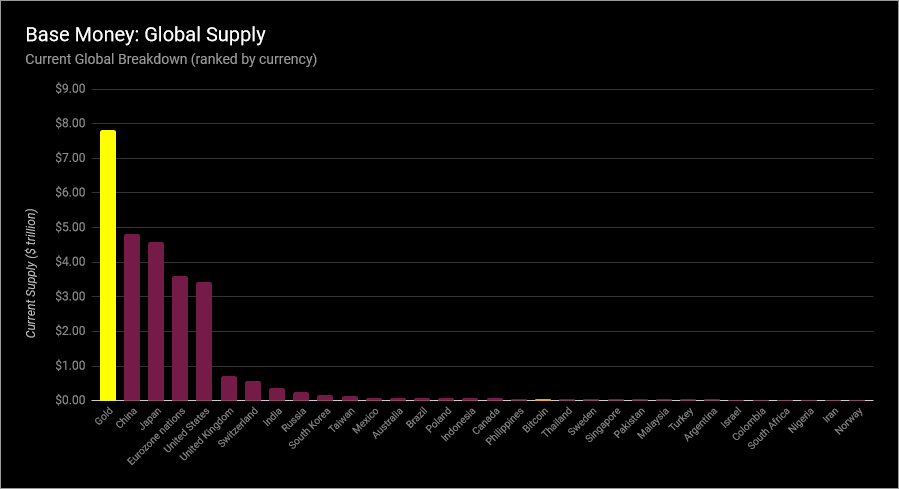

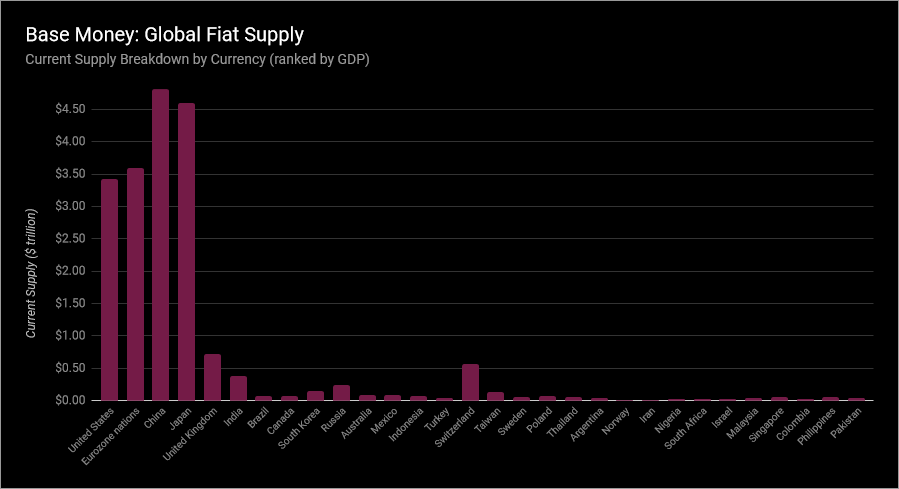

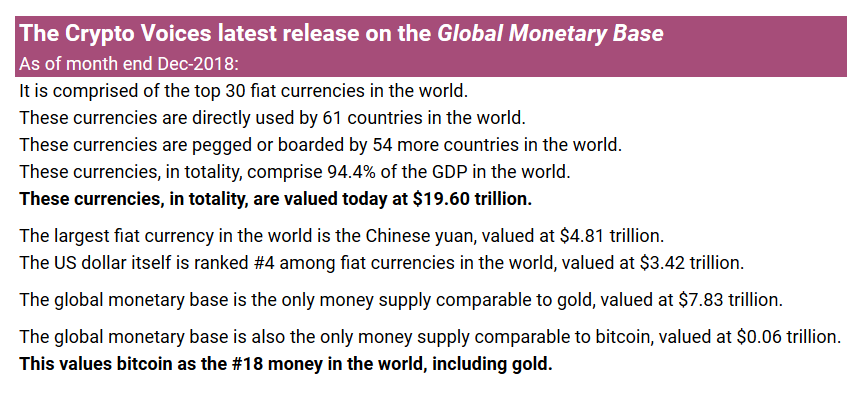

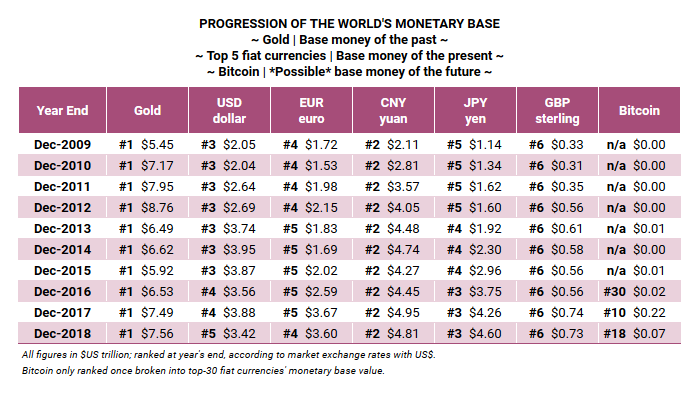

Where does Bitcoin rank globally? #18.

USD? #5.

Gold? #1.

/fin